Importance of a well-structured chart of accounts for manufacturing businesses

When it comes to managing the financial health of your manufacturing business, having a well-structured chart of accounts for manufacturing company is absolutely essential. This financial tool serves as the backbone of your accounting system, providing a clear and organized framework for tracking your company’s financial transactions. By effectively managing your chart of accounts, you can gain valuable insights into your manufacturing processes, make informed decisions, and ensure accurate financial reporting.

A chart of accounts is a comprehensive list of all the accounts used by a business to record its financial transactions. It serves as a roadmap that guides you through the complex world of accounting, helping you categorize and track your income, expenses, assets, and liabilities. Without a properly organized chart of accounts, it’s like trying to navigate through a dense forest without a map you’re bound to get lost and encounter numerous obstacles along the way.

For manufacturing businesses, a well-structured chart of accounts is particularly crucial. The intricacies of the manufacturing industry demand meticulous attention to detail and precise tracking of costs, inventory, and production processes. By implementing a chart of accounts that is specifically tailored to your manufacturing operations, you can streamline your financial management processes and gain a deeper understanding of your business’s financial performance.

So, why is it so important to invest time and effort into developing a well-structured chart of accounts for your manufacturing business? Let’s take a closer look at the key reasons:

- Accurate Cost Analysis: Manufacturing involves numerous cost components, such as raw materials, labor, overhead expenses, and production equipment. With a well-designed chart of accounts, you can track and analyze these costs with precision, allowing you to identify areas for cost optimization, improve profitability, and make data-driven decisions.

- Efficient Inventory Management: Inventory is a critical asset for manufacturing businesses. By incorporating specific inventory accounts into your chart of accounts, you can effectively monitor your stock levels, track the flow of materials, and ensure optimal inventory management. This enables you to avoid overstocking or stockouts, reduce carrying costs, and maintain a smooth production process.

- Accurate Financial Reporting: A well-structured chart of accounts ensures that your financial statements accurately reflect the financial health of your manufacturing business. By categorizing your income and expenses into appropriate accounts, you can generate reliable financial reports that comply with accounting standards, facilitate audits, and provide valuable insights to stakeholders.

- Streamlined Tax Preparation: Tax compliance is a critical aspect of running any business. With a well-organized chart of accounts, you can easily extract the necessary financial information to prepare your tax returns accurately. This can help you minimize errors, reduce the risk of penalties, and ensure a smooth tax filing process.

- Enhanced Decision-Making: By having a clear and organized chart of accounts, you can access real-time financial data and gain a comprehensive view of your business’s financial performance. This empowers you to make informed decisions regarding pricing, investments, expansion plans, and cost-saving strategies, ultimately driving the growth and success of your manufacturing business.

In the upcoming sections of this guide, we will dive deeper into understanding the chart of accounts, creating a chart of accounts for manufacturing businesses, exploring sample accounts, and discussing best practices for managing this financial tool effectively. So, let’s embark on this journey to master the chart of accounts for manufacturing and unlock the full potential of your business’s financial management.

Understanding the Chart of Accounts

When it comes to managing the financial aspects of your manufacturing business, having a well-structured chart of accounts is absolutely essential. This tool acts as a roadmap for your financial transactions, providing a clear and organized framework for tracking and categorizing your company’s financial activities.

Definition and Purpose

So, what exactly is a chart of accounts? In simple terms, it is a comprehensive list of all the different types of accounts that your business uses to record financial transactions. Each account represents a specific category or classification, such as assets, liabilities, revenue, or expenses.

The purpose of a chart of accounts is to provide a standardized system for recording financial data, ensuring consistency and accuracy in your financial reporting. By categorizing your transactions into different accounts, you can easily analyze and interpret your financial information, making informed decisions to drive the success of your manufacturing business.

Key Components

A typical chart of accounts consists of several key components. Let’s take a closer look at each of them:

- Account Name: This is the name given to each individual account, representing a specific category of financial transactions. For example, you may have accounts like “Raw Materials Inventory,” “Work-in-Progress Inventory,” “Finished Goods Inventory,” and so on.

- Account Number: Each account is assigned a unique numerical code, known as an account number. This helps to organize and identify the accounts within the chart of accounts. The numbering system can vary depending on the size and complexity of your business, but it is important to establish a logical and consistent structure.

- Account Type: Accounts are classified into different types, such as assets, liabilities, equity, revenue, and expenses. This classification helps to group similar transactions together, making it easier to analyze and report on specific financial aspects of your manufacturing business.

- Account Balance: The account balance represents the current value or status of the account. It can be positive (debit) or negative (credit) depending on the type of account and the nature of the transactions recorded within it.

Types of Accounts

Within a chart of accounts, there are various types of accounts that serve different purposes. Here are some common types of accounts you may include:

- Asset Accounts: These accounts represent the resources owned by your manufacturing business, such as cash, inventory, equipment, and property.

- Liability Accounts: These accounts reflect the financial obligations and debts of your business, such as loans, accounts payable, and accrued expenses.

- Equity Accounts: Equity accounts show the ownership interest in your manufacturing business, including investments made by owners and retained earnings.

- Revenue Accounts: These accounts record the income generated from your manufacturing operations, such as sales revenue, service fees, and interest income.

- Expense Accounts: Expense accounts track the costs and expenditures incurred in running your manufacturing business, including raw materials, labor, utilities, and marketing expenses.

Understanding the different types of accounts and their respective roles is crucial in setting up an effective chart of accounts for your manufacturing business. It allows you to capture and categorize all your financial transactions accurately, providing a solid foundation for financial analysis and decision-making.

Now that we have a clear understanding of the chart of accounts and its components, let’s move on to the next section: Creating a Chart of Accounts for Manufacturing Businesses.

Creating a Chart of Accounts for Manufacturing Businesses

When it comes to creating a chart of accounts for your manufacturing business, there are several key steps you need to follow to ensure accuracy and efficiency. This essential financial tool will help you track and categorize your company’s financial transactions, making it easier to analyze your business’s financial health.

Analyzing Manufacturing Processes

The first step in creating your chart of accounts is to analyze your manufacturing processes. This involves taking a close look at how your products are made, from the raw materials all the way to the finished goods. By understanding the intricacies of your manufacturing operations, you can identify the various cost categories that need to be accounted for in your chart of accounts.

Identifying Cost Categories

Once you have a clear understanding of your manufacturing processes, you can identify the different cost categories that are associated with your business. These categories might include raw materials, labor costs, overhead expenses, and more. By accurately identifying these cost categories, you can ensure that your chart of accounts covers all the necessary financial elements of your manufacturing operations.

Organizing Accounts by Function

To create a well-structured chart of accounts, it’s important to organize your accounts by function. This means grouping similar accounts together based on their purpose within your manufacturing business. For example, you might have separate accounts for raw materials inventory, work-in-progress inventory, finished goods inventory, and cost of goods sold. By organizing your accounts in this way, you can easily track and manage your manufacturing costs.

Incorporating Cost Centers

Another important aspect to consider when creating your chart of accounts is to incorporate cost centers. Cost centers are specific departments or areas within your manufacturing business that incur costs. By assigning each cost center its own set of accounts, you can track expenses and allocate costs more accurately. This allows you to gain valuable insights into the financial performance of each cost center and make informed decisions to optimize your manufacturing processes.

Creating a chart of accounts for your manufacturing business may seem like a daunting task, but by following these steps, you can ensure that your financial records are accurate and well-organized. Remember to regularly review and update your chart of accounts as your business grows and evolves. With a well-structured chart of accounts in place, you’ll have a solid foundation for effective financial management in your manufacturing business.

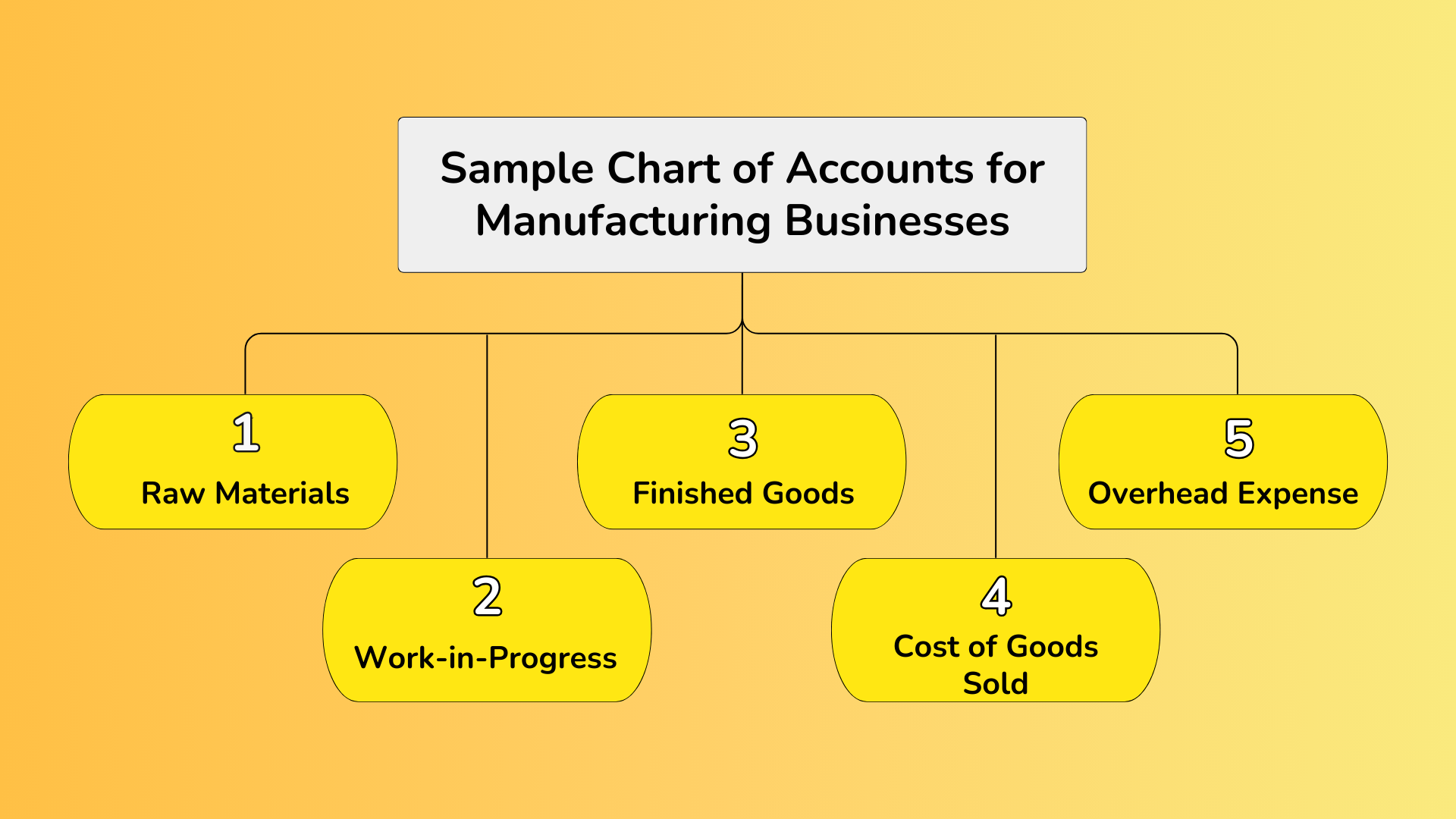

Sample Chart of Accounts for Manufacturing Businesses

When it comes to manufacturing businesses, having a well-designed chart of accounts is crucial for effective financial management. A chart of accounts is a comprehensive list of all the accounts used to record financial transactions within a company, providing a clear and organized structure for reporting and analysis.

To help you understand how a chart of accounts can be structured for manufacturing businesses, let’s take a look at some key categories commonly found in a chart of accounts for this industry:

Raw Materials Inventory Accounts

In manufacturing, raw materials are the basic components used to create finished goods. Therefore, it’s important to have specific accounts dedicated to tracking the inventory of raw materials. These accounts allow you to monitor the quantity and value of raw materials on hand, ensuring accurate costing and inventory management.

Work-in-Progress Inventory Accounts

As manufacturing processes unfold, products transition from raw materials to work-in-progress. Work-in-progress inventory accounts capture the costs incurred during the production process, including labor, overhead, and any other direct costs associated with transforming raw materials into partially finished goods.

Finished Goods Inventory Accounts

Once the manufacturing process is complete, products become finished goods ready for sale. Having separate accounts for finished goods inventory enables you to monitor the value of the goods available for sale, ensuring accurate financial reporting and inventory control.

Cost of Goods Sold Accounts

The cost of goods sold (COGS) accounts are essential for tracking the direct costs associated with producing the goods sold by the manufacturing business. These accounts include the costs of raw materials, labor, and overhead directly attributable to the production of the goods. Accurately tracking COGS allows for better profitability analysis and informed decision-making.

Overhead Expense Accounts

Manufacturing businesses often have various overhead expenses that are not directly tied to a specific product but are necessary for the overall operation of the business. Overhead expense accounts encompass costs such as rent, utilities, equipment maintenance, and administrative expenses. Properly categorizing and tracking these expenses ensures accurate financial reporting and helps with cost control.

By incorporating these key account categories into your chart of accounts, you can effectively track and manage the financial aspects of your manufacturing business. It’s important to note that the specific accounts within each category may vary depending on your business’s unique needs and industry requirements.

Best Practices for Managing the Chart of Accounts

When it comes to managing your chart of accounts, there are several best practices that can help ensure its effectiveness and efficiency. By following these practices, you can maintain consistency, improve accuracy, and streamline your financial reporting processes.

Maintaining Consistency

Consistency is key when it comes to managing your chart of accounts. It is important to establish and adhere to a standardized structure and naming convention for your accounts. This consistency will make it easier to track and analyze financial data, as well as ensure accurate reporting across different periods and departments.

To maintain consistency, consider the following tips:

- Standardize Account Names: Use clear and concise names for your accounts that accurately reflect their purpose and function. Avoid using abbreviations or acronyms that may be confusing to others.

- Establish a Numbering System: Utilize a numbering system to categorize and organize your accounts. This can help to easily identify different account types and their relationships within the chart of accounts.

- Document Account Descriptions: Provide a brief description for each account to clarify its purpose and usage. This documentation can serve as a reference for anyone who needs to access or analyze the financial data.

Regularly Reviewing and Updating

To ensure the ongoing accuracy and relevance of your chart of accounts, it is crucial to regularly review and update it. As your business evolves and grows, your financial needs may change, and new accounts may need to be added or existing ones modified.

Consider the following practices:

- Periodic Reviews: Conduct regular reviews of your chart of accounts to identify any outdated or unnecessary accounts. Remove redundant accounts and consolidate similar ones to simplify your financial reporting.

- Collaboration with Stakeholders: Involve key stakeholders, such as department heads and finance professionals, in the review process. Their insights and feedback can help ensure that the chart of accounts aligns with the needs of different business units.

- Flexibility for Growth: Anticipate future growth and expansion by designing your chart of accounts in a way that allows for scalability. This will ensure that your financial reporting can accommodate new accounts or changes in your business structure.

Utilizing Sub-Accounts and Account Codes

Sub-accounts and account codes can be valuable tools for organizing and categorizing your chart of accounts. They provide a hierarchical structure that allows for more detailed tracking and reporting of financial data.

Consider the following practices for utilizing sub-accounts and account codes:

- Hierarchical Structure: Create sub-accounts under main accounts to provide additional levels of detail and specificity. This can be particularly useful when tracking expenses or revenues across different departments or projects.

- Account Codes: Assign unique codes to each account to facilitate easy identification and sorting. These codes can be alphanumeric and follow a logical sequence that aligns with your business needs.

Integrating with Accounting Software

Integrating your chart of accounts with accounting software can greatly enhance its management and reporting capabilities. Accounting software can automate processes, streamline data entry, and generate accurate financial reports.

Consider the following practices for integrating your chart of accounts with accounting software:

- Choose Compatible Software: Select accounting software that is compatible with your chart of accounts structure and requirements. Ensure that the software can handle the level of detail and complexity needed for your business.

- Import and Export Data: Utilize the functionality to import and export data between the software and your chart of accounts. This will help ensure data accuracy and reduce manual data entry errors.

- Regular Data Backups: Implement a regular backup system for your accounting software and chart of accounts data. This will safeguard your financial information and protect against potential data loss.

By following these best practices, you can effectively manage and optimize your chart of accounts to support your business’s financial operations and decision-making processes. Remember, the chart of accounts is a dynamic tool that should evolve with your business, so ongoing review and improvement are essential.

Conclusion

Congratulations! You have now reached the end of our comprehensive guide on mastering the chart of accounts for manufacturing businesses. We hope that this article has provided you with valuable insights and practical tips to enhance your financial management skills.

Throughout this guide, we have emphasized the importance of a well-structured chart of accounts in the manufacturing industry. By implementing a carefully designed chart of accounts, you can streamline your financial processes, gain better visibility into your costs, and make informed decisions to drive your business forward.

Understanding the definition and purpose of the chart of accounts, as well as its key components and different types of accounts, is crucial to creating an effective financial framework for your manufacturing business. By analyzing your manufacturing processes, identifying cost categories, organizing accounts by function, and incorporating cost centers, you can tailor your chart of accounts to suit your specific needs.

We have also provided you with a sample chart of accounts for manufacturing businesses, including accounts for raw materials inventory, work-in-progress inventory, finished goods inventory, cost of goods sold, and overhead expenses. This sample can serve as a starting point for developing your own chart of accounts, but remember to customize it according to your unique business requirements.

To ensure the ongoing success of your chart of accounts, we have shared some best practices for managing it. From maintaining consistency and regularly reviewing and updating your accounts to utilizing sub-accounts and account codes and integrating with accounting software, these practices will help you optimize your financial processes and stay organized.

In conclusion, a well-designed chart of accounts is a powerful tool that can empower finance professionals in the manufacturing industry. It enables you to accurately track and manage your financial transactions, analyze costs, and generate insightful reports for better decision-making. By implementing the strategies and techniques outlined in this guide, you can take control of your financial management and drive your manufacturing business towards success.

Remember, at Zapro, we are committed to providing you with the resources and support you need to excel in your financial endeavors. If you have any further questions or need assistance with your chart of accounts, don’t hesitate to reach out to our team of experts. Keep learning, keep growing, and keep mastering the art of financial management!

If you’d like to learn more about chart of accounts and explore other related topics, feel free to check out our chart of accounts guide for a deeper dive into this essential financial tool.