Inventory serves as a financial asset while also serving as a strategic management tool and a tax influence. Your inventory valuation choices determine financial performance results and affect both tax requirements and decisions from stakeholders. This detailed guide examines FIFO, LIFO, and Weighted-Average inventory valuation methods to demonstrate their financial statement effects.

This guide helps CFOs, finance directors, accountants, and operations managers develop inventory strategies that support business objectives.

Introduction: What This Guide Covers

In this blog, you’ll learn:

- What inventory valuation entails and its significance for businesses.

- Learn about FIFO, LIFO, and Weighted-Average together with their operational principles and financial effects.

- How each method affects your income statement reporting, balance sheet statements, and your tax reporting requirements.

- How Zapro.ai helps streamline valuation for modern inventory strategies.

What is Inventory Valuation?

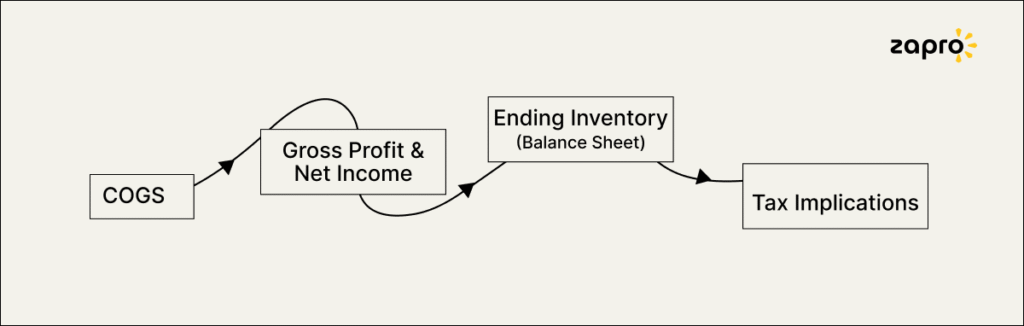

Inventory valuation is the process that determines the monetary values for all stored goods in a company at any moment. Bookkeeping requires this process since it directly affects the cost of goods sold (COGS), gross profit, net income, and the value of inventory assets on the balance sheet.

The chosen method affects three key elements:

- Taxable income

- Cash flow

- Decision-making on purchasing, production, and pricing strategies

FIFO (First-In, First-Out)

The FIFO system considers the initially purchased items as the first products sold in inventory. The method works best for perishable and time-sensitive products because it mirrors their natural sequence.

Financial Impact:

In times of rising prices, FIFO results in:

- Lower COGS

- Higher gross profit & net income

- Higher ending inventory value

Industry Example: Grocery, pharmaceuticals, food, and beverage

Stats: AICPA surveyed over 70% of the companies worldwide to find that FIFO remains their preferred choice because it matches actual inventory movement patterns.

LIFO (Last-In, First-Out)

Under LIFO inventory management, the most recent inventory purchases are sold before older items. LIFO functions mainly in the U.S. market because it provides tax benefits during inflationary periods.

Financial Impact:

- LIFO results in higher COGS while producing lower gross profit and net income, together with lower ending inventory value during periods of increasing costs.

- Tax deferral benefits

The use of LIFO is restricted to U.S. GAAP-compliant companies since IFRS does not permit this method.

LIFO can be a powerful tool for tax deferral in inflationary times, but it often misrepresents the physical flow of goods, making it a nuanced choice for financial reporting.

Weighted-Average Cost Method

The Weighted-Average Cost Method determines a combined cost value for available-for-sale units and then applies this average to both sold and remaining inventory.

Financial Impact:

- Creates consistency in cost reporting

- Smooths out price fluctuations

- Useful for businesses with interchangeable goods

The method works optimally in manufacturing operations, together with wholesale and electronics businesses that cannot effectively track individual batch expenses.

Impact on Financial Statements: Side-by-Side Comparison

Each financial reporting method produces distinct changes to your company’s essential financial statements.

1. Cost of Goods Sold (COGS)

- FIFO provides lower COGS in times of inflation, which leads to higher profits.

- LIFO leads to higher COGS in inflation, which reduces taxable income.

- Weighted-Average provides COGS in the middle range, which results in stable and smooth outcomes.

2. Gross Profit & Net Income

- FIFO results in higher profits because of inflation.

- LIFO creates reduced profits which provides tax advantages.

- Weighted-Average: Balanced profits, less volatile

3. Ending Inventory Value (Balance Sheet)

- FIFO: Higher asset value

- LIFO: Lower asset value

- Weighted-Average: Average asset value

Weighted-Average: Neutral impact, often IFRS-friendly

4. Tax Implications

- FIFO May increase tax burden during inflation

- LIFO Offers tax shield but is banned under IFRS

- Weighted-Average Neutral impact, often IFRS-friendly

Trend Insight: The increasing adoption of IFRS worldwide leads companies to abandon LIFO in favor of FIFO and Weighted-Average for transparent financial reporting and cross-border comparison.

How Zapro.ai Supports Flexible Inventory Valuation & Reporting

Inventory management presents itself as a complex process. The situation becomes worse when businesses handle inventory using outdated systems or manual processes. That’s where Zapro.ai comes in.

With Zapro.ai, businesses can:

- Use multiple valuation methods (FIFO, LIFO, Weighted-Average)

- Sync inventory costing with general ledger

- Generate customizable reports for accurate financial analysis

- Ensure audit-ready records and compliance documentation

Learn more at: Zapro.ai Inventory Management

Zapro’s Features for Financial Accuracy in Inventory

The following features of Zapro.ai enable smooth inventory valuation management:

- Real-time inventory costing: Instant updates as transactions happen

- Automated GL integration: Ensures consistency across finance systems

- Custom reporting dashboards: Reflect chosen valuation method

- Audit trails & compliance: Detailed logs for traceability and peace of mind

Explore all features: Zapro.ai Features

Case Study: Improved Financial Accuracy with Zapro.ai

Company: AlphaTech Manufacturing

Problem Statement: The company faced recurring cost fluctuations, which resulted in irregular gross margin figures and longer monthly closing processes.

Solution: The company adopted Zapro.ai for finished goods using FIFO and Weighted-Average for raw materials.

Results:

- 35% improvement in financial reporting accuracy

- 50% reduction in audit preparation time

- Real-time COGS reporting led to better margin decisions

Choosing the Right Inventory Management System

To choose the best inventory management software with financial alignment capabilities, always look for:

- Support for multiple valuation methods

- Integration with your ERP/accounting software

- Detailed reporting and analysis tools

- Audit-ready recordkeeping

- User-friendly dashboards for finance and ops teams

Calculating the ROI of Optimized Inventory Valuation with Zapro.ai

An advanced platform change to Zapro.ai brings actual business benefits to the table:

- Better tax planning from accurate cost tracking

- More trustworthy financial statements

- Faster close cycles and audits

- Improved investor confidence

Try the ROI calculator: Zapro.ai ROI Tool

Why Zapro.ai is Your Partner for Precise Inventory Financials

Zapro.ai functions as a financial partner beyond its basic inventory management features. It ensures:

- You meet both GAAP and IFRS requirements

- You always know the real cost of your stock

- Your reporting aligns with strategic and tax goals

- Your teams make data-backed decisions

Get in touch with us today!

Final Thoughts:

The selection of inventory valuation methods represents a strategic choice rather than a routine accounting procedure. The selection of proper valuation methods, alongside suitable management tools, remains essential for organizations seeking tax efficiency and financial transparency alongside audit simplicity.

Through Zapro.ai, businesses acquire the adaptability, regulatory compliance, and analytical capabilities needed to convert inventory expenses into competitive business advantages.

Zapro.ai: Simplify inventory valuation & boost financial accuracy.

Frequently Asked Questions (FAQs)

1. What is the difference between perpetual and periodic inventory systems?

The perpetual system maintains continuous monitoring of inventory quantities following all purchase and sale transactions. The periodic system conducts physical counts at established periods to update inventory balances and calculate COGS.

2. How do inventory write-downs affect financials?

When inventory market prices drop below purchase costs, a write-down occurs. A decrease in inventory value on the balance sheet occurs through this method while also reducing net income by recording it as an expense on the income statement.

3. Can a company change its inventory valuation method?

A company maintains the power to shift its inventory valuation approach, yet such modifications need thorough evaluation. The method change requires justification along with consistent application throughout all operations. Financial statements require disclosure of the change, and the company might need to revise its past financial reports when necessary.

4. How does inflation impact inventory valuation?

During times of inflation, FIFO produces higher net income while increasing tax obligations but LIFO produces lower net income together with reduced tax liabilities. The Weighted-Average method provides a middle-ground impact.

5. What are the tax implications of FIFO vs. LIFO?

Rising cost environments produce higher COGS and reduced taxable income from LIFO, which leads to lower tax obligations. FIFO leads to elevated taxable income, which increases tax liabilities, but FIFO does not.

6. How does inventory shrinkage affect valuation?

The physical inventory level decreases when organizations experience inventory shrinkage due to damage, theft, and errors. Under periodic systems, COGS calculations automatically include shrinkage because they use beginning and ending inventory amounts. Under a perpetual system, the business reports shrinkage separately through a loss expense.

Don’t miss our weekly updates

We’ll email you 1-3 times per week—and never share your information.

Healthcare

Healthcare Financial Services

Financial Services Technology

Technology Venture Capitalist

Venture Capitalist Chief Procurement Officer

Chief Procurement Officer Chief Financial Officer

Chief Financial Officer