Imagine discovering that a department in your company has been buying software licenses on personal credit cards for three years, bypassing every security check and missing out on a 30% bulk discount. Or worse, finding out a key vendor doesn’t meet the new 2026 data privacy regulations, leaving your business liable for millions in fines.

These aren’t just administrative “oops” moments; they are major cracks in your company’s foundation. In a world of global supply chains and strict digital regulations, keeping your spending “by the book” is the only way to protect your margins and your reputation.

What Is Procurement Compliance?

Procurement compliance is the process of ensuring that every purchase made by an organization follows both internal company policies and external legal regulations. It is the “safety rail” of the purchasing world.

While many confuse it with simple procurement control, there is a key difference. Controls are the specific steps (like requiring two signatures), while compliance is the broader state of adhering to the entire procurement governance and compliance framework. It ensures that you buy from approved vendors, stay within budget, and satisfy legal requirements like GDPR or SOC 2.

Procurement Compliance Importance in Modern Organizations

In 2026, compliance isn’t just about following rules; it’s a strategic defense mechanism. Here is why procurement and compliance are inseparable:

- Protecting Financial Integrity: It prevents “maverick spend” (unauthorized purchases) that leaks cash.

- Avoiding Penalties: Regulatory bodies are stricter than ever. Non-compliance can lead to massive legal fines.

- Fraud Prevention: Structured policies make it nearly impossible for “kickback” schemes or ghost invoicing to occur.

- Audit Readiness: When everything is compliant, internal and external audits become a non-event rather than a month-long headache.

Buying procurement software is buying change. Your change-management capabilities matter more than features.

[Founder, Procurement Leaders Forum; featured in Supply Chain Quarterly]

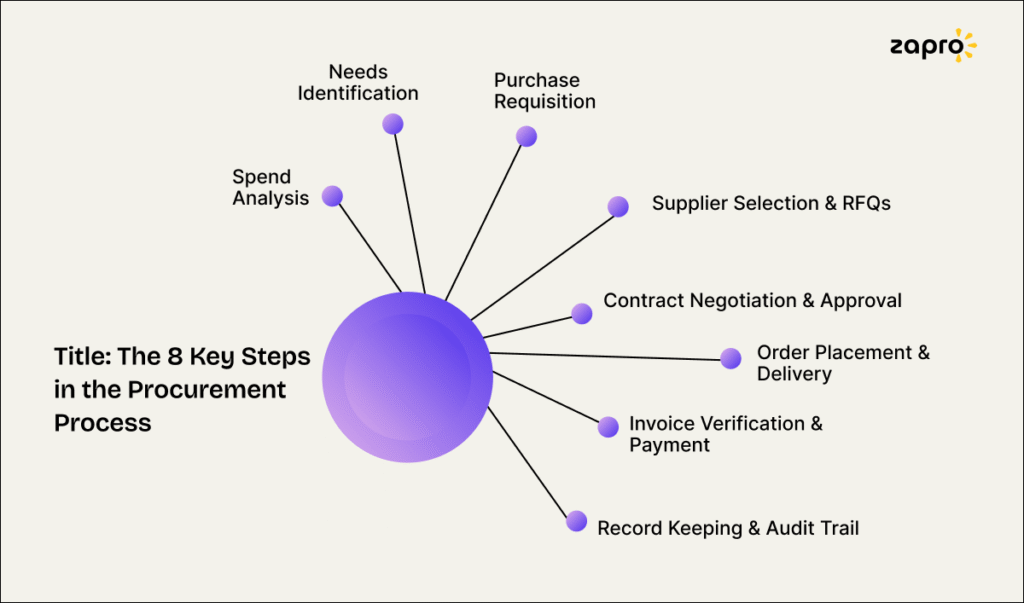

Procurement Compliance Framework: How It Works

A procurement compliance framework provides structured guidelines for managing purchases and ensuring policy adherence. It typically includes defined processes, approval hierarchies, and monitoring mechanisms. A standard framework includes:

Policy Documentation

A clear “Buying Guide” that everyone in the company can understand.

Approval Hierarchies

Digital paths that route requests to the right managers based on cost.

Segregation of Duties

Ensuring the person who requests the item isn’t the same person who approves the payment.

Risk-Based Vendor Evaluation

Vetting suppliers based on how critical they are to your operations.

Learn about procurement plan.

How to Measure Compliance with Procurement Policies

To measure compliance with procurement policies, teams monitor KPIs like adherence to approved suppliers, timely approvals, and contract compliance. Tracking these metrics helps identify gaps and improve procurement governance. To measure compliance with procurement policies, teams track these key performance indicators (KPIs):

- Contract Utilization Rate: Are people actually buying from the vendors you spent months negotiating with?

- PO-to-Invoice Match Rate: How many invoices arrived without a matching, approved Purchase Order?

- Exception Rate: How often are “emergency” purchases happening outside the standard flow?

- Audit Finding Frequency: The number of policy violations caught during internal reviews.

Procurement Compliance Checklist for 2026

Organizations often face challenges like keeping up with regulations, managing complex supplier requirements, and ensuring staff adherence to policies. These hurdles can lead to compliance gaps and increased risk. If you want to ensure your compliance procurement strategy is airtight, use this checklist:

Updated Policies

Do they cover remote work tools and AI-vendor vetting? Approved Vendor List (AVL): Is it centralized and updated in real-time?

Digital Contract Storage

Are all agreements searchable and indexed?

Threshold Controls

Are there hard stops for spending over a certain dollar amount?

Segregation of Duties

Is the “Requestor” separate from the “Approver” and “Payer”?

Audit Trails

Is there a digital “footprint” for every single change made to a PO?

Automate approvals, track every purchase, and stay audit-ready from day one.

Procurement Compliance Challenges Organizations Face

Most organizations struggle with navigating complex regulations, inconsistent enforcement, and inadequate tracking of procurement activities. These challenges make achieving full compliance difficult and resource-intensive. The road to total compliance is rarely smooth. Most organizations struggle with:

- Maverick Spending: Employees finding it “easier” to just use a corporate card for a quick SaaS subscription.

- Regulatory Complexity: Keeping up with international trade laws and data residency rules.

- Manual Bottlenecks: If the compliance check takes two weeks, people will find a way to bypass it.

- Data Silos: When Finance uses one system and Procurement uses another, the truth gets lost in the middle.

Procurement Compliance Best Practices

Procurement compliance best practices focus on clear policy enforcement, thorough documentation, and regular audits. Prioritizing these areas helps minimize risk and maintain accountability. To move toward procurement compliance best practices, focus on these three areas:

- Automate Everything: The more “human” the process, the higher the risk of error. Use software to enforce the rules.

- Regular Training: Don’t just publish a policy; explain why it matters to the employees.

- Vendor Risk Scoring: Don’t treat a local stationery supplier with the same scrutiny as a cloud data provider. Prioritize your efforts where the risk is highest.

How to Prioritize Procurement Compliance Initiatives

Instead of trying to overhaul every process simultaneously, focus on high-risk categories like IT and data security where regulatory fines are heaviest.

Start with “quick wins” by automating simple approval workflows, then move toward complex vendor risk scoring to ensure your most critical suppliers are the most heavily vetted. You can’t fix everything at once. Prioritize procurement compliance initiatives using a risk-based approach:

- High-Risk Categories First: Focus on IT, Data, and high-value manufacturing materials.

- Regulatory Exposure: Address areas like GDPR or environmental compliance that carry the heaviest fines.

- Quick Wins: Automate simple approval workflows to show immediate efficiency gains.

Role of Procurement Software in Ensuring Compliance

Procurement software helps enforce policies, track approvals, and maintain regulatory compliance automatically. It ensures that following the easiest processes also aligns with legal and internal standards. In 2026, compliance is a software problem. Digital platforms ensure that the “path of least resistance” is also the most compliant path.

- Built-in Policy Controls: The system literally won’t let a user submit a request if it violates a rule.

- Budget Enforcement: Hard stops that prevent a PO from being issued if the department is over budget.

- Real-time Dashboards: Giving leadership an “at-a-glance” view of compliance health.

How Zapro Supports Procurement Compliance

Zapro is built to turn procurement compliance definitions into actual daily practice. We help you enforce your internal rules without slowing down the business.

With Zapro, your approval hierarchies are automated, your vendor documentation is centralized, and every transaction generates an unchangeable audit trail. We provide the visibility you need to catch maverick spend before it happens, ensuring that your procurement department is a source of strength, not a liability.

Conclusion

Procurement compliance isn’t just a hurdle to jump over; it’s the foundation of a scalable, profitable business. By building a structured framework and leveraging the right digital tools, you can ensure that your company’s growth is never compromised by avoidable risks.

Keep every procurement decision traceable and within policy.

Eliminate manual bottlenecks with Zapro’s cloud PO system. Smart automation, instant approvals, and complete spend visibility in one platform.

FAQ

1. Why is procurement compliance important?

It protects the company from fraud, legal fines, security breaches, and financial waste.

2. What is a procurement compliance framework?

It is a structured set of policies, digital tools, and roles that ensure all company spending is authorized and legal.

3. How do you measure compliance with procurement policies?

By tracking KPIs like the percentage of spend on-contract and the frequency of “maverick” or unauthorized purchases.

4. What are the biggest procurement compliance challenges?

Manual processes, employee resistance to new rules, and the complexity of global regulations.

5. What is included in a procurement compliance checklist?

Approved vendor lists, clear approval paths, digital audit trails, and regular policy updates.

6. How can software improve procurement compliance?

By automating approvals, enforcing budget limits, and creating a transparent record of every purchase.

Healthcare

Healthcare Financial Services

Financial Services Technology

Technology Venture Capitalist

Venture Capitalist Chief Procurement Officer

Chief Procurement Officer Chief Financial Officer

Chief Financial Officer