Importance of a Chart of Accounts for Financial Success

When it comes to managing your finances, having a chart of accounts is an essential tool for success. Whether you’re running a small business, managing a non-profit organization, or simply trying to keep track of your personal finances, a chart of accounts provides a structured framework for organizing and categorizing your financial transactions.

But what exactly is a chart of accounts, and why is it so important? In this article, we’ll delve into the definition and purpose of a chart of accounts, explore its key components, and highlight the benefits of using a customizable chart of accounts template. By the end, you’ll understand how this powerful financial tool can streamline your financial reporting, help you make better decisions, and set you on the path to financial success.

So, let’s dive in and explore the world of chart of accounts!

But first, let’s clarify what a chart of accounts is and why it’s crucial for your financial success.

What is a Chart of Accounts?

A chart of accounts is an integral component of financial reporting in the world of accounting. It serves as a framework that organizes and categorizes your company’s financial transactions, providing a systematic way to record and track your financial activities.

The purpose of a chart of accounts is to provide a standardized structure for classifying and categorizing financial transactions, ensuring consistency and accuracy in financial reporting. By assigning specific codes and labels to different types of transactions, a chart of accounts allows you to easily identify and track various financial activities, such as revenue, expenses, assets, liabilities, and equity.

Now, let’s delve into the components of a chart of accounts. A typical chart of accounts consists of various elements that work together to create a comprehensive system for organizing your financial data. These components include:

The primary purpose of a Chart of Accounts is to provide a standardized framework for classifying and recording financial transactions. By assigning unique codes or numbers to different types of financial activities, it enables you to categorize transactions accurately and generate meaningful financial reports.

A well-structured Chart of Accounts consists of several key components that work together harmoniously. These components include:

- Account Codes or Numbers: Each account in the Chart of Accounts is assigned a unique code or number, which facilitates easy identification and sorting of transactions. This numbering system can be hierarchical, with different levels of accounts organized in a logical order.

- Account Names: Account names provide a descriptive label for each account, making it easier to understand the nature of the transactions associated with that account. Clear and concise account names are crucial for effective financial management and analysis.

- Account Types: Accounts are typically classified into different types based on their nature and purpose. Common account types include assets, liabilities, equity, revenue, and expenses. Categorizing accounts into their respective types helps in generating accurate financial statements and conducting meaningful financial analysis.

- Account Groups: Accounts can be further grouped together based on their similarities or shared characteristics. Grouping similar accounts together simplifies financial reporting and analysis by providing a higher level of organization and coherence.

- Sub-Accounts: To achieve more granular analysis and reporting, sub-accounts can be created within primary accounts. These sub-accounts allow you to track specific details and transactions within broader account categories.

A well-organized and thoughtfully designed Chart of Accounts is a powerful tool that empowers finance professionals like you to efficiently manage and analyze financial data. It provides a solid foundation for accurate financial reporting, budgeting, forecasting, and decision-making.

Benefits of a Well-Designed Chart of Accounts

A well-designed Chart of Accounts is a powerful tool that can provide numerous benefits to your financial reporting process. By structuring your accounts in a logical and organized manner, you can ensure accurate financial reporting, streamline data analysis, and facilitate efficient auditing and compliance. Let’s explore each of these benefits in more detail.

Accurate Financial Reporting

One of the primary advantages of a well-designed Chart of Accounts is its ability to facilitate accurate financial reporting. By categorizing your financial transactions into specific accounts, you can easily track and record your income, expenses, assets, liabilities, and equity. This standardized structure allows for consistent and reliable reporting, ensuring that your financial statements provide an accurate representation of your organization’s financial health.

With a clear and well-organized Chart of Accounts, you can easily generate financial reports such as income statements, balance sheets, and cash flow statements. These reports provide crucial insights into your business’s performance, allowing you to make informed decisions and identify areas for improvement. Whether you’re analyzing revenue trends, monitoring expenses, or assessing profitability, a well-designed Chart of Accounts serves as the backbone of your financial reporting process.

Streamlined Data Analysis

In addition to accurate financial reporting, a well-designed Chart of Accounts also enables streamlined data analysis. By categorizing your accounts based on relevant criteria, such as department, location, or product line, you can easily filter and analyze your financial data to gain valuable insights.

For instance, let’s say you run a retail business with multiple store locations. By assigning unique account codes to each location, you can easily track and compare the performance of individual stores. This allows you to identify top-performing locations, evaluate sales trends, and make data-driven decisions to drive growth.

Moreover, a well-designed Chart of Accounts can also support more advanced data analysis techniques, such as variance analysis or ratio analysis. By organizing your accounts in a logical manner, you can easily calculate and compare key financial ratios, such as gross profit margin or return on investment. These analyses provide a deeper understanding of your business’s financial performance, enabling you to identify areas of strength and weakness and make strategic adjustments.

Efficient Auditing and Compliance

Another significant benefit of a well-designed Chart of Accounts is its ability to facilitate efficient auditing and compliance. When your accounts are properly organized and categorized, auditors can easily navigate through your financial records and verify the accuracy and completeness of your financial statements.

A well-designed Chart of Accounts makes the auditing process smoother by providing a clear framework for reviewing financial transactions, identifying potential errors or irregularities, and conducting necessary reconciliations. By ensuring that your accounts are properly classified and documented, you can minimize the time and effort required for audits, allowing your organization to focus on its core operations.

Furthermore, a well-designed Chart of Accounts also helps ensure compliance with regulatory requirements and accounting standards. By following industry best practices and aligning your chart with relevant guidelines, you can meet reporting obligations and minimize the risk of non-compliance. This is particularly important for organizations operating in highly regulated industries, such as financial institutions or healthcare organizations.

Best Practices for Creating and Maintaining a Chart of Accounts

When it comes to creating and maintaining a chart of accounts, there are several best practices that can help ensure its effectiveness and efficiency. By following these practices, you can align your chart of accounts with industry standards, keep it up-to-date, collaborate effectively with stakeholders, and integrate it seamlessly with your accounting software.

Aligning with Industry Standards

Aligning your chart of accounts with industry standards is crucial for accurate financial reporting and analysis. Industry standards provide a framework for organizing and categorizing financial data, making it easier to compare and benchmark performance across similar businesses. It also ensures consistency and enhances the credibility of your financial statements.

To align with industry standards, you can refer to an industry-specific chart of accounts templates or guides tailored to your business type or sector. These resources provide a starting point and can be customized to meet your specific needs.

Regular Review and Updates

A chart of accounts is not a static document; it requires regular review and updates to reflect changes in your business operations, financial reporting requirements, and industry trends. By reviewing your chart of accounts periodically, you can identify outdated or redundant accounts, add new accounts as needed, and ensure that it remains relevant and useful.

Consider conducting a review at least once a year or whenever there are significant changes in your business, such as expansion, mergers, or changes in accounting regulations. This process ensures that your chart of accounts evolves with your business and continues to provide accurate and meaningful financial information.

Collaboration with Stakeholders

Collaboration with stakeholders is essential for creating and maintaining a chart of accounts that meets the needs of your entire organization. Involve key stakeholders such as your finance team, department heads, and external accountants in the design and review process. Their input and expertise can help ensure that the chart of accounts captures the necessary financial information and supports effective decision-making.

Engage in open discussions to gather feedback, address concerns, and identify any specific requirements or reporting needs. This collaborative approach fosters a sense of ownership and promotes better adoption of the chart of accounts throughout the organization.

Integration with Accounting Software

Integrating your chart of accounts with accounting software is a crucial step in streamlining your financial reporting and analysis processes. Accounting software automates data entry, reduces manual errors, and provides real-time insights into your financial performance.

When selecting accounting software, ensure that it supports the customization and import of your chart of accounts. This allows for seamless integration and eliminates the need for manual data entry or reconciliation.

By following these best practices, you can create and maintain a chart of accounts that aligns with industry standards, remains up-to-date, facilitates collaboration, and integrates smoothly with your accounting software. Remember, a well-designed chart of accounts is the foundation for accurate financial reporting, streamlined data analysis, efficient auditing, and compliance.

Designing a Chart of Accounts for Financial Reporting

When it comes to financial reporting, designing a well-organized and effective chart of accounts is crucial. A chart of accounts serves as a roadmap for your financial transactions, providing a clear and concise framework for recording and categorizing your financial data. In this section, we will explore the key aspects of designing a chart of accounts for financial reporting.

Understanding the Chart of Accounts Structure

The structure of a chart of accounts is the foundation on which all financial reporting is built. It is essential to have a clear understanding of this structure in order to create a chart of accounts that meets your specific business needs. The structure typically consists of a hierarchical arrangement of accounts, with each account representing a specific category or type of financial transaction.

Segmentation and Organization

Segmentation and organization are key considerations when designing a chart of accounts. By dividing your accounts into logical segments, you can easily track and analyze different aspects of your financial data. This segmentation allows you to group similar accounts together, making it easier to generate meaningful reports and gain valuable insights into your business’s financial performance.

Account Numbering System

The account numbering system is another important aspect of a well-designed chart of accounts. This system assigns a unique number to each account, providing a systematic way to identify and locate accounts within the chart. A well-structured numbering system can streamline data entry, simplify financial analysis, and facilitate efficient auditing and compliance processes.

Common Account Categories

When designing your chart of accounts, it is helpful to consider common account categories that are relevant to your business. These categories can serve as a starting point and guide you in creating a chart of accounts that aligns with industry standards and best practices. Typical account categories include assets, liabilities, equity, revenue, and expenses, but the specific categories may vary depending on your business type and industry.

By understanding the structure, segmentation, and organization of a chart of accounts, implementing an effective account numbering system, and considering common account categories, you can create a chart of accounts that not only meets your financial reporting needs but also provides a solid foundation for accurate financial analysis, streamlined data management, and efficient auditing and compliance processes.

How to Create a Chart of Accounts

Creating a chart of accounts is a crucial step in managing your business finances effectively. It provides a structured framework that allows you to organize and categorize your financial transactions, making it easier to track and analyze your company’s financial health. In this section, we will guide you through the process of creating a chart of accounts, ensuring that it is tailored to your specific business needs.

Assess Your Business Needs

Before diving into the creation of your chart of accounts, it is important to assess your unique business requirements. Take some time to understand the nature of your business, its operations, and the type of financial information you need to track. Consider factors such as the size of your business, the industry you operate in, and any specific regulations or reporting requirements that apply to your business.

By understanding your business needs, you can determine the appropriate level of detail required in your chart of accounts. For example, a small retail business may need a simpler chart with basic categories like sales, expenses, and inventory, while a larger manufacturing company may require more detailed accounts to track various aspects of their operations, such as raw materials, labor costs, and overhead expenses.

Customize the Chart of Accounts

Once you have assessed your business needs, it’s time to customize your chart of accounts to reflect those requirements. Start by identifying the main categories that will form the foundation of your chart, such as assets, liabilities, equity, revenue, and expenses. These categories will serve as the high-level buckets for organizing your financial transactions.

Within each category, you can create subcategories that provide further granularity. For example, under expenses, you may have subcategories like rent, utilities, salaries, and marketing expenses. This level of detail allows for better tracking and analysis of specific areas of your business.

It’s important to note that there is no one-size-fits-all approach to creating a chart of accounts. You have the flexibility to customize it according to your business’s unique needs. However, it’s recommended to follow generally accepted accounting principles (GAAP) and industry best practices to ensure consistency and compatibility with financial reporting standards.

Implement and Maintain

After customizing your chart of accounts, it’s time to implement it in your accounting system. This involves setting up the necessary accounts and assigning appropriate account codes and descriptions to each one. The account codes provide a standardized way to identify and categorize each account, while the descriptions provide additional details about the nature of the account.

Once your chart of accounts is implemented, it’s important to maintain it regularly. As your business evolves, you may need to add new accounts, modify existing ones, or remove accounts that are no longer relevant. Regularly reviewing and updating your chart of accounts ensures that it remains an accurate reflection of your business’s financial structure and facilitates accurate financial reporting.

Remember, creating a chart of accounts is not a one-time task. It is an ongoing process that requires regular attention and maintenance to adapt to the changing needs of your business.

By following these steps, you can create a customized chart of accounts that effectively organizes your financial transactions and provides a solid foundation for accurate financial reporting and analysis.

Benefits of Using a Customizable Chart of Accounts Template

A customizable chart of accounts is a powerful tool that can greatly contribute to the financial success of your business. By implementing a well-structured and adaptable chart of accounts, you can unlock several key benefits that will streamline your financial processes and enhance your decision-making capabilities.

Streamlined Financial Reporting

One of the primary advantages of using a customizable chart of accounts template is the ability to generate streamlined financial reports. With a well-organized chart of accounts, you can easily categorize and track your income and expenses, allowing for more accurate and efficient reporting. This enables you to gain a clear understanding of your financial position, identify trends, and make informed decisions for your business.

Accurate Tracking of Income and Expenses

A customizable chart of accounts template also facilitates accurate tracking of income and expenses. By defining specific accounts for different revenue sources and cost categories, you can easily record and monitor the flow of money in and out of your business. This level of detail provides valuable insights into your financial performance, helping you identify areas for improvement and optimize your profitability.

Efficient Tax Preparation

Tax season can be a stressful time for many business owners, but with a customizable chart of accounts template in place, tax preparation becomes significantly more efficient. By having well-defined accounts dedicated to tax-related transactions, you can easily gather the necessary information and ensure compliance with tax regulations. This simplifies the process of preparing financial statements, calculating tax liabilities, and filing your tax returns accurately and on time.

Better Decision-Making

A well-structured chart of accounts is not just a tool for tracking financial transactions, but also a valuable resource for better decision-making. By organizing accounts into meaningful categories, you can gain a holistic view of your business’s financial health. This enables you to analyze data, spot trends, and make data-driven decisions that align with your strategic goals. Whether it’s evaluating the profitability of a specific product line or assessing the financial impact of a potential investment, a customizable chart of accounts empowers you to make informed choices with confidence.

In conclusion, a customizable chart of accounts template is an essential component of financial success. It offers benefits such as streamlined financial reporting, accurate tracking of income and expenses, efficient tax preparation, and improved decision-making. By investing time and effort into creating and customizing your chart of accounts, you can enhance the financial management of your business and pave the way for future growth and success.

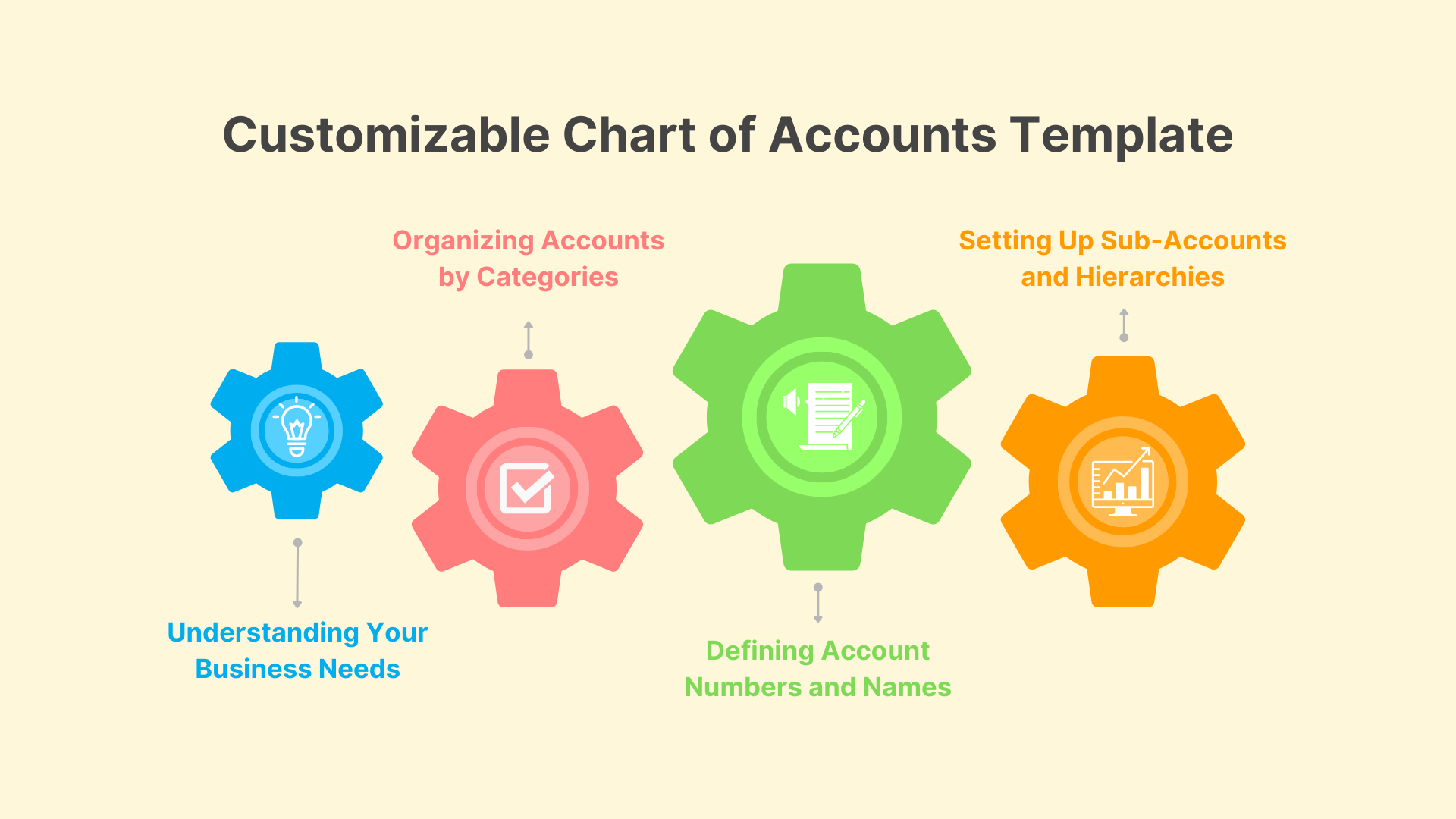

Creating a Customizable Chart of Accounts Template

When it comes to creating a customizable chart of accounts template, there are a few important steps you need to follow. By taking the time to carefully consider these steps, you can ensure that your chart of accounts is tailored to your specific business needs and will provide you with the financial insights necessary for success.

Understanding Your Business Needs

The first step in creating your chart of accounts template is to understand your business needs. Every business is unique, and your chart of accounts should reflect that. Take the time to assess your specific financial reporting requirements, including the type of information you need to track, the level of detail you require, and any specific regulations or industry standards that apply to your business.

Organizing Accounts by Categories

Once you have a clear understanding of your business needs, the next step is to organize your accounts by categories. This involves grouping similar types of transactions together to make it easier to track and analyze your financial data. Common categories include revenue, expenses, assets, liabilities, equity, and cost of goods sold. By organizing your accounts in this way, you can streamline your financial reporting process and gain valuable insights into the financial health of your business.

Defining Account Numbers and Names

After categorizing your accounts, it’s important to define account numbers and names. This step involves assigning a unique number to each account and giving it a clear and descriptive name. The account number helps identify the category and subcategory to which the account belongs, while the name provides additional context and clarification. For example, you might assign the account number 4000 to the revenue category and name it “Sales Revenue.” By using a consistent numbering system and clear naming conventions, you can ensure that your chart of accounts is easy to navigate and understand.

Setting Up Sub-Accounts and Hierarchies

Finally, you’ll want to set up sub-accounts and hierarchies within your chart of accounts. This allows you to create a more detailed and comprehensive financial reporting structure. Sub-accounts are used to further categorize transactions within a main account category. For example, under the expenses category, you might have sub-accounts for office supplies, rent, utilities, and salaries. Hierarchies, on the other hand, establish a relationship between accounts, indicating how they are related to one another. This can be useful for generating financial reports that provide a more in-depth analysis of your business’s financial performance.

By following these steps and taking the time to create a customizable chart of accounts template that aligns with your business needs, you can ensure that your financial reporting is accurate, efficient, and tailored to your specific requirements. Remember to regularly review and update your chart of accounts as your business evolves and grows, ensuring that it continues to provide you with the insights you need to make informed decisions.

Tips for Customizing Your Chart of Accounts Template

When it comes to customizing your chart of accounts template, there are a few tips that can help you create a system that best suits your business needs. By keeping these tips in mind, you can ensure that your chart of accounts is simple, consistent, and adaptable for future growth. Let’s explore these tips in detail:

Keep It Simple

Simplicity is key when designing your chart of accounts. Avoid the temptation to create overly complex account structures that may confuse you or your team. Instead, strive for a straightforward and intuitive system that is easy to navigate. By keeping it simple, you’ll reduce the chances of errors and make it easier to track and analyze your financial data.

Be Consistent

Consistency is crucial when customizing your chart of accounts template. Establish a set of rules and guidelines to ensure that account names, numbers, and categories are used consistently throughout your system. This consistency will make it easier to compare and analyze financial data over time and across different periods. It will also streamline your financial reporting processes, allowing for accurate and efficient reporting.

Consider Future Growth

While customizing your chart of accounts template, it’s important to consider the future growth and expansion of your business. Think about the accounts you may need as your business evolves and plan accordingly. By anticipating future needs, you can create a chart of accounts that can easily accommodate new accounts and categories without major disruptions or changes. This foresight will save you time and effort down the line.

Regularly Review and Update

Customizing your chart of accounts template is not a one-time task. It’s essential to regularly review and update your chart of accounts as your business changes and evolves. This ensures that your accounts remain relevant and aligned with your current financial operations. Regular reviews also allow you to identify any redundancies, inconsistencies, or outdated accounts that need to be removed or modified. By staying proactive in maintaining your chart of accounts, you’ll have a more accurate and useful financial reporting system.

By following these tips, you can customize your chart of accounts template to fit your business needs effectively. Remember, simplicity, consistency, future growth considerations, and regular review and updates are the keys to a successful chart of accounts. With a well-designed and customized chart of accounts, you’ll have a solid foundation for streamlined financial reporting, accurate tracking of income and expenses, efficient tax preparation, and better decision-making.

Conclusion

In conclusion, creating a customizable chart of accounts is a crucial step towards achieving financial success for your business. By implementing a well-structured accounting chart of accounts, you can streamline your financial reporting, accurately track your income and expenses, prepare taxes more efficiently, and make better-informed decisions.

Throughout this article, we have explored the importance of a chart of accounts and its key components. We have also discussed the numerous benefits of using a customizable template for your chart of accounts. By understanding your business needs, organizing accounts by categories, defining account numbers and names, and setting up sub-accounts and hierarchies, you can create a chart of accounts that perfectly suits your business requirements.

To further assist you in customizing your chart of accounts template, we have provided some valuable tips. Keeping it simple, maintaining consistency, considering future growth, and regularly reviewing and updating your chart of accounts are all essential practices.

Remember, a well-designed chart of accounts serves as the foundation for effective financial management. Whether you are a small business, a non-profit organization, a startup, or a manufacturing or retail company, a properly customized chart of accounts will provide you with invaluable insights into your financial health.

For more information on creating and optimizing your Chart of Accounts Template, check out Zapro’s comprehensive Chart of Accounts Guide. With Zapro, you can take control of your financial future and navigate the financial seas with confidence.