Introduction

Do you know how small businesses manage procurement?

It all begins and ends with an email, a pact made at the end of a long discussion, or, worst of all, a messy shared spreadsheet. Long story short, this gives headaches day after day: it could be unexpected bills, over-budget spending, and constant reconciliation errors. Small businesses are juggling a hundred things, and the last thing they want to see is a surprise on their balance sheet.

The easy way to attend to this is not by hiring more staff; it’s leveraging technology. Install a compelling purchase order software for small businesses. It will transform a disorderly, reactive purchasing process into a streamlined, controlled, and proactive system.In this article, we put together a comprehensive guide that will explain purchase order software, outline the essential features to look for, and provide a clear roadmap for selecting the best purchase order system for small business to help you save money, time, and stress.

What is a Purchase Order System?

A purchase order system for small business helps automate everything from creation and approval to tracking, and management of purchase orders (POs). A purchase order is a document that is forged between a buyer to a seller, listing out the essential details on the intention to purchase specific goods or services at a specific price.

The purchase ordering system’s workflow is entirely orchestrated by the software platform. Basically, it creates a central hub for procurement data, applies budget-friendly rules for spending, and creates an indispensable audit trail. This digital centralization is why a dedicated PO system for small business is so much more powerful and reliable than relying on generic accounting software or email chains alone. It establishes the discipline needed for scalable purchasing.

The Importance of Purchase Order Software for Small Business

From messy spreadsheets, piles of paperwork, and follow ups to a dedicated purchasing software for small business. Moving to the right platform offers instantaneous, concrete benefits that support growth and profitability.

Efficiency

Manual processes are slow and start to stagnate for many invalid reasons. This could range from a procurement platform team person submitting a purchase request, which may sit in an inbox for days waiting for approval. This slow, multi-step process can consume days or weeks’ time.

The right purchase order system for a small business would speed up the process by automating entirely. Once the request is received, it is immediately forwarded to the person who is authorized to approve it, generates the PO with pre-filled vendor data after the approval formalities are over, and then, it sends it directly to the supplier. This PO system for small business dramatically reduces the cycle time for procurement.

Cost Control

The first and foremost advantage of using the best purchase order system is the control it grants over the budget. Without a PO system, requests often bypass financial checks, leading to “rogue spending”. A strong purchasing software for small business enforces budget boundaries before a purchase is made. By enforcing pre-approvals and linking every PO to a budget, cost center, or project code, the system quietly takes control before chaos begins. Spending never spills over, and you don’t end up firefighting unauthorized purchases after the money’s already gone. This forward-looking control is what separates a well-run operation from one that’s always playing catch-up — no surprises, no grey areas, just clean, disciplined finance.

Inventory Management

For small businesses that live and breathe physical goods, connecting procurement directly to inventory isn’t just helpful, it’s transformational. The best purchase order system for small business comes with inventory management built in, tracking stock even before it hits your shelves. The moment a PO is created, the system anticipates the incoming goods; when they arrive and get logged through a “Goods Receipt Note,” the stock levels update instantly.

This approach safeguards the business – no empty shelves, no cash trapped in overstock. It provides real-time visibility into the Cost of Goods Sold (COGS), and that turns what used to be a guessing game into a genuine competitive edge.

Compliance and Record-Keeping

A Purchase Order isn’t just paperwork; it’s the legal heartbeat of every transaction. A purchase ordering system automates what used to be a tedious chore, stamping every entry with time, date, and digital proof. Everything lives in one secure place, creating an airtight audit trail ready for tax season or compliance checks. The system performs the classic “three-way match” linking the PO, the Goods Receipt Note, and the Vendor Invoice. When all three align, the transaction is verified, cutting down the risk of payment errors or fraud. The result? Smoother audits, cleaner books, and peace of mind knowing every cent has a trail.

Supplier Relationships

A clean, professional procurement process doesn’t just save time, it builds trust. When you roll out PO systems for small business, your vendors see accurate, timely, and consistent orders every time. Disputes drop, communication improves, and invoices get processed faster thanks to that same three-way match working quietly in the background. Paying vendors on time and correctly isn’t just good etiquette; it’s good business. It opens doors to better pricing, priority service, and long-term goodwill. In a crowded market, strong supplier relationships backed by reliable purchase order software for small business are a strategic advantage that pays back in more ways than one.

Learn about Cloud Purchase Order System.

Companies with automated purchase orders experience a 20% reduction in costs associated with supplier payments and invoice processing.

– Gartner

What to Look for in a PO System for Small Businesses

The market is full of purchase ordering systems, but here’s the truth — not every one of them is built for the agility and pace of a small business. The needs are different: smaller teams, faster decisions, and limited time to figure things out. When choosing the best PO system for a small business, focus on the fundamentals that actually make a difference in your day-to-day operations.

Ease of Use and Setup

Small businesses rarely have the luxury of an in-house IT department. That’s why your purchasing software for small business needs to be intuitive, something that feels like second nature, not another project to manage. Look for a cloud-based purchase order system that’s ready to go in hours, not weeks. The best systems come with a clean, logical interface and mobile-friendly design so your team can jump right in, whether they handle POs daily or once a month. Complexity slows you down, so the best purchase order software for small businesses is the one that anyone can use confidently from day one.

Integration Capabilities

A standalone PO system might look great in isolation, but if it doesn’t talk to your other tools, it’s a dead end. The real power of a purchase order system for small businesses comes when it integrates seamlessly with your accounting or ERP software – think QuickBooks, Xero, or Sage. When your vendor data, purchase orders, and invoices flow automatically into your general ledger, you eliminate the manual work and human errors that drain time and money. Integration isn’t a “nice to have” it’s the backbone of accuracy and ROI for your PO system for small business.

Inventory Management Features

If your business deals with physical goods, procurement and inventory go hand in hand. The best purchase order system for small businesses connects these dots effortlessly. You should be able to log Goods Received Notes (GRNs) directly against a PO, manage partial deliveries, and even assign stock to specific locations or asset tags. This three-way match — PO, GRN, and Invoice — keeps your books clean and your stock levels precise. It prevents over-ordering, stockouts, and cash flow surprises while turning your purchasing software for small business into a true operational control center.

Cost and Scalability

The best purchase order software for small business offers flexible, transparent pricing, usually on a per-user or per-feature basis. As a small business, you need to avoid the expensive, complex, and oversized enterprise solutions. Look for tools that scale with you. The system should easily accommodate an increase in users, transaction volume, or the addition of international currencies without requiring a massive, disruptive re-implementation. An affordable starting price combined with predictable, linear scaling ensures the best po system decision today remains the right one five years from now.

Mobile Accessibility

Modern business doesn’t happen only at a desk. An employee might be on the shop floor or traveling when they need to submit a request, or a manager might be out of the office when a critical PO needs urgent approval. Mobile accessibility is mandatory for any modern purchase order system for small business. Look for a dedicated mobile app or a fully responsive web interface that allows users to create, review, approve, and track POs on their smartphones. This feature is crucial for maintaining the speed and efficiency benefits that a digital purchase ordering system promises.

Approval Workflows

This is where real control lives. A strong purchasing software for small business gives you the ability to define exactly who approves what — whether it’s tiered approvals based on spend amount, routing by department, or parallel sign-offs. You can set a $500 request to go to a manager and a $5,000 one to a director — automatically. These guardrails prevent budget leakage and guarantee that every dollar gets a second pair of eyes before it’s spent. In a small business, that’s not bureaucracy — that’s smart protection.

Real-Time Reporting and Analytics

The longer you use a PO system for small business, the more valuable it becomes, not just because of automation, but because of insight. Every PO, approval, and invoice adds to a pool of data you can actually use. Real-time dashboards show how much you’ve committed, who you’re spending with, and how quickly approvals move. Budget variance reports keep you alert before overspending happens, not after. Over time, these insights let you negotiate better, plan ahead, and turn purchasing into a genuine strategic advantage, which is exactly what the best purchase order software for small business should do.

Learn more about purchase requisition software.

Best Purchase Order Software for Small Business

| Software | Best For | Key Features | Pricing |

| Zapro | Best Overall (All-Size Businesses) | AI-powered automation, guided intake, smart matching, real-time budget control, supplier portal. | P2P Starter: From $499/month. Enterprise S2P Suite: Custom pricing. |

| SAP Ariba | Large Enterprises with Global Operations | End-to-end procurement, supplier risk management, advanced compliance controls. | Varies widely. Free up to 4 documents, with subscription levels ranging from $50 to $5,500 annually for suppliers, and median buyer contracts at $61,513 annually. |

| Coupa | Strategic Spend Management | Comprehensive spend management, strategic sourcing, AI-driven recommendations. | Median buyer contracts are around $92,957 annually. Supplier plans start at $499/year for premium support. |

| NetSuite Procurement | Finance-Centric Businesses | Built-in integration with NetSuite ERP, real-time budget tracking, automated requisitions. | Pricing is customized and varies. A typical mid-sized deployment can range from $50,000 to $500,000 annually, with monthly plans starting at $999 plus user fees. |

| ProcureDesk | Customizable P2P Automation | Customizable workflows, catalog integration with 200+ vendors, invoice management. | Pricing starts at $498/month (billed annually) for 10 users. |

| Procurify | Businesses Needing Virtual Spend Cards | PO automation, budget controls, virtual spend cards, receipt/invoice management. | Pricing is typically high, starting around $1,000/month. |

| Precoro | Global Teams | Multi-currency support, custom approval workflows, remote access. | Core: $499/month. Automation: $999/month (both billed annually). Enterprise: Custom pricing. |

| Order.co | E-Commerce Heavy Teams | Custom catalogs, automated bulk payments, order tracking. | Pricing for their platform starts at $29/month (billed annually) with various tiers available depending on the number of orders and locations. |

| Tradogram | Best Free Option for Low-Volume Purchasing | Free plan with up to 5 transactions/month, PO automation, expense tracking. | Free plan available. Paid plans start at $195/month for the Pro plan and $375/month for the Premium plan (both billed annually). |

| Kissflow Procurement Cloud | Custom Workflows | Low-code/no-code customization, hosted & punchout catalogs, contract management. | Starting price is around $1,990/month, with an average annual cost of $31,500. |

1. Zapro – Best Overall Purchase Order Software

If you’re looking for a PO system that combines simplicity, automation, and intelligence, Zapro is the clear winner. In contrast to conventional purchase order systems, which merely digitize the process, Zapro applies AI-driven automation to automate purchasing to be smarter, faster, and free of errors.

Key Features

- Guided Intake: Employees can submit purchase requests with ease with accuracy and compliance checks built into it.

- Automated Approvals: Bottlenecks are eliminated, and workflows are automated with instant notifications for managers.

- AI-Powered Matching: Purchase orders, invoices, and receipts are automatically matched, cutting errors by up to 75%.

- Budget Control: Policies and budgets are enforced in real-time, so overspending never falls through the cracks.

- Supplier Collaboration: A single vendor portal enables suppliers to see POs, update delivery status, and confirm commitments.

- Analytics & Reporting: CFOs have full visibility into spend, supplier performance, and compliance.

Learn more about automated purchase order system.

Why Zapro Stands Out

What sets Zapro apart is how modular and scalable it is. You can start with purchase order automation and expand to full source-to-pay (S2P) when your business grows — all without replacing systems. For small businesses, this means affordability. For large enterprises, this means flexibility and scalability.

Pricing

- P2P Starter: From $499/month – covers purchase orders, approvals, and budget tracking.

- Enterprise S2P Suite: Custom pricing – includes sourcing, supplier management, contract management, and AP automation.

Zapro’s FastTrack deployment can get you live in as little as 5 days, making it one of the fastest-to-implement PO solutions on the market.

Learn more about best SaaS procurement.

Experience the Future of Purchase Orders.

2. SAP Ariba

Best for Enterprises with Global Operations

SAP Ariba provides global enterprises with an optimal platform through its cloud-based procurement solutions and intelligent spend management and supply chain services which support digital transactions with millions of worldwide partners.

Notable Features

- End-to-end procurement management

- Supplier risk management tools

- Integration with SAP ERP systems

- Advanced compliance and audit controls

Drawback: Implementation is complex and costly, making it better suited for large enterprises.

3. Coupa

Best for Strategic Spend Management

The unified AI-powered platform of Coupa provides strategic spend management capabilities through its complete visibility and automated real-time data collection across procurement tools and supply chain and financial operations. The platform enables businesses to optimize their spending through strategic sourcing and supply chain design and real-time inventory management which leads to data-based decisions for margin growth and process optimization and supply chain resilience.

Notable Features

- Comprehensive spend management

- Strategic sourcing and contract lifecycle tools

- AI-driven recommendations

- Integration with major ERP systems

Drawback: Pricing and complexity may not suit SMBs.

4. NetSuite Procurement

Best for Finance-Centric Businesses

The procurement solution from NetSuite works best for organizations that focus on finance because it handles procurement from start to finish while implementing financial controls and compliance and delivering real-time spending and vendor performance data and complete integration with financial management tools. The centralized procurement system with budget management and detailed reporting capabilities enables finance teams to decrease expenses while optimizing cash flow and making data-based decisions to boost profitability and maintain regulatory compliance.

Notable Features

- Built-in integration with NetSuite ERP

- Automated purchase requisitions and POs

- Real-time budget tracking

- Reporting dashboards

Drawback: Works best for businesses already using NetSuite ERP.

5. ProcureDesk

Best for Customizable P2P Automation

The procurement and Accounts Payable automation solution ProcureDesk serves growing businesses by providing cost control features and real-time cash flow visibility and efficient order and invoice processing capabilities. The system allows users to create customized purchasing processes while providing complete vendor system integration which enables two-click order approval. The solution optimizes the Procure-to-Pay (P2P) process through customizable workflows and supplier self-service portals which run from requisition to payment.

Notable Features

- Catalog integration with 200+ vendors

- Punchout catalogs (Amazon, Thermo Fisher, etc.)

- Invoice management and three-way matching

- Real-time spend reporting

Drawback: Small learning curve and limited scalability for very large enterprises.

Learn more about Purchase Order Management Tools.

6. Procurify

Best for Companies Needing Virtual Spend Cards

The integrated system of Procurify makes it an ideal solution for businesses that require virtual spend cards because it offers real-time visibility and control over company spending. The Visa debit cards connected to Airwallex enable decentralized spending while reducing fraud risks and automating reconciliation and eliminating the need for time-consuming expense reports. The platform of Procurify allows teams to make required purchases rapidly while maintaining pre-set spending boundaries which enables them to expand their spending safely and efficiently.

Notable Features

- Purchase requisition & PO automation

- Budget controls and tracking

- Virtual spend cards

- Receipt and invoice management

Drawback: High pricing (starting at $1K/month) makes it less accessible for small businesses.

7. Precoro

Best for Global Teams

The cloud-based design of Precoro makes it suitable for worldwide teams because it provides remote access and collaborative features and budget customization and approval workflows and real-time reporting for worldwide vendor management and departmental spending control. The platform provides a user-friendly interface and AI-powered features that simplify complex procurement operations while its free open API and QuickBooks Online and NetSuite integrations enable it to work with different systems used by international organizations.

Notable Features

- PO, invoice, and receipt management

- Budget tracking & approval workflows

- Multi-currency support

- Supplier management

Drawback: Catalog limitations may affect scalability for very large organizations.

8. Order.co

Best for E-Commerce Heavy Teams

Order.co operates as a B2B e-commerce platform which enables businesses to streamline their procurement operations and payment systems. The platform streamlines procurement operations through automated requisition and approval and reconciliation processes which enhance both efficiency and simplicity of buying activities. The platform uses artificial intelligence and automated systems to deliver enhanced purchasing visibility which results in reduced expenses for businesses. The platform serves as an excellent solution for organizations that seek to enhance their purchasing operations.

Notable Features

- Custom catalogs from multiple e-commerce sites

- Automated bulk payments

- Budget approvals

- Order tracking

Drawback: Lacks strong vendor contract management features.

9. Tradogram

Best Free Option for Low-Volume Purchasing

Tradogram has a free basic plan for low-volume purchasing. It lets one user handle up to five transactions each month. This free plan includes key features like managing purchase orders and approval workflows. It’s a good way to try out the platform before moving to a paid plan with more features and more transactions.

Tradogram empowers buyers and purchasing decision-makers worldwide to control costs and automate procurement processes like Procure-to-Pay, Strategic Sourcing, Supplier Management, Accounts Payable, and Spend Analysis.

Notable Features

- Unlimited supplier management

- PO automation

- Expense tracking

- Project-based procurement

Drawback: Free plan only supports five monthly transactions; paid plans required for scalability.

10. Kissflow Procurement Cloud

Best for Custom Workflows

Always appreciated for its low-code/no-code capabilities that can help build without technical expertise; Kissflow Procurement Cloud is a source-to-pay platform that is best-suited for businesses that are searching for highly customized and flexible procurement workflows. Effortlessly, organizations get to automate their entire procurement cycle, from sourcing to final settlements, customizing the software according to the business needs, it supports working smoothly with financial systems like QuickBooks and SAP.

Notable Features

- Hosted & punchout catalogs

- PO automation

- Contract & vendor management

- Strategic sourcing

Drawback: For advanced customization coding knowledge is required. Many users have found it challenging with regional settings, data synchronization, and poor log retention periods.

Learn about best procurement software.

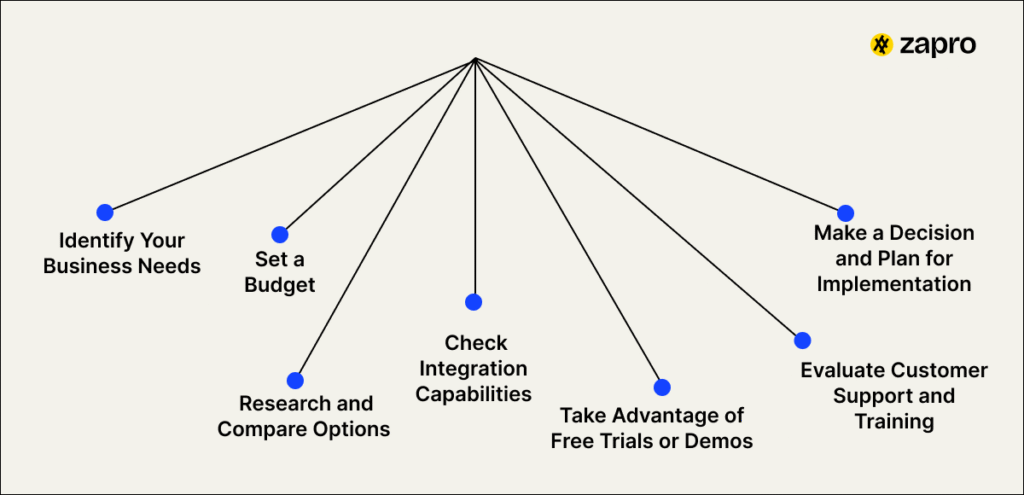

Steps to Selecting the Purchase Order System for Small Business

Choosing the right purchase order software for small business requires careful due diligence. Follow these steps to ensure you select a solution that truly serves your needs:

1. Identify Your Business Needs

Start by mapping out what’s not working in your current process. Are approvals getting lost in email threads? Do invoices arrive before POs exist? Find out the high-priority features like QuickBooks integration, mobile approvals, or compliance support. If your business buys services, you’ll want strong non-PO invoicing. If you buy goods, inventory tracking is a must. Getting clear on what you need instantly narrows your choices and helps you focus on the right type of purchase ordering system.

2. Set a Budget

Decide what you can realistically spend each year, including licenses, setup, and support. A good PO system for small business should pay for itself by reducing manual errors, saving time, and tightening control over spending. The best way is to start from ROI, not just cost, because the right tool will save more than it costs to run.

3. Research and Compare Options

Do you know how small businesses usually pick software?

They look at a list, maybe glance at some features, and hope it works. That rarely ends well.

The best way to get started is by going through reviews and case studies. Remember, to read the ones that feature companies similar to yours. Besides, the reviews and case studies, compare the feature sets and ensure the solution is genuinely a purchasing software for small business, not an enterprise tool.

4. Check Integration Capabilities

Without perfect integration capabilities, the best purchase order system cannot handle your specific multi-entity or multi-currency needs. Therefore, it needs a direct enquiry, asking the vendors for specific details on their integrations with your core accounting or ERP system. A system that plugs into your workflow without extra hassle saves hours of headaches every month.

5. Take Advantage of Free Trials or Demos

The only way to know if a system works for your team is to try it. Have your core procurement and finance team members test the trial version. Run a three-way match. Watch how approvals flow. Check the user experience and the approval cycle time.

6. Evaluate Customer Support and Training

The perfect PO system for small business rolls out with accessible and responsive support, especially during the initial phase. You’ll have to track the average response times, the free training materials that are easy to get, and whether support is included in the base license fee or if it is an extra cost. Reliable support is crucial for ensuring rapid user adoption.

7. Make a Decision and Plan for Implementation

Once the right solution is identified, jot out a perfect implementation plan. Define your customized approval workflows, migrate vendor master data, and schedule user training. A smooth rollout ensures your team immediately benefits from the chosen best purchase order system for small business.

Learn about best procure to pay software.

Benefits of Implementing the Purchase Order Tool

The benefits of moving to a dedicated purchase ordering system touch every corner of a small business. It’s not just about making purchasing easier; it’s about equipping your teams with the perfect tools to compete with bigger players in the market, while keeping everything under control.

Reduces Manual Work and Errors

Paper-based systems are slow and full of mistakes. A purchase order software for small business automates data entry, approval routing, and matching processes. Staff save time, mistakes drop, and the headaches of chasing invoices and POs manually are gone.

Enhances Budget and Spend Control

With the right system, budget management stops being a look-back exercise. Every purchase is pre-approved and tied to a specific budget line. Overspending becomes nearly impossible, and you gain control before the money leaves your account. This kind of visibility is invaluable for keeping profits intact.

Improves Procurement Transparency

Everything in procurement gets logged, centralized, and easy to track. The top-level team in the company will be able to view who is doing what – like the buying, transactions, deals, budget spends and etc., This transparency allows for better accountability and easier identification of opportunities for cost savings.

Speeds Up Approval Processes

Digital, automated workflows ensure that requests do not get lost, and those who approve will be notified, even through mobile, without any delay. In this way, the time taken for an order, starting from a request, to go through issuance will be minimized drastically, thus operations will be activated and the speed of the whole supply chain will be improved, which is a very important feature of the best po system.

Strengthens Vendor Management

The precision that the purchase order system for small business results in a lower number of payment disputes and a quicker payment cycle. Vendor profiles that are managed centrally ensure that there is consistency, while the trusted payment practices provide a solid basis for the partnership thus the small business will be in the position of being a preferred customer.

Conclusion

A decision to go for the best purchase order software for small business is among the most exceptional moves to the professionalization of your finance and procurement department. It is the main and the most efficient way that transforms the po system for small business from being just messy and confusing to being orderly, scalable, and with full visibility.

By picking the right purchasing software for a small business that focuses on user-friendliness, has great integration and can be accessed through a mobile device, you can have considerable savings in your costs and also make your company be at a good position to experience continuous growth.

Simplify spend. Empower growth. With Zapro.

Turn every purchase order into a seamless, stress-free process.

FAQs

1. What is the best purchase order software for small businesses?

The purchase order software best for small businesses is generally a cloud-native, SaaS product that allows the user to seamlessly connect the software with popular accounting platforms such as QuickBooks or Xero. The most suitable solutions in this category are those that put forward ease of use as a top priority, offer all-inclusive mobile accessibility for the approval process, and have an approval workflow that can be customized based on the complexity. Consequently, these solutions allow the control level normally seen in large corporations without the downsides of complexity and large cost inherent to enterprises.

2. How does purchase order software work?

This is a demo of how the purchase order system for a small business can be a tool to automate the P2P (Procure-to-Pay) cycle, etc. Firstly, an employee is required to generate a digital Purchase Requisition. Then the system takes over and the routing is done automatically, but this time for approval. Once the document is ratified, it changes the query into an official Purchase Order (PO) and delivers it to the vendor. Ultimately, this facilitates the three-way match (the comparison of the PO, the delivery note, and the invoice) to check the payment, which is the economic control and precision—a function of any best purchase order system.

3. Why do small businesses need a purchase order system?

The primary role of a PO system for small business is to be a spending control, fraud prevention tool, and a compliance enforcer. Without it, human mistakes and unrestrained spending may destroy the already thin profit margin at a high rate. Dedicated purchase ordering systems are usually integrated with the enterprise resource planning (ERP) system used to manage the business processes of sales, inventory, distribution, procurement, finance, and accounting in the organization. This way, the buyer can issue the purchase order directly through the system.

As a result, all information is automatically logged in all the relevant databases, and the financial planning system can be updated in real-time. Most importantly, users can be provided with access to current purchase order information no matter their location, time of the day, or the device used. Implements a compulsory pre-authorization step for every expenditure of a dollar that excludes surprise invoices and generates a conforming audit trail for legal and tax purposes.

4. Can purchase order software integrate with QuickBooks or Xero?

It is possible for almost all contemporary best purchase order systems for small business solutions to have either native or well-established API integration with popular small business accounting platforms like QuickBooks, Xero, and Sage. This link is vital; it directly cooperatively transfers approved POs (to be used as committed spending) and matched invoices (as bills) generated in the accounting ledger without the need for manual data entry, thus ensuring master vendor data remains in sync.

5. How Zapro helps with purchase order software for small businesses?

Zapro gives a one-stop procurement platform comprising the powerful purchase order software for small business as the chief feature, which has been developed with the goal of being highly intuitive as well as adaptable for various businesses. Zapro supports AI-driven automation for quicker PO generation, custom approval workflows to regulate spending limits, mobile accessibility to take care of approvals while on the move, and deep integration with accounting systems, thus it makes sure that small businesses acquire enterprise-grade control more than their expenditure without the hassle.

Don’t miss our weekly updates

We’ll email you 1-3 times per week—and never share your information.

Healthcare

Healthcare Financial Services

Financial Services Technology

Technology Venture Capitalist

Venture Capitalist Chief Procurement Officer

Chief Procurement Officer Chief Financial Officer

Chief Financial Officer