According to an industry study report, on an average businesses waste 19% of their profits due to inefficient procurement practices, according to industry studies. This is where the procure to pay (P2P) process offers its incredible help. By putting it into place, a business can bring in structure to the system, create perfect accountability, and automate functions. It also takes care of the funds spent and sends alerts when it is about to exceed budget limits. In simple terms, the P2P connects the act of purchasing goods or services with the financial systems that make payments, creating one seamless workflow.

In order to use it effectively, it is important to comprehend what is procure to pay and how the procure to pay business process works. By doing so, businesses will get a clear idea on how to make best use of it to strengthen vendor relationships, cut unnecessary costs, and ensure compliance with internal and external regulations. In this article, we explore procure to pay definition, outline the procure to pay process flow, highlight the advantages, and explain how latest automation platforms like Zapro transform the P2P experience.

What is Procure-to-Pay?

As the name implies, the procure-to-pay definition is about procuring goods or services for the business and culminates in the final payment to the supplier. It is not just any goods or services, but the ones identified for business. The term itself is a combination of “procure,” meaning to obtain, and “pay,” referring to the settlement of financial obligations. Together, they describe an end-to-end framework that eliminates gaps between procurement and finance.

what is procure to pay process?

Procurement to payment process means to connects all the functions that start from sourcing to final payment. Procuring goods and services is approached in a systematic way, documented, and in no way connected to ad-hoc purchasing. The insights obtained from the function, sourcing of goods or services, vendor relationships, and financial data are used to improve efficiency and accountability. Today, many organizations of all sizes depend on P2P systems to manage spending, avoid manual errors, and gain full visibility over their procurement operations.

The Complete Procure-to-Pay Process Flow

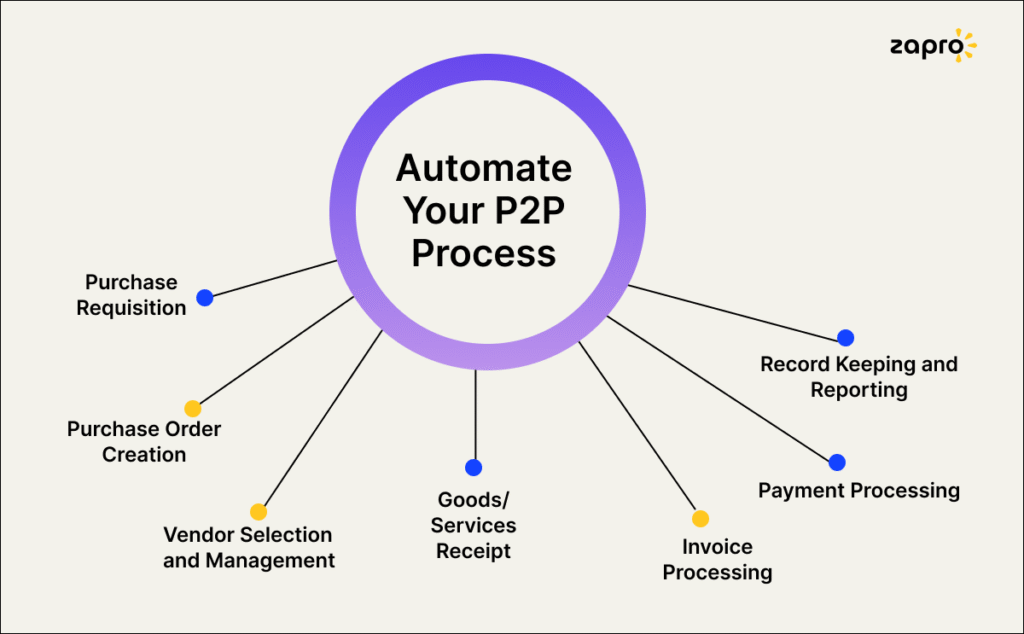

The procure to pay process flow contains standardized steps which organizations follow but their exact workflows differ from one organization to another. The process follows this sequence of steps:

1. Purchase Requisition

The internal team identifies a requirement which leads to a requisition submission for approval purposes. The process verifies that all purchases fulfill essential needs while staying within budget limits.

2. Purchase Order Creation

The approved purchase order (PO) gets created after approval and the supplier receives it for their review.

3.Vendor Selection and Management

The selection process for vendors involves evaluating potential suppliers through price evaluation and quality assessment and reliability assessment.

4. Goods/Services Receipt

The business organization verifies that all received goods and services match their original delivery expectations.

5. Invoice Processing

The supplier sends invoices which need verification against purchase orders and receipts to prevent any discrepancies.

6. Payment Processing

The finance team initiates payment processing after validation according to the agreed payment terms.

7. Record Keeping and Reporting

The last step involves documenting all transactions for auditing purposes and compliance requirements and analytical needs.

Why Effective Procurement is the Jedi Master of Supply Chain Management

In the wise words of Yoda, “Control your supply chain, you must.” Effective procure-to-pay is the key to unlocking cost savings, ensuring timely deliveries (no more waiting for that crucial shipment like you’re waiting for Godot), and maintaining quality standards that would make even the pickiest Michelin inspector nod in approval.

But what happens when procurement isn’t so effective? Well, imagine this:

- Missed Opportunities: Inefficient procure-to-pay processes can hinder innovation and agility. A 2023 study by Deloitte found that 70% of tech CPOs believe their current procurement processes are not agile enough to support rapid technology adoption.

- Increased Risk: Poor supplier management can lead to security breaches and compliance violations. According to a recent IBM report, the global average cost of a data breach is estimated to be $4.88 million in 2024.

- Damaged Reputation: Subpar product quality due to ineffective sourcing can damage a tech company’s brand image and customer trust. A recent study by BlueVoyant found that 98% of organizations have been negatively impacted by a cybersecurity breach in their supply chain.

- Innovation Delays: Late deliveries of critical components can delay product launches and stall innovation. In the fast-paced tech world, even a small delay can be costly, with some estimates suggesting it can impact revenue by up to 20%. That’s like having the Death Star plans, but the TIE fighters aren’t ready for takeoff!

- Lost Revenue: Delays in procuring critical components or software can significantly impact product development cycles and time-to-market, leading to lost revenue and competitive disadvantage. Research by McKinsey shows that companies with agile procure-to-pay processes can achieve a 3-5% increase in revenue growth.

By harnessing the power of comprehensive procurement solutions, you can avoid these pitfalls and achieve procure-to-pay mastery. You can gain Jedi-level control over your procurement processes, improve visibility into your supply chain (no more surprises hiding in the shadows), and make strategic decisions that impress Master Yoda himself.

Diving Deep into Comprehensive Procurement Solutions (No Scuba Gear Required)

Comprehensive procure-to-pay solutions are like the Swiss Army knives of the procurement world. These solutions provide a centralized platform to manage all your procure-to-pay activities, covering the entire process, from requisition to payment.

Think of it as your procurement command center, where you can monitor every aspect of your supply chain with a button.

Learn more about Procure-to-pay vs Source-to-pay.

Key Components of P2P Systems

A p2p procure to pay system operates efficiently through multiple essential components that create an organized system:

1. Purchase Requisition Management

The Purchase Requisition Management system verifies all requests before they proceed to the next stage.

2. Vendor Management

The system enables vendor management to handle supplier data maintenance and performance assessment and compliance monitoring.

3. Contract Management

The Contract Management system monitors agreement compliance while tracking renewal schedules and risk reduction activities.

4. Invoice Processing

The system controls how organizations handle invoice receipt and validation and order matching processes.

5. Payment Processing

The payment processing system enables vendors to receive timely payments which helps prevent payment disputes and late fees.

6. Analytics and Reporting

The system provides analytical reports that help leaders understand spending behaviors so they can base their decisions on data.

The fundamental elements of p2p procurement create a single efficient process which replaces individual unconnected operations. Organizations that implement contemporary procurement systems achieve enhanced team collaboration together with reduced expenses from mistakes.

Together, these components create a comprehensive procure-to-pay solution that empowers you to optimize your processes, reduce costs, and drive business success.

80% of procurement leaders now prioritize automation in the procure-to-pay cycle—and AI-powered tools are already cutting cycle times by around 40%.

Benefits and Advantages of Procure-to-Pay

Organizations that execute procure to pay steps correctly will experience multiple benefits from this process. The system enables cost reduction through spend policy enforcement and discount capture from suppliers. The process becomes more efficient through automation platform which reduces the need for human teams to perform repetitive tasks.

The implementation of a strong P2P framework provides organizations with better control and compliance while minimizing the chance of policy breaches and fraudulent activities. The accuracy and timeliness of payments through the system lead to better vendor relationships because suppliers develop trust in the company. The combination of improved spend tracking and reporting capabilities enables businesses to detect operational problems and security threats at an early stage which transforms P2P into a strategic business tool.

S2P vs P2P: Understanding the Difference

The distinction between s2p and p2p remains straightforward to all users. The Source-to-Pay (S2P) process includes all stages from supplier search and contract talks to payment execution. The procure to pay (P2P) process starts after a purchase requisition is created and handles requisition-to-payment operations.

S2P operates as a comprehensive strategic framework which extends beyond P2P’s operational scope. Organizations that want to develop supplier networks and secure improved contracts through S2P while businesses seeking operational excellence and compliance use P2P. Businesses need to understand the correct time to implement each approach because they serve different purposes for achieving success.

Common P2P Challenges and Solutions

The implementation of P2P systems by businesses encounters various obstacles despite their numerous benefits. The combination of manual team-wide visibility creates problems for tracking expenses while non-standardized processes generate compliance issues.

Organizations struggle with operations with inefficient systems resulting in delayed transactions and repeated orders and unprocessed approval requests. The absence of managing their vendors because they need to monitor multiple suppliers who perform at different levels.

The integration of P2P systems with ERP or financial platforms becomes complicated because of existing integration challenges. Modern automation platforms address these problems through their ability to provide instant visibility and standardized workflows and smooth system connections that minimize operational obstacles.

How Can Automation Improve the Procure-to-Pay Process?

The procurement to payment process now operates as a data-driven smart system because automation converts its traditional paper-based manual operations. Automated P2P platforms perform three main functions which include invoice validation and purchase order matching and payment scheduling tasks. The system decreases human mistakes while it accelerates approval processes and maintains regulatory requirements.

The system generates instant dashboards which monitor vendor performance alongside spending activities and potential risks in real-time. Businesses that implement automated Procure 2Pay workflows achieve time savings and develop better supplier relationships through their ability to make prompt and reliable payments. Modern enterprises now require automated procure to pay processes instead of viewing them as optional solutions.

Upgrade Your Procure-to-Pay — Faster, Smarter, and Future-Ready

Best Practices for P2P Implementation

The implementation of a P2P system demands detailed strategic planning. Organizations need to begin their P2P implementation by defining their objectives which include cost reduction and compliance and operational efficiency. The success of P2P implementation depends on obtaining full support from procurement and finance and IT departments.

Businesses search for the right technology requires businesses to assess tools based on their user-friendliness and their ability to integrate with existing systems and their capacity to expand. The combination of effective change management and performance tracking systems enables organizations to achieve successful P2P implementation and measure their return on investment. Businesses that implement these best practices will achieve sustainable success with their P2P initiatives.

How Zapro Transforms Your Procure-to-Pay Process

Zapro provides organizations with a contemporary p2p procure to pay solution that uses automation as its fundamental principle. The platform enables organizations to manage requisitions and purchase orders and invoices and payments through automated processes which create a seamless workflow between procurement and finance teams. The system includes AI-based compliance verification and vendor performance tracking and instant spending data analysis capabilities.

The system integrates perfectly with ERP and CRM and accounting platforms which removes data silos and prevents human mistakes. Organizations that use Zapro achieve financial savings and accelerated processes and enhanced vendor management capabilities which lead to sustained business growth.

The implementation of Zapro has enabled various organizations to achieve faster operations and better compliance and enhanced supplier relationships according to customer testimonials. The combination of strong ROI and forward-thinking design in Zapro provides businesses with procurement automation and market-leading competitive benefits.

Conclusion and Next Steps

The procure to pay process flow enables procurement and finance departments to work together for enhanced operational efficiency and better compliance and financial savings. Businesses that understand procure to pay procedures and execute them correctly can minimize risks while building better vendor relationships and making better decisions.

The procurement journey from requisition to payment becomes fully automated through Zapro and other similar platforms. The upcoming P2P evolution will depend on artificial intelligence-based analytics and instant data analysis and complete system unification. Schedule a free Zapro demo to discover how your organization can benefit from transforming its procurement operations.

Start Your P2P Journey with Zapro

Automate and scale procurement effortlessly—Zapro eliminates manual tasks and boosts efficiency.

FAQ

1. What is the difference between procure-to-pay and procurement?

Procurement is the broader function that includes sourcing, negotiations, and supplier management. Procure-to-pay, on the other hand, is a subset that focuses on the transactional process of requisitioning, purchasing, and paying for goods and services.

2. What is the difference between accounts payable and procure-to-pay?

Accounts payable only covers the payment side, ensuring suppliers are compensated for their invoices. Procure-to-pay covers the full cycle, beginning with purchase requisitions and ending with payments, making it more comprehensive.

3. What is an example of a P2P process?

A typical example of a P2P process is when an employee requests office supplies, a purchase order is issued, goods are received, the invoice is matched, and payment is made to the supplier. Each step is documented and tracked for accuracy.

4. What does P2P mean in business?

In business, P2P (procure to pay) means the standardized process of purchasing goods or services and managing the associated financial transactions. It brings procurement and finance into one unified workflow.

5. How Zapro helps to automate the procure-to-pay process?

Zapro automates every step of the procure to pay process, from requisition approval to vendor payments. Its AI-driven system reduces manual errors, ensures compliance, and provides real-time visibility into spending, making procurement smarter and more efficient.

Don’t miss our weekly updates

We’ll email you 1-3 times per week—and never share your information.

Healthcare

Healthcare Financial Services

Financial Services Technology

Technology Venture Capitalist

Venture Capitalist Chief Procurement Officer

Chief Procurement Officer Chief Financial Officer

Chief Financial Officer