In the labyrinth of business operations, it’s easy to get lost amid the myriad of terms and concepts. Especially for budding entrepreneurs, the difference between a purchase order and an invoice might seem perplexing. In the simplest terms, a purchase order is the official document issued by a buyer to a vendor, indicating the types, quantities, and agreed prices for products or services, while an invoice is the bill sent by vendors to buyers after a purchase order has been fulfilled. Both are crucial to the smooth functioning of any business, regardless of its size or industry.

What Is A Purchase Order?

A purchase order (PO) is a commercial and legal document issued by a buyer to a seller, indicating the products, quantities, and agreed prices for products or services. It serves as an official order form that the buyer submits to the seller, indicating the details about the purchase.

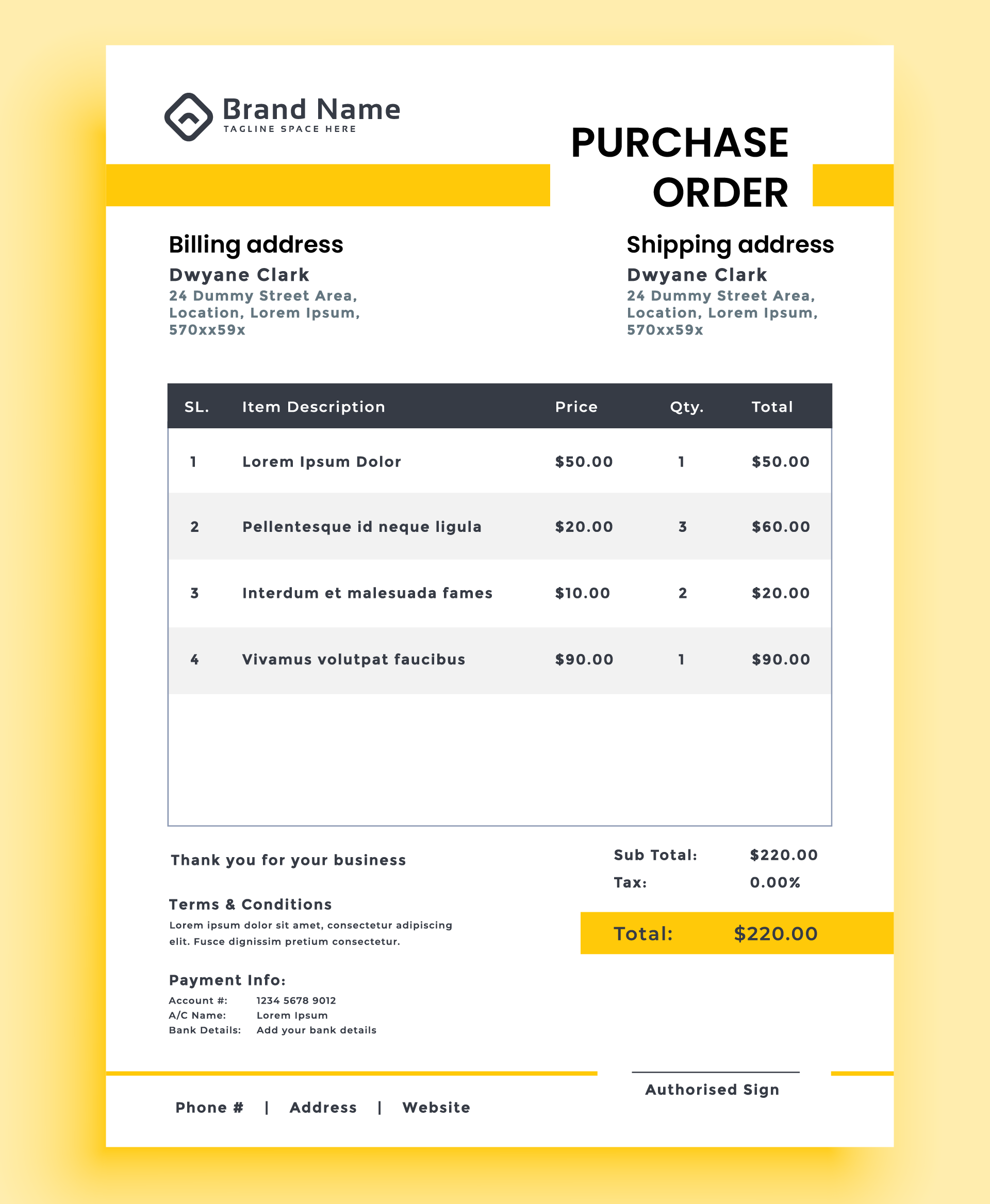

What does a purchase order contain?

As a good practice, all purchase order forms must be sequential, with the purchase order number acting as a unique identifier for that particular set of goods or services. With that as a fundamental basis, a standard purchase order may also contain the following information:

Purchase Order Number:

A unique identifier for the specific transaction. It helps in tracking and referencing the purchase order in the future.

Items Description:

A detailed description of the goods or services being ordered. This provides clarity to the seller about what is expected.

Model:

If applicable, the model or version of the product being ordered. This specification helps in precisely identifying the item.

Product Number:

A specific identification number assigned to the product or service. This aids in accurate tracking and avoids confusion.

Purchaser Contact Information:

Contact details of the buyer or purchasing department, including names, phone numbers, and email addresses. This ensures communication channels are clear.

Seller Contact Information:

Contact details of the seller or supplier, including names, phone numbers, and email addresses. Facilitates communication between the buyer and seller.

Item’s Unit Price:

The price per unit of the product or service. This is crucial for calculating the total cost of the order.

Quantity:

The quantity of units or items being ordered. It specifies the volume of goods or services requested.

Billing Address:

The address to which the seller should send the invoice for payment. It’s important for accurate billing and record-keeping.

Shipping Address:

The address where the ordered goods should be delivered. This ensures that the products reach the correct location.

Delivery Timeframes:

The agreed-upon schedule for delivering the goods or completing the services. Specifies the timeframe within which the delivery is expected.

Payment Terms:

The terms and conditions regarding payment, including due dates, payment methods, and any applicable discounts or penalties.

Issuer’s Signature:

The signature of the person authorized to approve and issue the purchase order. This adds an element of authorization and accountability to the document.

Having all these details in a purchase order helps create a clear and comprehensive agreement between the buyer and the seller, minimizing the chances of misunderstandings or disputes.

When Is A Purchase Order Used?

A purchase order is used at various stages in a business transaction:

- After Approval of Purchase Requisition: The purchase order form, along with any underlying purchase requisition, is approved before it’s submitted to a vetted and approved vendor.

- After Vendor Selection: Once a vendor is selected to fulfill an order, the purchase order prepared by the purchasing department is used to order goods.

- Release of Goods Under a Blanket Purchase Order or a Contract: Companies often issue a blanket purchase order to get volume discounts for all orders from a vendor within a specific time period. A sub-purchase order can then be released periodically when it’s time to order goods from the vendor.

What Is An Invoice?

An invoice is a bill sent by a vendor to a buyer as an official request for the goods or services that the vendor has provided. Generally, an invoice is raised after the order is fulfilled and contains the details of the goods or services provided, along with the amount due.

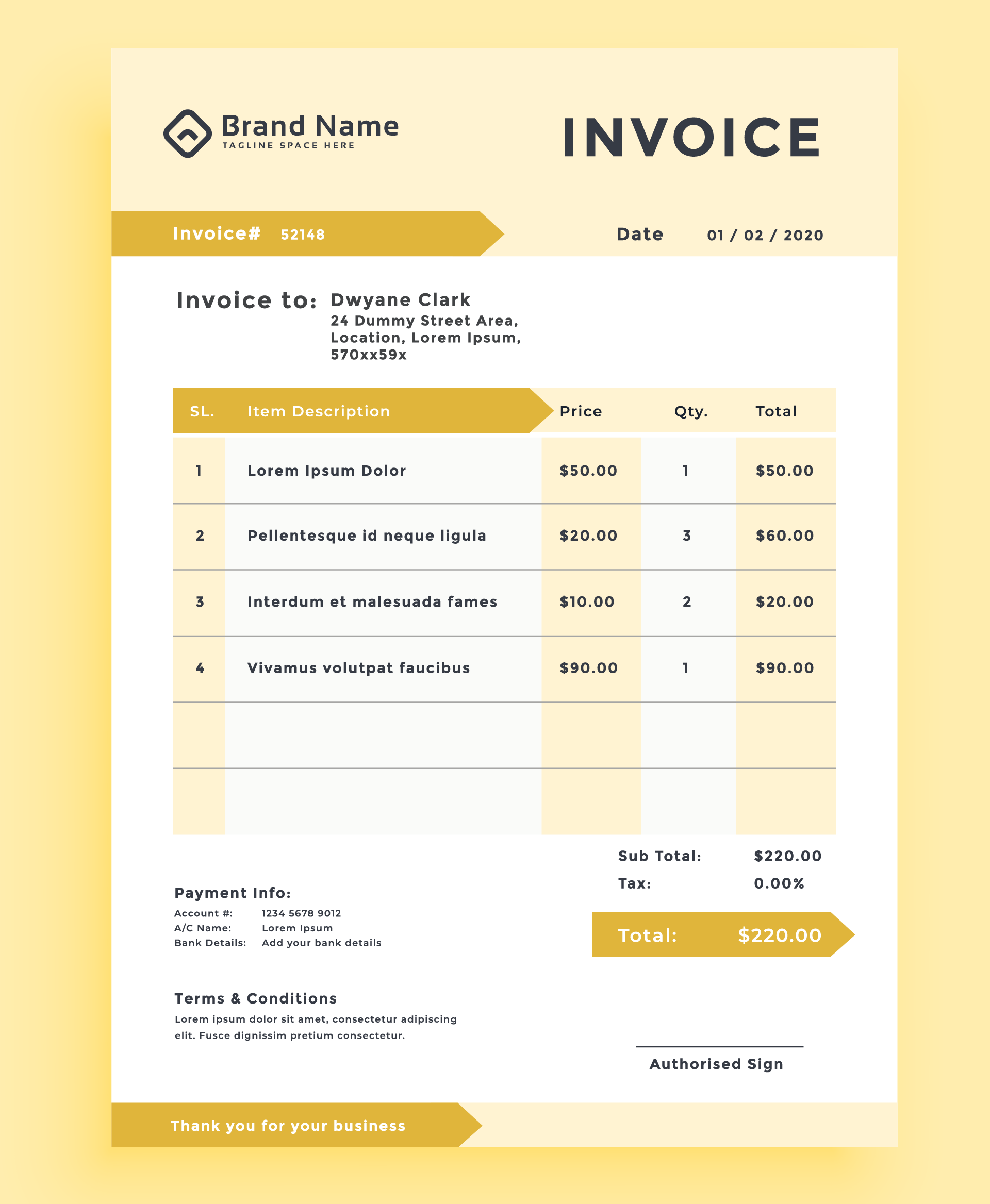

Components of an Invoice

A standard invoice usually contains the following elements:

Invoice Number:

A unique identifier assigned to the invoice, enabling easy tracking and referencing of the specific transaction.

PO Number (Purchase Order Number):

The associated Purchase Order number that initiated the transaction. This helps in linking the invoice to the original purchase order for reference and reconciliation.

Order Date:

The date on which the purchase order was made or when the agreement for goods or services was established.

Shipment or Purchase Date:

The date when the goods were shipped or the services were purchased. This indicates the timing of the transaction.

Shipping Address and Payment Terms:

The delivery address where the goods should be sent, and the agreed-upon payment terms specifying the conditions under which payment should be made. This section provides critical information for the buyer.

Due Date:

The deadline by which the payment must be received by the seller. It clarifies the timeframe for payment and helps avoid late payments.

Vendor Contact Information:

Contact details of the seller or vendor, including names, phone numbers, and email addresses. This information allows the buyer to easily communicate with the seller regarding the invoice.

Product Numbers, Descriptions, and Quantities:

Details of the goods or services sold, including product numbers, descriptions, and quantities. This section provides a comprehensive breakdown of what is being billed.

Sales Tax Rate and Amount:

Any applicable sales tax rate and the corresponding amount. This is crucial for compliance with tax regulations and ensures transparency in the total amount due.

Shipping Costs:

The cost associated with shipping the goods, if applicable. This may include shipping fees, freight charges, or any other related costs.

Total Invoice Amount:

The sum total of all charges, including the cost of goods or services, taxes, and shipping. This represents the final amount due from the buyer to the seller.

Including these details on an invoice provides a comprehensive and clear representation of the transaction, facilitating accurate payment processing and minimizing the potential for misunderstandings or disputes.

When Is An Invoice Used?

An invoice comes into play at various stages of a business transaction:

- Upon Shipment or Receipt of Goods: An invoice is used to bill the customer upon shipment or in-person receipt of the goods or services.

- When a Customer Uses a Credit Card for Payment: If a customer uses a credit card for payment, the invoice is considered immediately paid.

- For Invoice Processing in Accounts Payable or Accounts Receivable: The invoice-to-pay cycle includes vendor invoice processing, approval, and payment.

- For Ongoing Subscription Billings or Other Recurring Invoices: Businesses may issue recurring invoices when the customer is obligated to make multiple payments.

Purchase Order Vs Invoice: Key Differences

While both purchase orders and invoices are integral parts of the purchasing process, they serve distinct purposes. Below are the key differences between a purchase order and an invoice:

| Aspect | Purchase Order | Invoice |

| Document Type | Order confirmation sent by the buyer to the vendor | Payment request sent by the supplier to the buyer |

| When It’s Generated | Generated when the buyer places an order | Generated after the order is fulfilled |

| Purpose | Defines the terms of a purchase | Defines the confirmation of a sale |

Purchase Order Vs Invoice: Key Similarities

Despite their differences, purchase orders and invoices share some common characteristics:

- Commercial Communication: Both are commercial communication about purchases.

- Role in Optimizing Spend: They play an integral role in optimizing company spend.

- Visibility into the Purchasing Process: Both provide better visibility into the purchasing process.

- Basic Order Details: Both include basic order details, shipping information, vendor details, and price.

Why do companies need both purchase order and invoice?

Once you explore the intricacies behind purchase orders vs. invoice, you will notice that despite their similarities and differences, they are essential purchasing functions that work in tandem to achieve higher business goals.

Purchase orders and invoices help clarify budgets, eliminate errors, enhance cash flow, streamline inventory management, establish spending controls, and prevent conflicts arising from complex purchasing processes. As they are well-documented records of a business transaction, fewer problems occur due to miscommunication.

They clearly define the expectations both the buyers and sellers have toward completing a business transaction. It is an absolute must for businesses to use to keep themselves protected from a legal standpoint.

Although generating an elaborate purchase order or invoice may be time-consuming, they are an excellent way to smoothen the purchasing process and build solid business relationships with suppliers and vendors.

The Importance of Both Purchase Orders and Invoices

Purchase orders and invoices are mutually important for businesses. Together, they facilitate budget clarity, minimize errors, enhance cash flow, streamline inventory management, establish spending controls, and prevent conflicts arising from complex purchasing processes. They are well-documented records of a business transaction, reducing the chances of miscommunication-related problems.

Automating Purchase Orders and Invoices with Zapro

Now that you understand the functions of the purchase order vs. invoice and the shortcomings of manual processes, the decision to transition to automation may be more straightforward.

Zapro is an automated procurement solution that can help you systemize the purchasing process by leveraging state-of-the-art automation tools to avoid unnecessary hassles during and after purchasing. Our supplier portal will enable your suppliers to collaboratively accept, reject, and request changes in purchase orders.

Moreover, when suppliers need to submit invoices, they can do so directly through Zapro’s supplier portal per legal and operational expectations. Ultimately, a robust solution such as Zapro can dramatically reduce the workload for the AP department, improve the invoice data quality, and lessen the chances of you facing hassles with your next audit.

Book a demo with us and learn how we can help you streamline your purchase order and invoice management.