Importance of a comprehensive chart of accounts for marketing agencies

If you’re running a marketing agency, you know that managing your finances effectively is crucial to the success of your business. One of the key tools that can help you in this endeavor is a comprehensive chart of accounts. Now, you might be wondering, what exactly is a chart of accounts and why is it so important?

Well, to put it simply, a chart of accounts is a systematic way of organizing and categorizing your financial transactions. It provides a clear framework for tracking your revenue, expenses, assets, liabilities, and equity. By creating a well-structured chart of accounts, you can gain valuable insights into your financial health and make informed decisions to maximize your agency’s efficiency and profitability.

Having a comprehensive chart of accounts is particularly crucial for marketing agencies, where financial management can be complex. As an agency, you deal with various revenue streams, expenses, and assets specific to your industry. Without a proper system in place, it can be challenging to keep track of your financial activities and analyze your performance accurately.

A well-designed chart of accounts tailored to the needs of your marketing agency can provide you with a solid foundation for financial management. It allows you to categorize your income and expenses in a way that reflects the unique nature of your business. This, in turn, helps you gain a deeper understanding of your agency’s financial operations and identify areas for improvement.

In the following sections, we will delve into the definition and purpose of a chart of accounts, explore its key components, and provide you with a sample chart of accounts specifically designed for marketing agencies. We will also discuss how you can customize the chart to fit your agency’s specific needs and the numerous benefits it can bring to your business.

So, without further ado, let’s dive into the world of chart of accounts and discover how it can revolutionize the financial management of your marketing agency.

What is a Chart of Accounts?

Definition and purpose

In the world of accounting, a chart of accounts plays a fundamental role in organizing and categorizing financial transactions for a business. Essentially, it is a comprehensive list of all the accounts used to record the company’s financial activities. This essential tool provides a structured framework that enables efficient bookkeeping and accurate financial reporting.

The purpose of a chart of accounts is to classify various financial transactions into distinct categories. It serves as a roadmap for recording and tracking the flow of money within a business. By assigning specific codes or numbers to each account, it becomes easier to identify and analyze financial data related to revenues, expenses, assets, liabilities, and equity.

Think of the chart of accounts as a language that accountants use to communicate and understand the financial health of a company. It provides a standardized framework for organizing financial information, making it easily accessible and interpretable for both internal and external stakeholders.

With a well-structured chart of accounts, you can gain valuable insights into your business’s financial performance, identify trends, and make informed decisions. Whether you run a small startup or a large corporation, having a well-defined chart of accounts is crucial for effective financial management.

Now that you understand the definition and purpose of a chart of accounts, let’s explore its key components and how they apply specifically to marketing agencies. Stay tuned!

Key Components of a Chart of Accounts for Marketing Agencies

When it comes to managing the financial health of your marketing agency, having a comprehensive chart of accounts is essential. This tool serves as a roadmap for organizing and categorizing your agency’s financial transactions, ensuring that you have a clear and accurate picture of your income and expenses. In this section, we will explore the key components of a chart of accounts specifically tailored for marketing agencies.

Revenue Accounts

First and foremost, let’s delve into revenue accounts. These accounts are crucial for tracking the income generated by your agency’s services. Depending on the nature of your marketing agency, your revenue accounts may include categories such as advertising revenue, consulting fees, retainer fees, or project-based income. By properly categorizing your sources of revenue, you can easily analyze and evaluate the performance of different aspects of your agency’s business.

Expense Accounts

Next up, we have expense accounts. These accounts capture the costs associated with running your marketing agency. From salaries and benefits for your employees to software subscriptions and office rent, expense accounts provide a detailed breakdown of where your money is going. By meticulously categorizing your expenses, you can identify areas where you may be overspending or find opportunities to optimize your budget.

Asset and Liability Accounts

Now, let’s shift our focus to asset and liability accounts. These accounts track the resources your marketing agency owns (assets) and the financial obligations it has (liabilities). Assets may include items such as cash, accounts receivable, investments, and office equipment. On the other hand, liabilities encompass items like accounts payable, bank loans, and credit card debts. Maintaining accurate records of your agency’s assets and liabilities allows you to assess its financial health and make informed decisions about future investments.

Equity Accounts

Last but not least, we have equity accounts. These accounts represent the ownership interests in your marketing agency. Equity can come from various sources, such as the initial investment made by the agency’s owners or retained earnings from past profits. By tracking equity accounts, you can monitor the growth and value of your agency over time.

Now that you understand the key components of a chart of accounts for marketing agencies, you can see how this tool provides a comprehensive framework for organizing your agency’s finances.

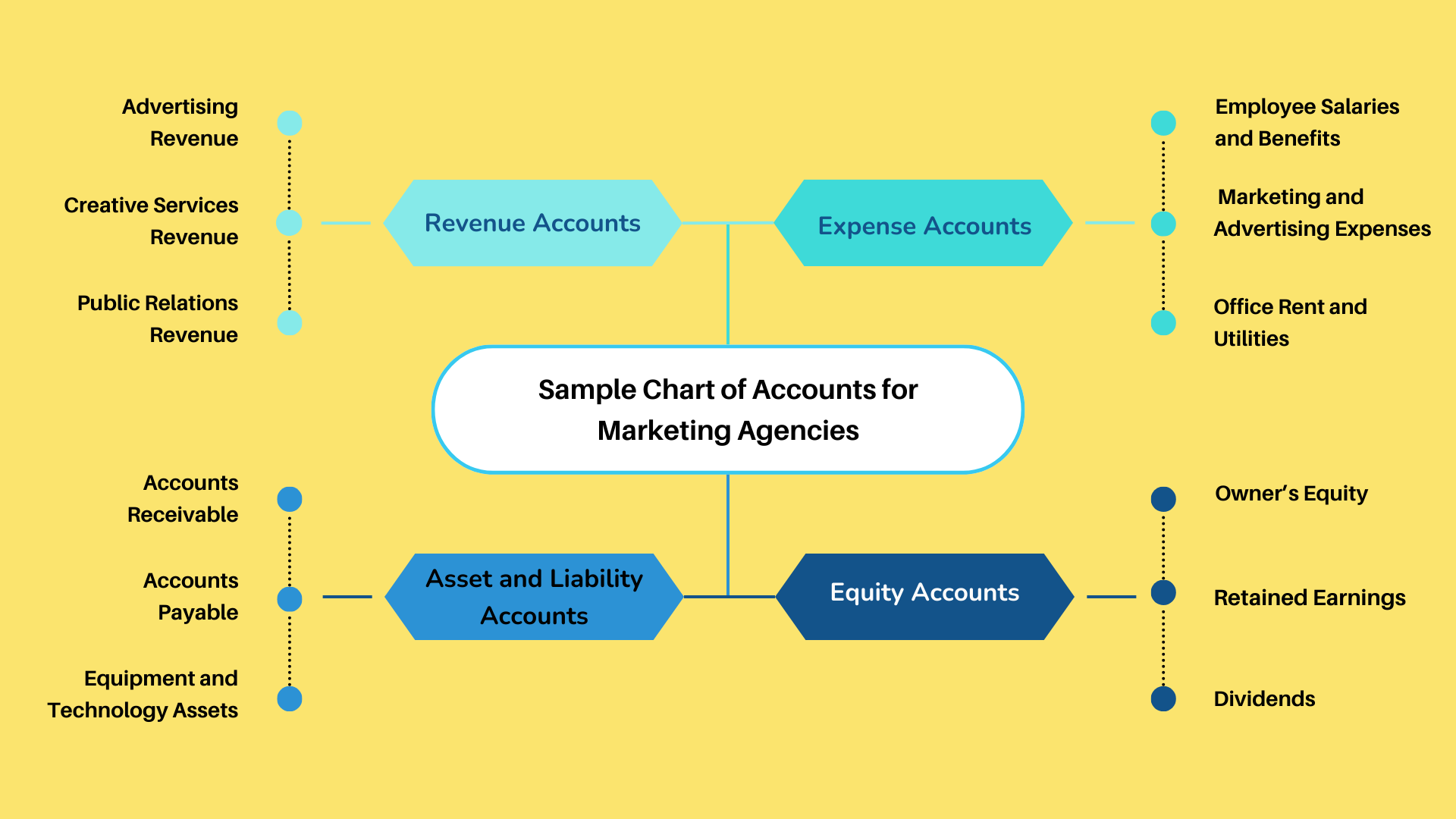

Sample Chart of Accounts for Marketing Agencies

When it comes to managing the financial aspects of your marketing agency, having a comprehensive chart of accounts is crucial. It provides a structured framework that allows you to track and categorize your agency’s financial transactions effectively. By utilizing a well-organized chart of accounts, you can gain valuable insights into your agency’s financial health and make informed business decisions.

Let’s explore some examples of different types of accounts that you can include in your chart of accounts for marketing agencies:

Revenue Accounts Examples

- Advertising Revenue: This account represents the income generated from advertising services provided by your agency. It includes revenue from various advertising campaigns, such as print media, digital advertising, and social media marketing.

- Creative Services Revenue: This account captures the revenue generated from creative services offered by your agency, such as graphic design, copywriting, and branding.

- Public Relations Revenue: This account tracks the income generated from public relations services, including media relations, press releases, and reputation management.

Expense Accounts Examples

- Employee Salaries and Benefits: This account covers the expenses related to employee salaries, wages, and benefits, such as health insurance, retirement plans, and payroll taxes.

- Marketing and Advertising Expenses: This account includes expenses incurred for marketing and advertising purposes, such as ad placements, digital marketing tools, and promotional events.

- Office Rent and Utilities: This account tracks the expenses associated with office space, including rent, utilities, maintenance, and repairs.

Asset and Liability Accounts Examples

- Accounts Receivable: This account represents the amount of money owed to your agency by clients for services rendered but not yet paid for.

- Accounts Payable: This account captures the amounts your agency owes to suppliers, vendors, and creditors for goods and services received but not yet paid for.

- Equipment and Technology Assets: This account includes the value of equipment, computers, software, and other technological assets used by your agency to deliver services.

Equity Accounts Examples

- Owner’s Equity: This account represents the owner’s investment in the agency and any retained earnings. It reflects the net value of the agency after deducting liabilities from assets.

- Retained Earnings: This account tracks the accumulated profits of your agency that have not been distributed to owners or shareholders.

- Dividends: This account represents the portion of profits that have been distributed to owners or shareholders.

Remember, these examples are just a starting point, and you can customize your chart of accounts to suit the specific needs of your marketing agency. By tailoring your chart of accounts to your agency’s operations, you can ensure accurate and meaningful financial reporting.

Customizing the Chart of Accounts for Your Agency

When it comes to customizing the chart of accounts for your marketing agency, there are a few considerations and best practices that can help you tailor it to fit your agency’s unique needs. While a comprehensive chart of accounts provides a solid foundation for financial management, customization allows you to create a system that aligns perfectly with your specific operations and reporting requirements.

Considerations and Best Practices

- Understand Your Agency’s Financial Structure: Before you begin customizing the chart of accounts, take the time to thoroughly understand your agency’s financial structure. This includes identifying the different revenue streams, expense categories, assets, liabilities, and equity accounts relevant to your agency’s operations. By having a clear understanding of your financial structure, you can ensure that your chart of accounts accurately reflects your agency’s financial transactions.

- Utilize Industry-Specific Categories: Marketing agencies often have unique financial needs and requirements. Consider incorporating industry-specific categories into your chart of accounts to capture the nuances of your agency’s operations. For example, you may want to create separate accounts for advertising expenses, creative production costs, or client retainers. This level of granularity can provide valuable insights into your agency’s financial performance.

- Maintain Consistency: Consistency is key when customizing your chart of accounts. Establish a standardized naming convention and numbering system to ensure uniformity across all accounts. This consistency will make it easier to track and analyze financial data, as well as facilitate seamless integration with other financial systems or software.

- Flexibility for Growth: As your agency grows and evolves, your chart of accounts should be able to accommodate new revenue streams, expense categories, and other financial changes. Build flexibility into your chart of accounts by leaving room for expansion and incorporating general accounts that can be easily adapted to new requirements. This will save you time and effort in the long run, as you won’t have to completely overhaul your chart of accounts every time your agency undergoes changes.

Tailoring the Chart to Fit Your Agency’s Needs

Once you have considered the various aspects of customizing your chart of accounts, it’s time to tailor it to fit your agency’s specific needs. Here are a few steps to guide you through the process:

- Review and Modify: Start by reviewing the sample chart of accounts provided earlier in this article. Identify the accounts that closely match your agency’s financial structure and modify them as needed. Add or remove accounts, rename them, and reorganize them to align with your agency’s operations.

- Consult with Stakeholders: Involve key stakeholders in the customization process. This may include your agency’s financial team, department heads, and even external accountants or bookkeepers. Seek their input and feedback to ensure that the chart of accounts captures all the necessary information and meets their reporting needs.

- Test and Refine: Once you have made the initial modifications, test the chart of accounts in a real-world setting. Use it to record actual financial transactions and generate reports. This will help you identify any gaps or areas that need further refinement. Make adjustments as necessary to ensure that the chart of accounts provides accurate and meaningful financial information.

Remember, customizing your chart of accounts is an ongoing process. As your agency grows and changes, periodically review and update your chart of accounts to ensure that it continues to meet your agency’s evolving needs. By tailoring the chart of accounts to fit your agency, you can maximize its effectiveness as a tool for financial management and decision-making.

Benefits of a Comprehensive Chart of Accounts for Marketing Agencies

A comprehensive chart of accounts is an essential tool for improving financial management in marketing agencies. By organizing your agency’s financial transactions into specific categories, you gain a better understanding of your revenue, expenses, assets, liabilities, and equity. This knowledge allows you to make informed decisions that can drive your agency’s success.

Improved Financial Management

With a well-structured chart of accounts, you can effectively track and manage your agency’s finances. By categorizing your transactions into revenue, expense, asset, liability, and equity accounts, you gain a clear view of where your money is coming from and where it’s going. This enables you to identify areas of overspending, find opportunities for cost savings, and allocate resources more efficiently. Improved financial management ultimately leads to better cash flow management and long-term financial stability.

Enhanced Reporting and Analysis

A comprehensive chart of accounts provides the foundation for accurate and meaningful financial reporting and analysis. By categorizing your transactions in a consistent manner, you can generate reports that give you insights into your agency’s financial performance. These reports can include income statements, balance sheets, and cash flow statements, providing you with a holistic view of your agency’s financial health. With this information, you can identify trends, spot areas for improvement, and make data-driven decisions to optimize your agency’s operations.

Streamlined Tax Preparation

Tax season can be a stressful time for any business, but a comprehensive chart of accounts can help streamline the tax preparation process for marketing agencies. By organizing your transactions into specific categories, you can easily access the information needed to complete your tax returns accurately and efficiently. A well-maintained chart of accounts ensures that you have the necessary documentation to support your tax deductions and credits, minimizing the risk of errors or audit triggers. This saves you time, reduces stress, and ensures compliance with tax regulations.

Better Decision Making

A comprehensive chart of accounts empowers you to make better decisions for your marketing agency. By having a clear understanding of your revenue streams, expenses, and financial position, you can make informed choices regarding investments, pricing strategies, and resource allocation. With accurate and up-to-date financial information at your fingertips, you can evaluate the profitability of different client projects, identify areas for growth, and determine the return on investment for marketing campaigns. Making data-driven decisions based on a comprehensive chart of accounts enables you to drive your agency’s success and achieve your business goals.

In conclusion, a comprehensive chart of accounts is not just a financial tool; it is a valuable asset for marketing agencies. By providing improved financial management, enhanced reporting and analysis, streamlined tax preparation, and better decision-making capabilities, a well-structured chart of accounts sets the foundation for success in the dynamic world of marketing. So, take the time to customize your chart of accounts according to your agency’s needs and unlock the benefits it can bring to your business.

Conclusion

In conclusion, having a comprehensive chart of accounts for your marketing agency is essential. It serves as a blueprint for organizing and categorizing your financial transactions, allowing you to effectively track and manage your agency’s finances.

By understanding the importance of a chart of accounts and its key components, you can create a structure that aligns with your agency’s unique needs. Whether it’s revenue accounts, expense accounts, asset and liability accounts, or equity accounts, each category plays a crucial role in accurately recording your financial activities.

To help you get started, we provided you with a sample chart of accounting examples for marketing agencies. These examples give you a clear idea of how different accounts can be structured and classified within your chart.

If you’re looking for more guidance on creating and customizing your chart of accounts, be sure to check out our comprehensive chart of accounts guide. It will provide you with step-by-step instructions and best practices to help you optimize your financial management system.

Remember, your chart of accounts is not set in stone. As your agency evolves and grows, you may need to make adjustments along the way. Embrace the flexibility of your chart of accounts and use it as a tool to support your agency’s financial success.

Customize your chart of accounts effortlessly with Zapro, ensuring it aligns perfectly with your agency’s needs. Experience improved financial management, enhanced reporting, and streamlined tax preparation. Try Zapro today or schedule a demo for a tailored financial solution.