Every penny counts in the world of business, and knowing how to make the most of your company’s resources is a game-changer. Ideally, you want a well-oiled machine where financial decisions are strategic, expenses are optimized, and growth becomes an achievable reality. That’s the power of effective Business Spend Management (BSM), and it’s more crucial now than ever before. In this comprehensive blog, we will navigate through the what, why, and how of Business Spend Management. We’ll explore its significance, reveal proven approaches, and introduce you to the latest tools that empower businesses to thrive in today’s competitive landscape. With that said, let’s get started!

What is Business Spend Management?

Business Spend Management, also known as BSM, is a comprehensive and strategic approach to overseeing all aspects of a company’s financial expenditures. This includes procurement, invoice management, vendor relationships, and other business-related costs. At its core, BSM aims to efficiently track, manage, and optimize every aspect of a company’s spending. By gaining a holistic view of financial activities across departments like procurement, accounts payable, employee salaries, and vendor management, businesses can extract maximum value from their investments. BSM provides invaluable insights into expenditure patterns, allowing businesses to identify cost-saving opportunities, negotiate better contracts, and enhance overall financial performance. Moreover, it enables companies to foster transparency and compliance while ensuring that financial decisions align with organizational goals.

Why is Spend Management Important?

Spend management plays a pivotal role in a company’s financial health. It serves as the backbone of cost control, allowing businesses to identify areas of unnecessary spending and potential savings. Here are some compelling reasons why spend management is crucial:

- Financial Transparency: It provides a clear picture of an organization’s expenditures, offering complete transparency and control over the company’s finances.

- Cost Optimization: Through spend management, businesses can identify and eliminate wasteful spending, thus optimizing costs and enhancing profitability.

- Supplier Relationship Management: It aids in managing supplier relationships effectively, allowing businesses to negotiate better terms and prices.

- Risk Management: A well-implemented spend management strategy helps in identifying potential financial risks and taking proactive measures to mitigate them.

- Improved Efficiency: By automating and streamlining procurement processes, spend management enhances operational efficiency and productivity.

Importance of Business Spend Management

BSM holds paramount importance as a strategic financial process that shapes the foundation of a successful organization. By providing a comprehensive framework to monitor, manage, and optimize spending activities, BSM empowers businesses to achieve cost efficiency, enhance financial transparency, and align expenditures with broader business goals. With a clear view of financial data and streamlined procurement practices, BSM enables companies to make well-informed decisions, mitigate risks, and ensure compliance with regulations. This proactive approach to financial management not only fosters better financial control but also creates opportunities for strategic growth and sustained competitive advantage, making BSM an indispensable aspect of modern business operations.

How to Implement Spend Management?

Implementing an efficient spend management strategy can be a game-changer for businesses. However, it requires a systematic approach and the right tools. Here are some steps to implement a compelling spend management strategy:

- Identify Business Needs: Understand your current processes, identify areas of improvement, and outline your business goals and aspirations.

- Digitize Processes: Embrace digital transformation and automate your procurement processes to reduce manual errors and inefficiencies.

- Analyze Spend: Gain insights into your business spending patterns and behaviors. Understand where the money is going and identify opportunities for savings.

- Evaluate Supplier Database: Regularly audit your supplier database and use spend analytics to streamline your supplier base.

- Establish Policies and Facilitate Collaboration: Define clear procurement policies and ensure all departments and stakeholders are onboard.

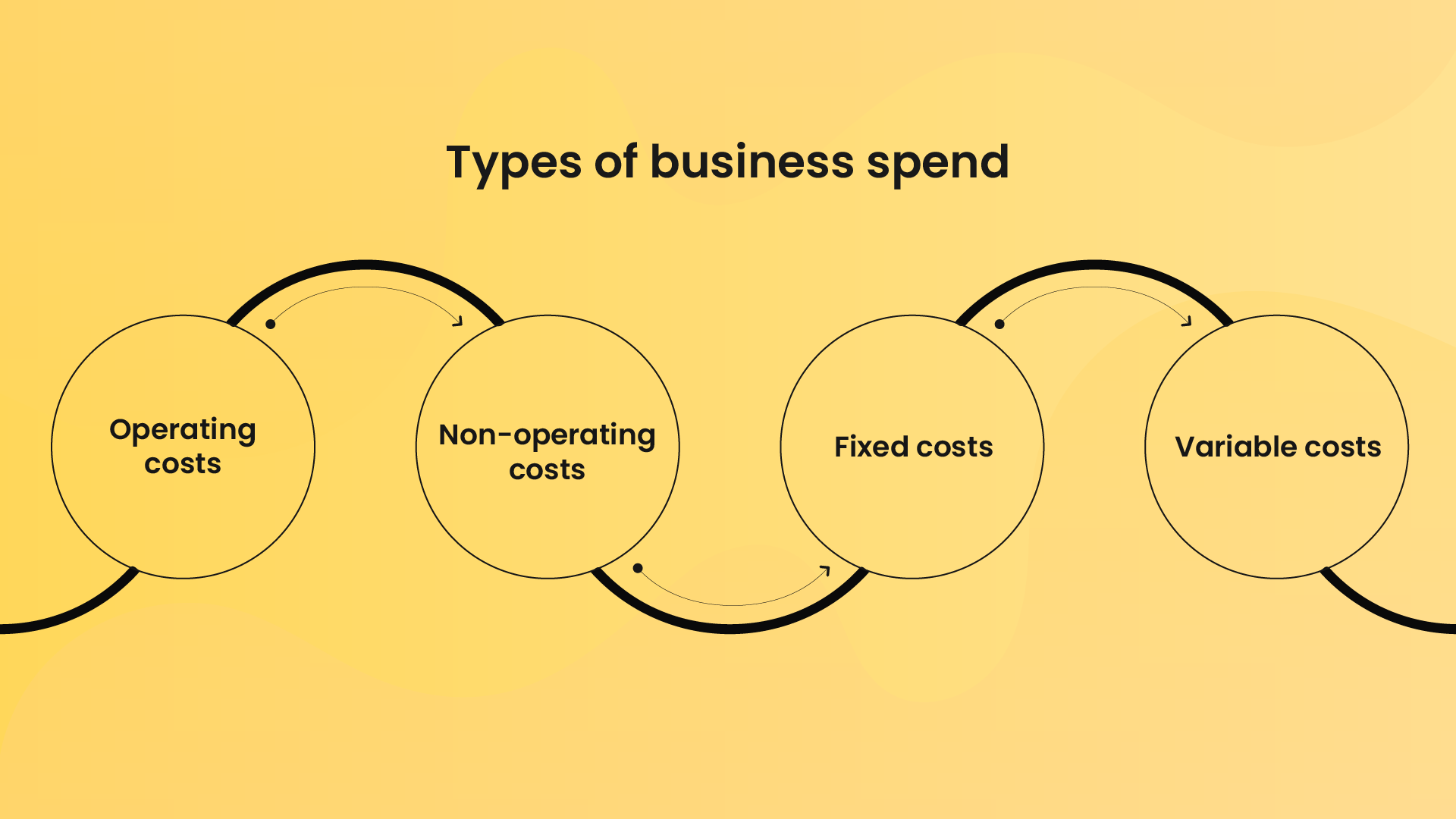

Types of Business Spend

Understanding the various types of business spend is crucial for effective financial management. Each type plays a distinct role in a company’s financial landscape, and comprehending their differences is vital for making informed spending decisions. When it comes to business spends, not all expenses are the same. Companies encounter different types of costs that impact their financial performance in unique ways. Recognizing these categories allows businesses to develop targeted strategies to optimize spending, allocate resources wisely, and achieve greater financial efficiency.

Understanding the various types of business spend is crucial for effective financial management. Each type plays a distinct role in a company’s financial landscape, and comprehending their differences is vital for making informed spending decisions. When it comes to business spends, not all expenses are the same. Companies encounter different types of costs that impact their financial performance in unique ways. Recognizing these categories allows businesses to develop targeted strategies to optimize spending, allocate resources wisely, and achieve greater financial efficiency.

1. Operating Costs

Operating costs, also known as operational expenses, encompass the day-to-day expenses required to run a business. These expenses are essential for the company’s core operations and directly contribute to its revenue generation. Examples of operating costs include employee salaries, rent, utilities, raw materials, marketing expenses, and administrative costs. Monitoring and managing operating costs are crucial to ensure ongoing business activities and maintain profitability.

2. Non-operating costs

Non-operating costs, in contrast, are expenses not directly tied to a company’s regular business operations. These costs arise from activities outside the company’s primary revenue-generating processes. Common examples of non-operating costs include interest expenses on loans, taxes, and one-time expenses like legal settlements or restructuring costs. Though they do not directly impact daily operations, non-operating costs can significantly affect a company’s financial health and should be carefully monitored.

3. Fixed costs

Fixed costs are expenses that remain constant regardless of the level of production or business activity. These costs do not fluctuate over short periods and are usually associated with long-term commitments. Examples of fixed costs include rent for a company’s office or manufacturing facility, insurance premiums, and certain employee salaries. While fixed costs provide stability to a business, they can also be a significant burden during economic downturns or periods of low activity.

4. Variable Costs

In contrast, variable costs are directly tied to the level of production or business activity. As the company produces more goods or services, variable costs increase proportionally. Common examples of variable costs include raw materials, direct labor costs, and sales commissions. Variable costs allow businesses to adapt to changes in demand and production levels but can present challenges in managing profit margins.

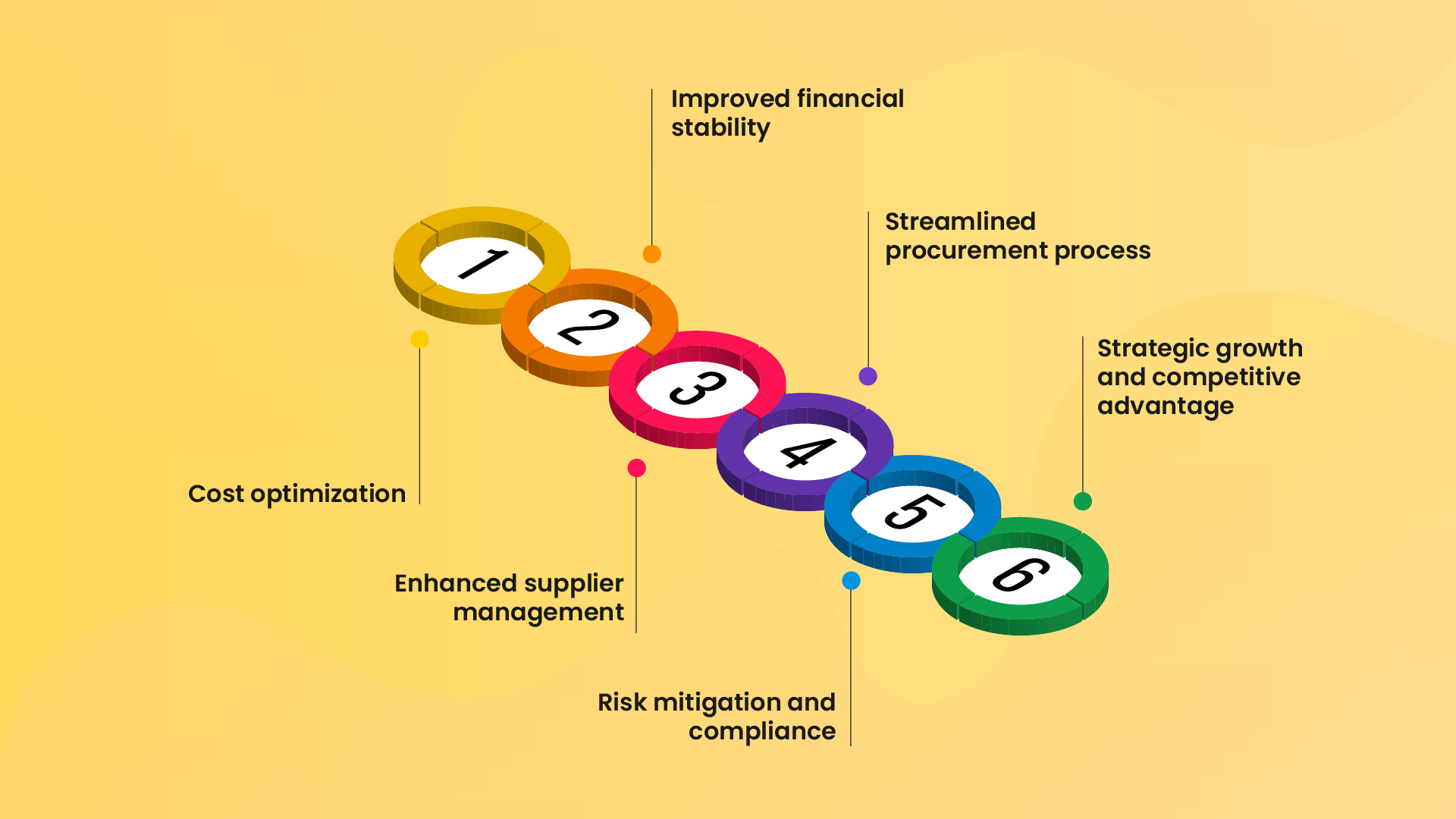

Benefits of Business Spend Management

BSM practices yield a multitude of invaluable benefits that directly impact a company’s financial health and overall success. From cost optimization to enhanced decision-making, BSM acts as a driving force in achieving financial excellence. Here are some of the key benefits of adopting BSM:

- Cost optimization

- Improved financial stability

- Enhanced supplier management

- Streamlined procurement process

- Risk mitigation and compliance

- Strategic growth and competitive advantage

1. Cost Optimization

BSM enables businesses to identify cost-saving opportunities and streamline spending across various departments. By leveraging data insights and analytics, companies can negotiate better contracts with suppliers, optimize procurement processes, and eliminate unnecessary expenses. This proactive approach to cost management enhances profitability and ensures resource efficiency.

2. Improved Financial Visibility

BSM provides a centralized view of financial data, allowing businesses to gain better visibility into their spending activities. With real-time insights, companies can track expenses, monitor budgets, and identify potential risks or discrepancies. This heightened financial transparency fosters better decision-making and empowers stakeholders with accurate data for strategic planning.

3. Enhanced Supplier Management

Through BSM, companies can develop stronger and more transparent relationships with suppliers. Improved supplier management leads to better contract negotiations, reduced supply chain risks, and increased supplier compliance. This, in turn, enhances the overall quality of products and services, contributing to customer satisfaction and loyalty.

4. Streamlined Procurement Process

BSM streamlines the procurement process, optimizing supplier selection, and purchasing practices. Automated workflows and approval systems ensure compliance with policies, reducing processing time and manual errors. A well-organized procurement process ensures timely deliveries, minimizes inventory costs, and enhances operational efficiency.

5. Risk Mitigation and Compliance

With BSM, businesses can identify and mitigate financial risks, ensuring compliance with regulatory requirements and industry standards. Advanced analytics help monitor supplier performance and financial stability, reducing the risk of disruptions or supply chain failures. This proactive risk management approach safeguards a company’s reputation and financial stability.

6. Strategic Growth and Competitive Advantage

By optimizing spending, BSM allows companies to redirect resources toward strategic initiatives and business expansion. Cost savings can be reinvested in research and development, marketing, or talent acquisition, fostering innovation and competitive differentiation.

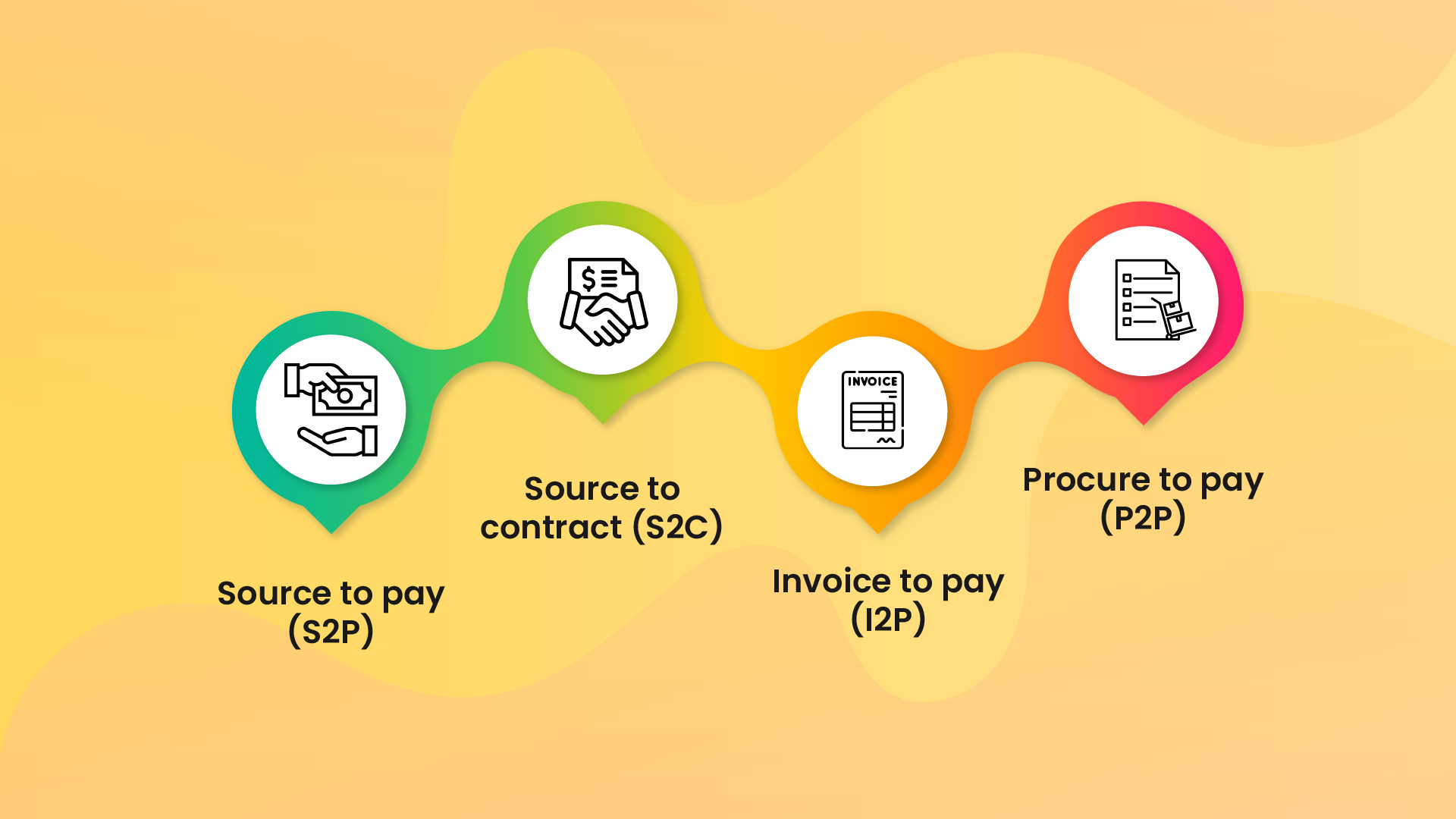

4 Approaches to Business Spend Management

Businesses employ different approaches to manage their spending efficiently and strategically. Each approach focuses on specific stages of the spending process, streamlining operations and optimizing financial outcomes. Let’s explore the four primary approaches to spend management:

1. Source to pay (S2P)

Source to pay is a comprehensive approach that covers the entire spending lifecycle, starting from sourcing suppliers to the final payment. It begins with identifying sourcing needs, selecting vendors, and negotiating contracts. Once the contract is in place, the procurement process commences, including purchase requisitions, approvals, and order placements. After receiving goods or services, the organization verifies and processes invoices, leading to payment to suppliers. The S2P approach enhances procurement efficiency, promotes supplier collaboration, and reduces the risk of maverick spending.

2. Source to contract (S2C)

Source to contract focuses on the early stages of spending, from sourcing suppliers to establishing contractual agreements. This approach emphasizes supplier selection, negotiation, and contract management. Once contracts are in place, the procurement process shifts to Source to Pay for purchasing and invoice management. S2C streamlines the supplier relationship management process, improves procurement decision-making, and ensures compliance with negotiated terms and conditions.

3. Invoice to pay (I2P)

Invoice to pay centers around managing the invoicing and payment stages of spending. It starts with the receipt and validation of invoices, ensuring they align with the agreed-upon contracts or purchase orders. The organization then processes the invoices for approval and payment, keeping track of payment schedules and ensuring timely settlement. Adopting I2P streamlines accounts payable processes, reduces manual errors, and enhances cash flow management.

4. Procure to pay (P2P)

Procure to Pay is a comprehensive approach covering the entire procurement process, starting from requisition to final payment. It begins with identifying purchasing needs, submitting purchase requisitions, and obtaining necessary approvals. After approvals, purchase orders are issued to suppliers, and goods or services are received. The organization then verifies invoices, matches them with purchase orders, and processes payments to suppliers. P2P streamlines procurement operations, improves spend visibility, and reduces procurement cycle times.

Strategies to Optimize Spend Management Processes

Optimizing spend management processes is essential for businesses looking to enhance efficiency, reduce costs, and maximize profits. By implementing the following strategies, you can streamline your spend management processes and drive financial success.

- Implement Spend Policies and Approval Workflows:

Establishing clear spend policies and approval workflows ensures that spending is in line with business objectives and that there are proper controls in place. By defining spending limits, specifying approved vendors, and implementing approval workflows, businesses can prevent unauthorized spending and enforce compliance with spend policies.

- Leverage Supplier Consolidation:

Consolidating suppliers can help businesses reduce costs, simplify procurement processes, and negotiate better terms. By strategically selecting key suppliers and consolidating purchasing volumes, businesses can benefit from economies of scale, negotiate volume-based discounts, and streamline supplier management.

- Automate Procurement and Invoicing:

Automating procurement and invoicing processes can significantly improve efficiency and accuracy. By leveraging procurement and invoicing software, businesses can streamline purchase requisitions, automate purchase order creation, capture invoices electronically, and automate the invoice approval process. This not only saves time but also reduces errors, improves invoice accuracy, and accelerates the payment cycle.

- Implement Spend Analytics and Reporting:

Leveraging data analytics tools and reporting capabilities enables businesses to gain better visibility into their spending patterns and make data-driven decisions. By analyzing spending data, businesses can identify cost-saving opportunities, track key performance indicators, and monitor the effectiveness of their spend management initiatives. Real-time reports and dashboards provide actionable insights that drive financial efficiency and maximize profitability.

- Negotiate Favorable Supplier Contracts:

Effective contract management is crucial for optimizing spend management processes. By negotiating favorable terms and conditions with suppliers, businesses can reduce costs, improve delivery terms, and mitigate risks. Regularly reviewing and renegotiating contracts ensures that businesses are getting the best value for their money and that supplier relationships remain mutually beneficial.

By implementing these strategies, businesses can optimize their spend management processes, reduce costs, and maximize profitability. It’s important to continually evaluate and refine these strategies based on changing business needs and market dynamics.

Leveraging Technology for Better Spend Management

Technology plays a vital role in enabling businesses to optimize spend management processes and drive financial efficiency. By leveraging the right tools and solutions, businesses can automate manual processes, enhance visibility, and make data-driven decisions. Here are some key technologies that can transform your spend management practices:

- Procurement Software:

Procurement software streamlines the procurement process by automating purchase requisitions, purchase orders, and supplier management. It allows businesses to centralize procurement activities, enforce spend policies, and negotiate better contracts. Additionally, procurement software provides real-time visibility into procurement activities, enabling businesses to track spending, identify cost-saving opportunities, and make informed decisions.

- Invoice Management Software:

Invoice management software automates the processing and payment of invoices. It captures invoice data, validates it against purchase orders and contracts, and routes invoices for approval. By automating these processes, businesses can reduce errors, eliminate manual data entry, and accelerate the invoice approval cycle. Invoice management software also provides visibility into invoice status, improves cash flow management, and prevents late payment penalties.

- Expense Management Software:

Expense management software simplifies the expense tracking process by automating expense reporting, approval workflows, and policy enforcement. It allows employees to easily submit expense reports, categorize expenses, and attach receipts. By automating expense tracking, businesses can reduce the administrative burden of manual expense reporting, enforce compliance with expense policies, and gain better visibility into employee spending.

- Data Analytics and Reporting Tools:

Data analytics and reporting tools provide businesses with the ability to analyze spending data, identify trends, and generate actionable insights. By leveraging these tools, businesses can gain better visibility into their spending patterns, track key performance indicators, and monitor the effectiveness of their spend management initiatives. Real-time reports and dashboards enable businesses to make data-driven decisions that drive financial efficiency and maximize profitability.

- Supplier Management Software:

Supplier management software centralizes supplier information, facilitates supplier performance evaluations, and automates contract management. It allows businesses to track supplier performance, conduct supplier audits, and negotiate favorable agreements. By leveraging supplier management software, businesses can streamline supplier relationships, reduce risks, and optimize contract management processes.

By leveraging these technology solutions, businesses can streamline their spend management processes, enhance visibility, and drive financial efficiency. It’s important to select the right tools that align with your business’s unique needs and integrate seamlessly with your existing systems.

Top 3 Business Spend Management Platform

There are numerous spend management platforms that are available in the market. We handpicked the top 3 based on factors such as flexibility, features, and integrations with other platforms. Let’s take a look at each of them.

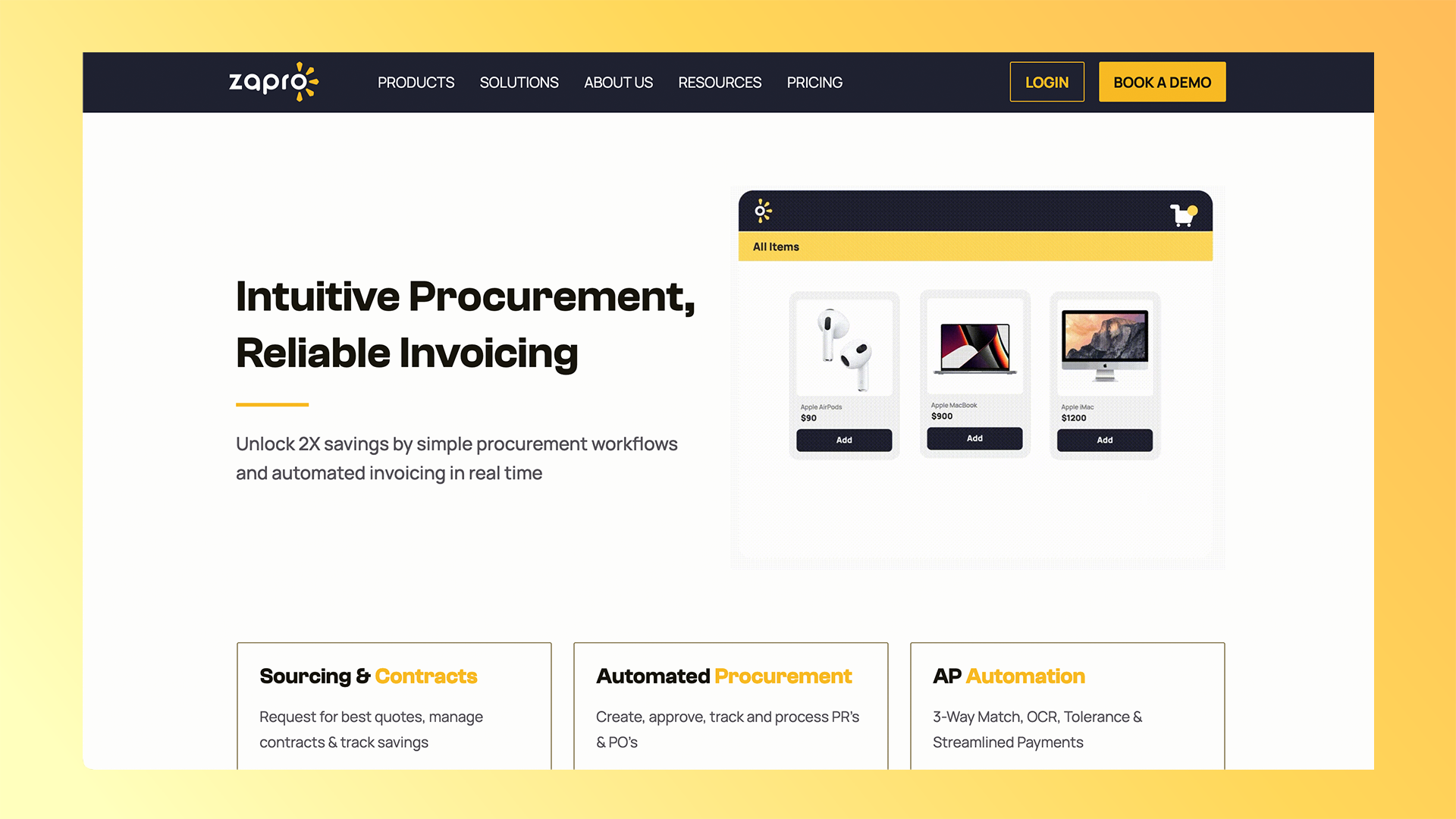

1. Zapro

Zapro.ai is a leading spend management platform that offers innovative solutions to help businesses effectively manage their spending activities and optimize financial performance. With a focus on procurement, invoice management, vendor management, and business expenditures, Zapro empowers organizations to gain greater visibility, make data-driven decisions, and achieve cost savings. Let’s explore how Zapro aids in Business Spend Management: Zapro’s spend management platform plays a pivotal role in transforming business spend management strategies. By enabling efficient supplier selection, cost optimization, risk management, and providing real-time insights, Zapro empowers organizations to drive efficiency, improve financial stability, and make data-driven decisions for sustained growth and success.

Zapro.ai is a leading spend management platform that offers innovative solutions to help businesses effectively manage their spending activities and optimize financial performance. With a focus on procurement, invoice management, vendor management, and business expenditures, Zapro empowers organizations to gain greater visibility, make data-driven decisions, and achieve cost savings. Let’s explore how Zapro aids in Business Spend Management: Zapro’s spend management platform plays a pivotal role in transforming business spend management strategies. By enabling efficient supplier selection, cost optimization, risk management, and providing real-time insights, Zapro empowers organizations to drive efficiency, improve financial stability, and make data-driven decisions for sustained growth and success.

2. Coupa

Coupa Business Spend Management is a cloud-based platform that offers a suite of features to help organizations manage and optimize their corporate spending. Power users and suppliers can manage business spending activities centrally using Coupa’s Business Spend Management (BSM) platform. With Coupa, your end users, consumers, admins, and IT teams will have the simplicity and adaptability they need to be successful, thanks to the platform’s comprehensiveness in managing business expenditures. Coupa is an enterprise- and SMB-friendly spending management tool. It is designed to be an end-all-be-all tool for controlling company spending. Coupa’s flexible, open-architecture software makes it simple to modify for your specific needs. Large corporations like Salesforce, Unilever, Groupon, and Aon use it, along with nonprofit, retail, and manufacturing organizations. Top features:

Coupa Business Spend Management is a cloud-based platform that offers a suite of features to help organizations manage and optimize their corporate spending. Power users and suppliers can manage business spending activities centrally using Coupa’s Business Spend Management (BSM) platform. With Coupa, your end users, consumers, admins, and IT teams will have the simplicity and adaptability they need to be successful, thanks to the platform’s comprehensiveness in managing business expenditures. Coupa is an enterprise- and SMB-friendly spending management tool. It is designed to be an end-all-be-all tool for controlling company spending. Coupa’s flexible, open-architecture software makes it simple to modify for your specific needs. Large corporations like Salesforce, Unilever, Groupon, and Aon use it, along with nonprofit, retail, and manufacturing organizations. Top features:

- Supplier information management

- Contract lifecycle management

- Strategic sourcing & procurement

- Inventory management

- Expense management & payment support

- Predictive spend analytics and data insights

Their online solution is fully mobile, supporting both Android and iOS. It connects with approximately 35 different Enterprise Resource Planning (ERP) software, including DocuSign, KPMG, MuleSoft, NetSuite, and Salesforce. Coupa’s adaptability is illustrated by its Business Service Management (BSM) choices that are multilingual, multicurrency, and multi-organizational, as well as the 360-degree insight it provides across numerous business processes. Pricing: Their pricing is flexible and depends on quotes, and they provide thorough assistance with setting up and using their software.

3. Ariba

Ariba Business Spend Management is a cloud-based platform offered by SAP Ariba. AP Ariba is a configurable, all-encompassing procurement platform with a rich range of features to meet your sourcing, procurement, and payment requirements. Having existed for almost 25 years, they are recognized as a leader in their industry. This solution appeals to giant corporations such as JP Morgan Chase, Deloitte, and Coca-Cola, but it is also utilized by medium-sized and small enterprises worldwide. Top features:

Ariba Business Spend Management is a cloud-based platform offered by SAP Ariba. AP Ariba is a configurable, all-encompassing procurement platform with a rich range of features to meet your sourcing, procurement, and payment requirements. Having existed for almost 25 years, they are recognized as a leader in their industry. This solution appeals to giant corporations such as JP Morgan Chase, Deloitte, and Coca-Cola, but it is also utilized by medium-sized and small enterprises worldwide. Top features:

- Supplier collaboration

- Analytics & reporting

- Strategic sourcing

- Procurement

- Supply chain management

- Spend management

This cloud-based procurement platform is compatible with Mac and Windows computers and Android and iOS mobile devices through seamless integration with SAP-specific ERP management software. The Ariba Network, a global commercial marketplace, is also a part of this package, expanding the possibilities for finding partners and conducting business with them. Pricing: SAP Ariba offers flexible pricing based on the requirements of each individual client and provides extensive assistance through an online knowledge base.

What to Look For in Business Spend Management Tools

When choosing a business spend management tool, look for one that tracks the company’s expenses, conducts effective spending analysis, handles the company’s procurement, and manages supplier relationships effectively.

Enhance Your Spend Management and Optimize Your Business Spends with Zapro

Looking to optimize your spend management strategy? Look no further than Zapro. With our comprehensive spend management solutions, we enable businesses to gain complete control over their expenditures, maximize supplier relationships, and enhance overall business performance. Contact us today to learn more about how Zapro can help your business achieve world-class Spend Analytics, Savings Tracking & Tail Spend Management Solutions.