Do you wonder why despite all your best efforts, your relationship with your suppliers is strained, you have constant disruptions with your supply chain, and you frequently suffer delays making your payments? Those finding themselves in these predicaments find themselves facing financial discrepancies, compliance issues, and audits. These are all telltale signs that your accounts payable processes are not performing as they should.Â

The best way to nip such adverse outcomes in the bud is to step back and explore how to streamline your accounts payable. We understand that for many, running a thriving business may need your constant attention, leaving you with little time to contemplate accounts payable process improvement ideas.Â

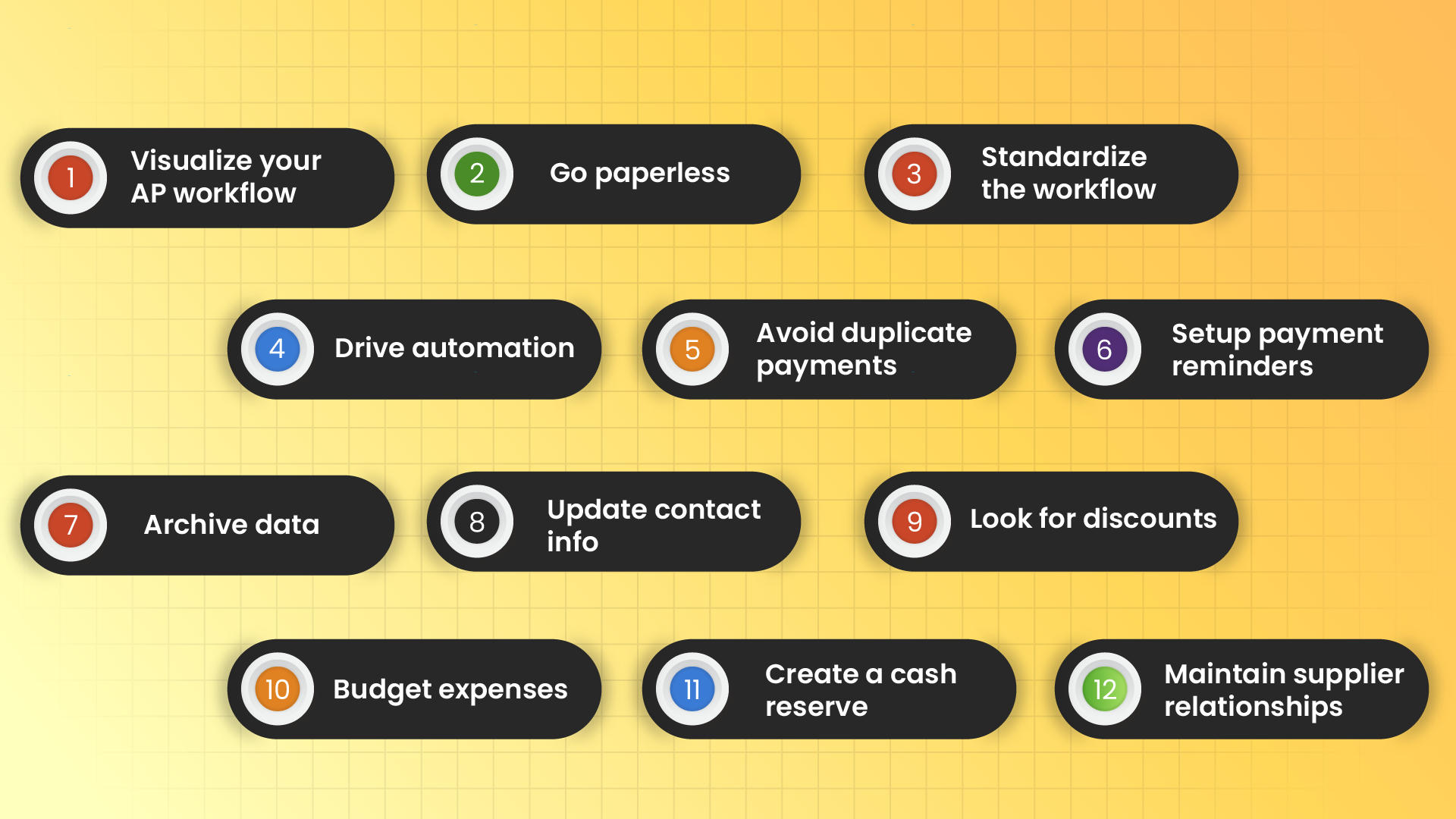

To make things easier, we have compiled a list of 12 instantly actionable steps to make your accounts payable process improvement project a smashing success. Following these steps to the tee will optimize your operational efficiency, record-keeping, payments, vendor relationships, and cash flow.Â

12 steps to accounts payable process improvement

Without any further delay, let’s help you get underway to complete accounts payable process improvement, better financial management, and ultimately secure a stronger standing in today’s competitive market.Â

- Visualize your AP workflow

- Go paperless

- Standardize the workflow

- Drive automation

- Avoid duplicate payments

- Setup payment reminders

- Archive data

- Update contact info

- Look for discounts

- Budget expenses

- Create a cash reserve

- Maintain supplier relationships

1. Visualize your AP workflow

Before making any accounts payable process improvement, you must first visualize your AP workflow. Why? A visual representation of your workflow helps you get a clear and concise overview of what exactly is happening through your entire AP process.Â

So pull out your markers, whiteboard, and sticky notes, and start mapping it out. Once you do so, you will know precisely where lies the most significant inefficiencies, bottlenecks, and other pain points affecting your organizational performance. While doing this, remember that every bit of detail can be crucial, so make sure your map is detailed and accurate.Â

2. Go paperless

The speed and accuracy of your financial data are critical to accounts payable process improvement. Paper-based receipts constantly coming in late will delay your AP processes significantly. The process will stagger even further when physical invoices get damaged or lost.Â

Our advice to you is to cut paper-based processes entirely. It’s an outdated and messy practice that requires additional resources to go through, sort, and store. Instead, pivot towards electronic invoices that you can easily track and manage.Â

Paperless processes also allow you to make prompt payments from anywhere without skipping a beat. All you need is the bank accounts of your vendors and a handy mobile phone or laptop to log on, review the e-invoice and make the transaction.Â

3. Standardize the workflow

The term workflow culminates from a combination of the word’ work,’ referring to the activities, tasks, and processes your AP requires, and ‘flow’ refers to the path to take to achieve the best outcomes. You need to periodically take the time to standardize your AP workflow to streamline how effectively you meet your business’s growing requirements, making it much harder for accounts payable process improvement. The critical thing to do here is to standardize how you manage your receipts and set a centralized location for their storage.Â

Create standardized AP practices and use an accounts payable aging report to keep tabs on the due dates for each invoice. It ensures you pay on time and maintain strong supplier relationships while giving you the clarity you need to keep your accounts payable process improvement going.Â

Overtly relying on tedious spreadsheets is one such pain point that standardization can fix by creating a template for employees to follow, eliminating disparate data across multiple systems.

4. Drive automation

The main problem that will stand in your way of accounts payable process improvement is manual processes. They are messy, inaccurate, and time-consuming because they involve too many stakeholders in every process. Such systems are prone to suffer from human error. Instead, don’t hesitate and automate. You will instantly cut down the number of people involved with your AP.Â

To go about this, employ one of the many available software that offers AP process automation. But before you finalize one, be sure to inquire about their features, try them out, and check if they address your business’s unique needs.Â

A good suggestion would be to find a low-code accounts payable process improvement software that can fix all your AP pain points without significant investment, technical knowledge, or new infrastructure to deploy. Most importantly, the AP automation software you choose must be able to scale while your business grows and fulfills its true potential.Â

5. Avoid duplicate payments

Duplicate payments are one of the leading results of inefficient invoice processing in accounts payable that causes businesses to suffer from financial losses and damaged supplier relationships.Â

To avoid making multiple payments for the same invoice, you must have 100% real-time visibility into all your invoice activity from a centralized location. A feat that may seem like a challenge if you have legacy AP systems, but rest assured, it is easily achievable through automation.Â

Once you achieve this, you can constantly monitor and track the performance of your invoice management, avoid fraud, set up reminders, speed up payment processing, avoid late payments, and ultimately stop making needless payments.Â

6. Setup payment reminders

In today’s fast past market, you will be constantly bogged with numerous challenges spread across all your core competencies. You may rely heavily upon traditional AP processes to work as they were intended as you need to make the best out of your most valuable resource, your time. This doesn’t always work out well for most business owners, who subsequently suffer from delayed payments and the repercussions that follow them.Â

A simple yet powerful solution to this problem is to set payment reminders based on your supplier’s due dates. It ensures that regardless of how busy it may get for your AP department, they will always be promptly reminded to make their supplier payments and maintain your relationships with them.Â

Regardless of whether you use a simple calendar alert or a more advanced automated option, it is a crucial step to follow. However, an automated option will give you more visibility and features to always keep you on track to pay your dues.Â

7. Archive data

Your data is your most helpful instrument, and the more you have of it, the more successful your plan for accounts payable process improvement will be. To hone it properly, you must collect and safely store it in a readily accessible centralized location.Â

When you archive your valuable AP data, including invoices, receipts, POs, and supplier notices, you ensure they are always readily available for streamlined AP decision-making. These archives will serve you for years as historical information that will help you plan your resources, make timely payments, manage your taxes, enhance compliance, negotiate better deals, and improve your cash flow.Â

So get archiving now.

8. Update contact info

Another simple solution for accounts payable process improvement that is often overlooked by businesses is maintaining updated contact information. Negotiating the best deals and building long-lasting relationships with suppliers requires constant communication. You can only do this if you have a consolidated contact information list of all your suppliers and vendors.Â

You never know what the preferred mode of communication could be for your suppliers and vendors, so to boost your accounts payable process improvement even more, collect the updated contact information for each one, including all communication channels they use.Â

9. Look for discounts

While your business grows, you will constantly need to procure numerous items to achieve your business activities. When you don’t strike the best deals, you will always pay needlessly more than you should for all your sourcing activities, making a significant dent in your accounts payable.Â

You cannot improve your accounts payable if this becomes a regular practice. Instead, empower your accounts payable department and all relevant stakeholders to periodically get on the phone, negotiate better deals, and seek opportunities for discounts where possible. For instance, your teams will identify situations where a particular item is sold at a discounted rate when bought in bulk. But to do this, they must be actively looking for discounts.Â

Remember, there will always be scope to optimize the procurement terms for your supplies, inventory, or services that you need.Â

10. Budget expenses

The best practice to improve your accounts payable process is always to have a clear overview of how much you owe, what your monthly bills look like, and your ability to fulfill these obligations. Your invoices can be an invaluable tool to achieve this understanding.Â

Ensure you use the information from every archived invoice to create realistic budgets and make timely payments without breaking the bank. The late fees you avoid are a bonus to your cash flow and go a long way in boosting your mission for accounts payable process improvement.

11. Create a cash reserve

The famous saying, “the best-laid plans can go awry,” is true for your business. Despite your careful budgeting and streamlining AP processes, sudden expenses and requirements are bound to crop up. During such situations, it is always best to be prepared with a cash reserve to pay for the requirement. It also helps you stay afloat without operational issues during the inevitable months when your cash flow staggers. But always ensure you use your cash reserves for the appropriate situations and practice replacing them when you find yourself out of the problem.Â

12. Maintain supplier relationships

In the end, the success of your accounts payable process improvement plan relies on how well you build lasting relationships with your suppliers. We have touched on building supplier relationships during various instances of this piece because we cannot stress enough how integral it is to your ongoing success.Â

As you grow, your demands will always increase, and it isn’t practical or feasible to approach a new set of suppliers and negotiate rates for every periodical requirement. Such a practice is a waste of your AP department and your business’s time and money.Â

Building strong business connections with trusted suppliers will help you achieve a reliable, feasible, optimized supply chain that will serve you well by helping you strive during good times and weathering the storm during bad times. So start building stronger relationships!

In conclusion, the solutions we have provided to fix your accounts payable processes are rather straightforward. With a little time and dedication, you can achieve all your accounts payable ideas and optimize your AP processes like never before. If you still need assistance, we are here to help. So feel free to reach out to us at Zapro.

Improve AP Processes With Zapro Automation

We at Zapro are an AP automation platform specializing in eliminating most of your manual accounting processes in favor of complete end-to-end AP automation.Â

Through our Automated AP management software, we can help your business thrive and attain more visibility into spending, reduce tedious tasks, and improve your bottom line.Â

Zapro’s user-friendly low-code software and intuitive dashboard will ensure you successfully achieve your accounts payable process improvement plan by streamlining invoice management, approvals management, payment management, and vendor collaboration like never before. Contact us to find out more.