Invoice approval workflow, a fundamental aspect of any business’s financial operations, can be a time-consuming and error-prone process when done manually. However, the advent of automated invoice approval systems has revolutionized this crucial function, making it more efficient and less prone to errors.

What Is an Invoice Approval?

Invoice approval is a critical stage in a company’s accounts payable process. This procedure involves reviewing and green-lighting supplier invoices before processing payment. The essential purpose of invoice approval is to authenticate the details of the invoice, match it with the corresponding purchase order, and validate the services or goods received.

Understanding the Invoice Approval Workflow

An invoice approval workflow is a systematic procedure that ensures invoices are processed accurately and promptly. It functions as a checklist, verifying every detail to prevent discrepancies and ensuring rapid invoice clearance.

The invoice approval workflow typically begins when the company receives a supplier invoice. This invoice is then checked by the individual responsible for purchasing the specific product or service. After verification, the invoice is forwarded to the accounting department for further processing.

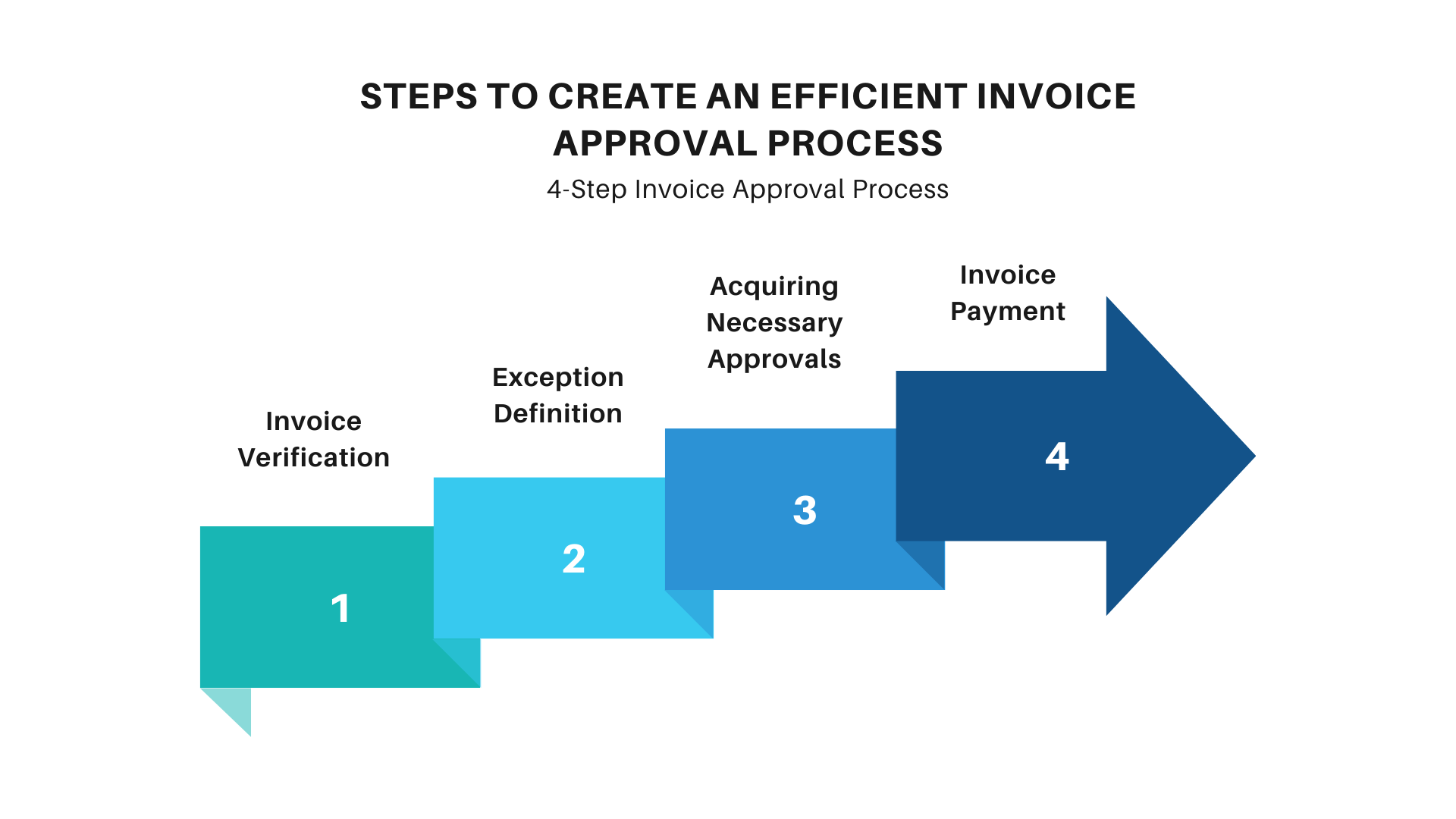

Steps to Create an Efficient Invoice Approval Process

Designing an effective invoice approval process requires a strategic approach. Here are a few steps to help you create an efficient system:

- Invoice Verification: Start by validating the received invoice against other purchase-related documents like purchase orders and receipts.

- Exception Definition: If the invoice fails the verification process due to any discrepancy, flag it for further review by the relevant personnel.

- Acquiring Necessary Approvals: Next, once the invoice has been validated and there are no discrepancies, send it for approval to the concerned individuals.

- Invoice Payment: After final approval, send the invoice to finance for payment processing. Before processing, review and adjust for any advance payments, pre-payments, or credit notes to ensure accurate financial transactions. Adjustments help reconcile discrepancies and maintain payment accuracy.

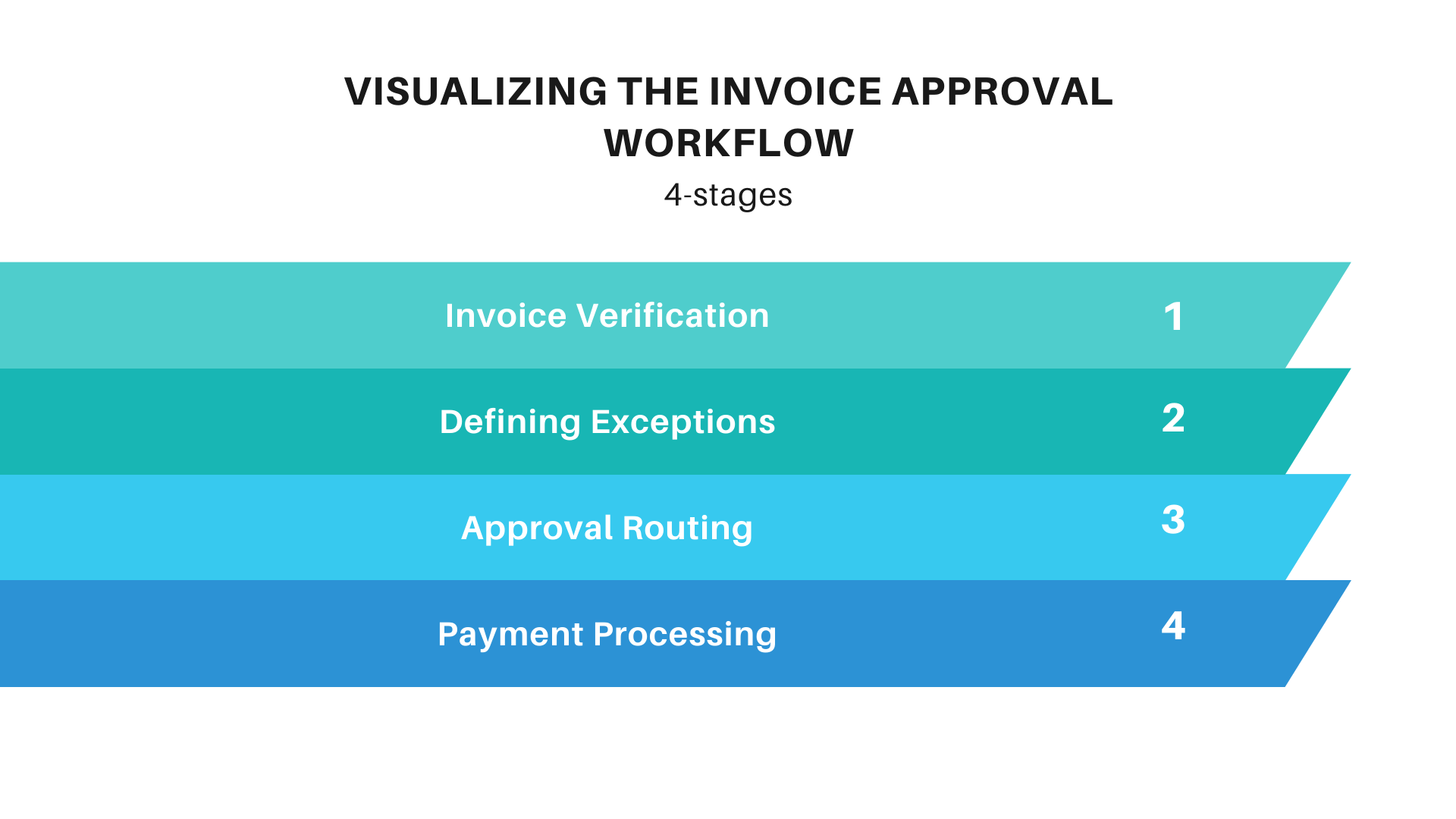

Visualizing the Invoice Approval Workflow

The invoice approval workflow, though it may vary among organizations, typically involves the following stages:

- Invoice Verification: This involves checking the invoice and matching it with related documents.

- Defining Exceptions: In case of any discrepancies, the invoice is redirected for error correction before reprocessing.

- Approval Routing: After validation, invoices follow an approval route based on purchasing document details. If a 3-way matching process is implemented, approval becomes optional, not mandatory. The matching ensures accuracy by aligning invoice, purchase order, and receipt information.

- Payment Processing: After approval, the invoice is forwarded to the finance team for payment processing.

The Challenge with Manual Invoice Approval

The challenges associated with manual invoice approval processes are multifaceted and can significantly impede the efficiency of financial workflows. Here’s an elaboration on the various issues, ranging from the inception of invoice processing to the handling of exceptions and the need for comprehensive audit trails:

Inefficient Invoice Capture:

- Manual entry of invoice data is prone to errors and can result in inaccuracies in the recorded information.

- Slow and labor-intensive, manual data entry may lead to processing delays, hindering timely payments.

Error-Prone Routing:

- The manual routing of invoices can lead to misplacement or delays, particularly in complex approval hierarchies.

- Inconsistent routing may result in approvals being overlooked or unnecessary delays in the approval process.

Data Errors and Inconsistencies:

- Manual processes are susceptible to human errors, such as data entry mistakes and typos, which can compromise the accuracy of financial records.

- Inconsistencies in data formatting or entry may further complicate reconciliation and reporting.

Exception Handling Challenges:

- Identifying and resolving exceptions in manual workflows, such as discrepancies or missing information, is a time-consuming and error-prone task.

- Lack of standardized processes may lead to challenges in handling diverse exceptions efficiently.

Limited Visibility and Tracking:

- Manual processes often lack real-time visibility into the status of invoices, making it challenging to track their progress.

- Limited transparency can result in difficulties identifying bottlenecks or addressing issues promptly.

Audit Trail Deficiencies:

- Comprehensive audit trails are essential for compliance and accountability. Manual systems may lack the detailed documentation necessary for thorough audits.

- Tracking the entire lifecycle of an invoice, including approvals and modifications, becomes challenging without automated audit trail features.

Dependency on Manual Approvals:

- Manual or semi-automated approval tools may require physical signatures or manual intervention, leading to delays in the approval cycle.

- Dependency on individuals for approvals can be a bottleneck, especially in situations where key approvers are unavailable.

Difficulty in Scaling:

- As the volume of invoices increases, manual processes become increasingly burdensome and may lead to scalability issues.

- Scaling operations becomes challenging without the agility offered by automated systems.

The Power of E-Procurement Solutions in Managing Invoice Approval Workflow

E-procurement solutions have emerged as a game-changer in managing invoice approvals. They combine data capture, automatic routing, contract management, and integration capabilities in a single platform, thereby streamlining the entire process.

Such solutions offer numerous benefits, including:

-

Electronic Invoice Presentment and Payment (EIPP):

EIPP refers to a comprehensive electronic solution that encompasses the entire invoicing process, from presenting invoices to facilitating electronic payment. It streamlines the invoicing and payment cycle, offering a digital platform for businesses to manage their financial transactions efficiently.

-

Automated Three-Way Matching:

This involves the automated validation of invoices by matching them against corresponding purchase orders and receipts. It ensures accuracy and consistency in financial transactions.

-

Improved Regulatory Compliance:

Automated systems incorporate compliance features, helping businesses adhere to regulatory requirements by enforcing standardized processes and documentation.

-

Integration with Finance and ERP Systems:

Seamless integration ensures that the invoicing system aligns with the broader financial and Enterprise Resource Planning (ERP) infrastructure, promoting data consistency and reducing silos.

-

Enhanced Visibility Over Liabilities:

EIPP solutions provide real-time visibility into financial obligations, allowing businesses to monitor and manage liabilities effectively, aiding in strategic financial planning.

-

Increased Employee Productivity:

Automation reduces manual tasks, enabling employees to focus on higher-value activities, thus boosting overall productivity and efficiency within the finance department.

-

Lowered Processing Costs and Time:

Automated processes significantly reduce the time and costs associated with manual data entry, approval routing, and handling exceptions, leading to operational savings.

-

Reduced Errors and Fraud Potential:

Automation minimizes human errors in data entry and approval, while built-in security features mitigate the potential for fraudulent activities within the invoicing process.

-

Elimination of Late Payment Penalties:

Automated systems streamline the payment process, reducing the likelihood of delayed payments and eliminating penalties associated with late payments.

-

Streamlined Reconciliation:

Automated reconciliation tools ensure that financial records align accurately, simplifying the reconciliation process and minimizing discrepancies.

Zapro: Your Go-To Solution for Automating Invoice Approval Workflow

One such e-procurement solution is Zapro. Trusted by numerous companies, Zapro is an advanced procurement cloud that simplifies and digitizes all functions in procurement. From purchase requisitions to purchase orders, vendor management, and creating invoice approval workflows, Zapro handles it all seamlessly.

By automating your invoice approval process with Zapro, you can minimize paperwork, reduce manual errors, accelerate the approval cycle, and enhance straight-through processing. Zapro operates as an advanced procurement cloud, offering comprehensive digitization of procurement functions, including purchase requisitions, purchase orders, vendor management, and, notably, invoice approval workflows.

Key Features and Solutions:

-

Invoice OCR (Optical Character Recognition):

Zapro employs cutting-edge OCR technology to automate the extraction of data from invoices. This not only reduces manual data entry but also minimizes errors, ensuring accurate and efficient processing.

-

Supplier Portal:

Zapro’s supplier portal facilitates seamless communication and collaboration between your organization and suppliers. Suppliers can submit invoices, track approvals, and resolve queries in real-time, promoting transparency and efficiency.

-

2/3 Way Matching:

Zapro implements a robust 2/3 way matching process, aligning invoices with corresponding purchase orders and receipts. This automated matching ensures accuracy, speeds up approvals, and mitigates discrepancies.

-

Robust Chart of Accounts:

Zapro provides a well-organized and customizable chart of accounts, enhancing visibility and categorization of financial transactions. This ensures clarity in reporting and compliance with accounting standards.

-

Approval Flows:

Zapro offers flexible approval workflows, allowing organizations to tailor approval processes based on their unique hierarchies and requirements. This adaptability ensures a streamlined and efficient approval cycle.

-

Policy Enforcement:

Zapro incorporates policy enforcement features, ensuring that invoices adhere to organizational policies and compliance standards. This helps prevent deviations and enhances overall governance.

-

Contract Compliance:

Zapro assists in monitoring and enforcing contract compliance within the invoicing process. This feature ensures that invoices align with contractual agreements, reducing the risk of discrepancies and disputes.

-

Payment Management:

Zapro streamlines payment management by providing a centralized platform for tracking and managing payments. This feature enhances visibility, reduces delays, and supports effective cash flow management.

By leveraging these features, Zapro offers a holistic solution to the challenges of manual invoice approval processes. From advanced OCR technology to tailored approval flows and contract compliance enforcement, Zapro is designed to elevate your invoice approval workflow, bringing efficiency, accuracy, and speed to every stage of the process. Say goodbye to processing delays and embrace a digital future with Zapro!