Crafting the Ultimate Chart of Accounts for a Construction Company: A Blueprint for Success!

In the world of construction, where every project is unique, a well-designed chart of accounts for construction company is crucial. Effective financial management, whether for a small contracting business or a large construction company, relies on this essential tool for maximizing efficiency and maintaining accurate financial records.

What is a Chart of Accounts?

A chart of accounts is a systematic listing of all the financial accounts used by a company. It serves as a blueprint for organizing and categorizing financial transactions and provides a framework for tracking income, expenses, assets, liabilities, and equity. Essentially, it acts as the backbone of your company’s financial structure, ensuring that every financial transaction is properly recorded and accounted for.

Why is it Important for you?

Now, you might be wondering, why is a chart of accounts so important for construction companies specifically? Well, in the construction industry, managing multiple projects simultaneously, each with its own set of costs, revenues, and expenses, can be incredibly challenging. Without a well-structured chart of accounts, it’s easy for financial data to become disorganized and difficult to interpret. This can lead to costly errors, inefficient processes, and a lack of financial visibility.

With a properly designed chart of accounts, construction companies can streamline their financial management processes and gain valuable insights into project profitability, cost control, and overall business performance. By categorizing expenses, revenues, and other financial transactions into specific accounts, you can easily track and analyze the financial health of each project, identify areas for improvement, and make informed decisions to ensure project success.

In the next sections, we will dive deeper into the chart of accounts for construction companies, exploring its key components, designing best practices, and providing a sample chart of accounts to help you get started. So, fasten your hard hat and get ready to construct a solid financial foundation for your construction business!

Understanding the Chart of Accounts

The chart of accounts is a fundamental tool that serves as the backbone of any construction company’s financial management system. It provides a comprehensive framework for organizing and categorizing financial transactions, allowing you to track and analyze your company’s financial performance with ease. In this section, we will explore the definition and purpose of the chart of accounts, as well as its key components.

Definition and Purpose

The chart of accounts can be defined as a structured list of all the accounts that a construction company uses to record its financial transactions. Each account represents a unique aspect of the company’s financial activities, such as assets, liabilities, equity, revenues, and expenses. By assigning a unique code or number to each account, the chart of accounts provides a standardized and systematic way of organizing financial data.

The primary purpose of the chart of accounts is to facilitate accurate and efficient financial reporting and analysis. It enables you to categorize and classify transactions in a way that aligns with your company’s specific needs and industry requirements. With a well-designed chart of accounts, you can easily generate financial statements, monitor cash flow, track project costs, and make informed decisions based on reliable financial data.

Key Components

A typical chart of accounts for a construction company consists of several key components that help categorize and classify financial transactions. These components include:

- General Ledger Accounts: These accounts represent the core financial categories and are essential for day-to-day bookkeeping. They include assets, liabilities, equity, revenues, and expenses. General ledger accounts provide a high-level overview of your company’s financial position and performance.

- Project-Specific Accounts: Construction projects often have unique financial requirements that necessitate project-specific accounts. These accounts track revenues, expenses, and costs associated with individual projects. They enable you to monitor project profitability, allocate resources efficiently, and identify areas for improvement.

- Cost Categories: Cost categories break down expenses into specific types, such as labor, materials, subcontractors, equipment, and overhead. By categorizing costs, you can analyze spending patterns, identify cost-saving opportunities, and allocate resources effectively.

- Revenue Accounts: Revenue accounts capture all sources of income for your construction company. These accounts encompass various revenue streams, such as contract revenue, change orders, reimbursements, and retainage. By tracking revenue accounts, you can assess your company’s financial performance and measure project profitability.

Understanding these key components of the chart of accounts is crucial for designing a comprehensive and effective system that meets the unique needs of your construction company. In the following section, we will delve deeper into the process of designing a chart of accounts, highlighting best practices and considerations to maximize its efficiency.

Designing a Chart of Accounts for Construction Companies

When it comes to designing a chart of accounts for construction companies, there are several key components to consider. A well-designed chart of accounts is essential for organizing and tracking financial data accurately and efficiently. It provides a systematic framework that allows you to categorize and record various transactions, making it easier to analyze and manage your company’s finances.

General Ledger Accounts

The general ledger accounts form the foundation of your chart of accounts. These accounts represent the basic financial categories that are applicable to any business, such as assets, liabilities, equity, revenues, and expenses. They provide a broad overview of your company’s financial position and performance.

Within the general ledger accounts, you should include sub-accounts that are specific to the construction industry. For example, you may have separate accounts for equipment, materials, subcontractors, and labor costs. This level of detail allows you to track and analyze expenses more effectively, providing valuable insights into your company’s financial health.

Project-Specific Accounts

Construction projects often have unique financial requirements and complexities. Therefore, it is important to include project-specific accounts in your chart of accounts. These accounts are tailored to the specific needs of each project and enable you to track income, expenses, and profitability on a project-by-project basis.

Project-specific accounts can include categories such as project revenue, project costs, change orders, and progress billing. By having dedicated accounts for each project, you can accurately monitor the financial performance of individual projects and make informed decisions to optimize profitability.

Cost Categories

To effectively manage costs in the construction industry, it is essential to include cost categories in your chart of accounts. These categories allow you to track and analyze costs related to different aspects of your business, such as direct labor, materials, subcontractors, equipment, and overhead expenses.

By categorizing costs in this way, you can identify areas where costs are higher than anticipated, enabling you to take corrective measures and improve profitability. Additionally, cost categories provide valuable information for estimating future projects and developing accurate budgets.

Revenue Accounts

Last but not least, revenue accounts are a crucial component of your chart of accounts. These accounts track the income generated by your construction projects and provide valuable insights into your company’s financial performance. Revenue accounts can include categories such as contract revenue, change orders, and retainage.

By accurately recording and analyzing revenue data, you can assess the profitability of your projects and identify areas where you can increase revenue. This information is essential for making informed decisions and maximizing your company’s financial success.

Designing a well-structured chart of accounts for your construction company is essential for effective financial management. It provides clarity, organization, and valuable insights into your company’s financial health. By incorporating general ledger accounts, project-specific accounts, cost categories, and revenue accounts, you can ensure that your chart of accounts is tailored to the unique needs of your construction business.

In the next section, we will explore the best practices for creating and maintaining a construction company chart of accounts that will maximize efficiency and streamline your financial processes.

Best Practices for Construction Company Chart of Accounts

When it comes to designing a chart of accounts for your construction company, there are several best practices that can help you maximize efficiency and streamline your financial processes. By following these guidelines, you can ensure that your chart of accounts is well-organized, adaptable, and integrates seamlessly with your accounting software.

Consistency and Standardization

Consistency and standardization are key factors in creating an effective chart of accounts for your construction company. By establishing a uniform structure and naming convention for your accounts, you can ensure that your financial records are accurate and easily understood by all stakeholders.

To achieve consistency, it is important to define and document the chart of accounts structure that aligns with your specific business needs. This structure should include a hierarchical numbering system that categorizes accounts into logical groups and subgroups. For example, you may have main categories such as assets, liabilities, equity, revenue, and expenses, with subcategories under each.

In addition to a standardized structure, it is crucial to establish naming conventions that are clear and concise. Avoid using abbreviations or acronyms that may be confusing to others. Instead, use descriptive names that accurately represent the nature of each account.

Flexibility for Growth

As your construction company grows and evolves, your chart of accounts should be able to adapt to changing circumstances. It is important to design your chart of accounts with flexibility in mind, anticipating future expansion, acquisitions, and new business ventures.

One way to achieve flexibility is by incorporating project-specific accounts into your chart of accounts. These accounts allow you to track the financial performance of individual projects separately, providing valuable insights into project profitability and cost allocation. By having project-specific accounts, you can easily generate project-specific financial statements and analyze the financial health of each project.

Another aspect of flexibility is the ability to add new accounts or modify existing ones as your business needs change. A well-designed chart of accounts should allow for customization and expansion without disrupting the overall structure. This can be achieved by using a chart of accounts template that provides a foundation for customization while maintaining consistency.

Integration with Accounting Software

In today’s digital age, integrating your chart of accounts with accounting software is essential for efficient financial management. By choosing accounting software that supports seamless integration with your chart of accounts, you can automate data entry, streamline financial reporting, and minimize errors.

When selecting accounting software, look for options that allow you to import your chart of accounts directly or easily map your existing accounts to the software’s standard chart of accounts. This will save you time and effort in setting up your financial system and ensure accurate data transfer between your software and chart of accounts.

Furthermore, integration with accounting software enables real-time financial reporting, giving you up-to-date insights into your construction company’s financial performance. You can generate financial statements, track project costs, monitor cash flow, and make data-driven decisions more efficiently.

In conclusion, by following these best practices for your construction company chart of accounts consistency and standardization, flexibility for growth, and integration with accounting software you can establish a solid foundation for efficient financial management. A well-designed chart of accounts will not only streamline your financial processes but also provide valuable insights into your construction projects profitability and help you make informed business decisions.

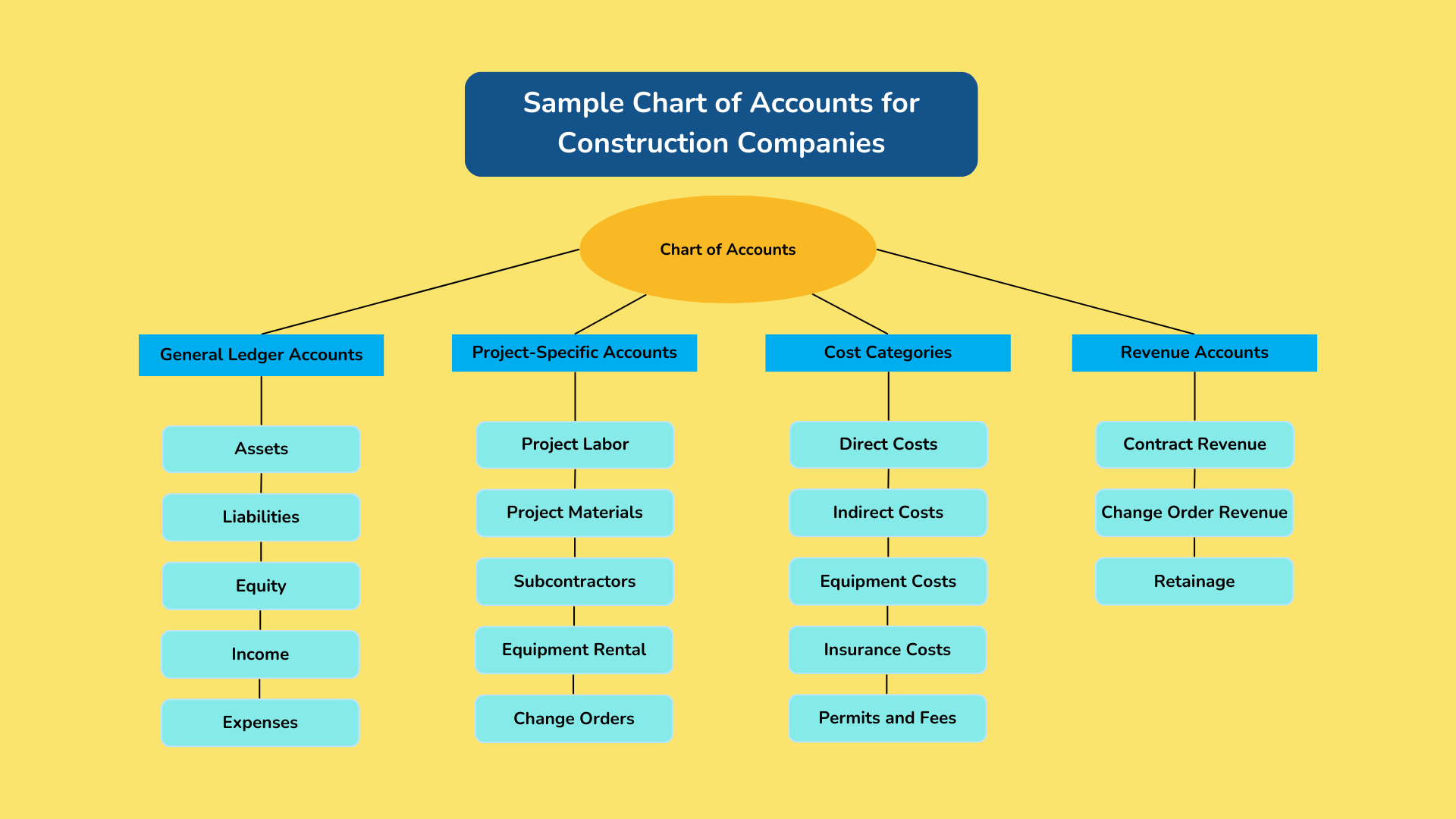

Sample Chart of Accounts for Construction Companies

Now that you understand the importance and key components of a chart of accounts for construction companies, let’s explore some sample accounts that you can include in your own chart.

General Ledger Accounts

General ledger accounts serve as the foundation of your chart of accounts. They provide a high-level overview of your company’s financial activities. Here are some examples of general ledger accounts that are commonly used in the construction industry:

- Assets: This category includes all the resources owned by your company, such as cash, accounts receivable, equipment, and vehicles.

- Liabilities: These accounts represent your company’s debts and obligations, such as accounts payable, loans, and accrued expenses.

- Equity: Equity accounts show the ownership interest in your company, including retained earnings and owner’s capital.

- Income: Income accounts track the revenue generated by your construction projects, such as contract income, change orders, and progress billings.

- Expenses: Expense accounts encompass the costs incurred during your construction projects, including labor, materials, subcontractors, and overhead expenses.

Project-Specific Accounts

In addition to the general ledger accounts, construction companies often create project-specific accounts to track the financial activities of individual projects. These accounts provide a detailed breakdown of project costs and revenue. Here are some project-specific accounts you may consider including in your chart:

- Project Labor: This account tracks the direct labor costs associated with a specific project. It includes wages, benefits, and payroll taxes for the workers involved in the project.

- Project Materials: This account captures the cost of materials used in a particular project. It includes items such as lumber, concrete, plumbing fixtures, and electrical components.

- Subcontractors: Subcontractor accounts track the costs incurred when hiring external contractors to perform specialized tasks within a project, such as plumbing, electrical work, or landscaping.

- Equipment Rental: If you rent equipment for your projects, it’s important to have a separate account to track those expenses. This account should include rental fees, fuel costs, and maintenance expenses.

- Change Orders: Change orders often arise during construction projects when there are modifications or additions to the original scope of work. Having a separate account for change orders allows you to track the associated costs and revenue.

Cost Categories

Cost categories provide a breakdown of expenses within your chart of accounts. They help you categorize costs by type and provide a clearer picture of where your money is being spent. Some common cost categories for construction companies include:

- Direct Costs: Direct costs are expenses directly attributable to a specific project, such as labor, materials, and subcontractor fees.

- Indirect Costs: Indirect costs, also known as overhead costs, are expenses that are not directly tied to a particular project but are necessary for the overall operation of your company. This may include office rent, utilities, insurance, and administrative salaries.

- Equipment Costs: Equipment costs account for the purchase, maintenance, and depreciation of the equipment used in your construction projects. This category includes both owned and rented equipment.

- Insurance Costs: Insurance costs include premiums paid for general liability insurance, workers’ compensation insurance, and other policies necessary to protect your company and employees.

- Permits and Fees: This category covers the costs associated with obtaining permits, licenses, and other regulatory fees required for construction projects.

Revenue Accounts

Revenue accounts track the income generated by your construction projects. They allow you to monitor the financial performance of each project and assess its profitability. Here are some revenue accounts commonly used in the construction industry:

- Contract Revenue: Contract revenue represents the total amount agreed upon in the contract for a specific project. This account tracks the progress billings and payments received from the client.

- Change Order Revenue: Change order revenue accounts for any additional income generated from change orders during the course of a project. This could include additional work requested by the client or adjustments to the original scope of work.

- Retainage: Retainage refers to a portion of the contract amount that is withheld by the client until the project is completed. This account tracks the retainage amount and its eventual release.

By including these sample accounts in your chart of accounts, you’ll have a solid foundation for tracking the financial activities of your construction company. Remember, you can customize these accounts based on the specific needs and requirements of your business.

Conclusion

In conclusion, a well-designed and properly implemented chart of accounts is essential for maximizing efficiency in your construction company’s financial management. By providing a clear and organized structure for recording financial transactions, the chart of accounts enables you to track and analyze your company’s financial performance accurately.

Throughout this article, we have explored the importance of a chart of accounts for construction companies and the key components that make up an effective chart. We have discussed the various general ledger accounts, project-specific accounts, cost categories, and revenue accounts that you should consider when designing your chart of accounts.

Moreover, we have highlighted some best practices to follow when creating your construction company’s chart of accounts. Consistency and standardization are crucial to ensure accurate and meaningful financial reporting. Additionally, flexibility for growth and integration with accounting software are essential to adapt to your company’s evolving needs and streamline your financial processes.

To provide you with a practical example, we have included a sample chart of accounts specifically tailored for construction companies. This sample encompasses general ledger accounts, project-specific accounts, cost categories, and revenue accounts that are commonly used in the industry. You can use this sample as a starting point and customize it to suit your company’s unique requirements.

By implementing a well-structured chart of accounts, you will gain several benefits. It will simplify your financial reporting, facilitate budgeting and cost control, enhance inventory management, and support decision-making based on accurate and up-to-date financial information. Moreover, it will streamline your auditing and tax preparation processes, ensuring compliance with legal and regulatory requirements.

Remember, a chart of accounts is not a one-time setup. Regular review and maintenance are necessary to ensure its relevance and effectiveness as your construction company grows and evolves. Stay proactive and make adjustments whenever needed to keep your financial management processes optimized.

Finally, don’t forget to check out Zapro. A leading provider of advanced construction management software, Zapro offers a comprehensive suite of tools to streamline your financial management process, including an intuitive chart of accounts feature. With Zapro, you can create, manage, and customize your COA with ease, ensuring maximum efficiency and profitability for your construction company.

For more information on the chart of accounts and how to create one for your construction company, you can refer to our comprehensive chart of accounts guide.

Remember, your company’s financial health starts with a solid chart of accounts!