Enhancing Invoice Approval Workflows: A Guide to Automating Your Process

As a business grows, so does the volume of invoices they receive. Manually processing such a high volume of invoices can be time-consuming, error-prone, and redundant, ultimately affecting productivity and damaging business relationships. Although such situations may seem bleak and unavoidable, you can quickly solve them by deploying an automated invoice approval workflow.Â

Automating invoice approval workflows can make your processes seamless, efficient, and accurate while reducing costs and mitigating the risk of fraud.Â

In this article, we’ll explore the benefits of an automated invoice approval workflow, the potential risks of manual processing, and the critical steps involved in an automated workflow.

The Traditional Invoice Approval Workflow: A Step-by-Step Guide

In a traditional invoice approval workflow, several steps must be followed to ensure invoices are processed accurately and efficiently. These steps include:

1. Invoice Receipt

The process begins when a business receives an invoice from a supplier. The invoice can be received through mail, email, or EDI. The invoice is then sent to the accounts payable team for processing.

2. Verification

The accounts payable team then verifies the accuracy of the invoice by checking the supplier name, goods or services, dates, amounts, and other details. This step is crucial to ensure that the invoice is correct and that the business is not overpaying for goods or services.

3. Matching

The invoice is then matched with the corresponding purchase order and goods receipt note (GRN) to ensure that the goods or services have been received and are accurate.

4. Approval

Once the invoice has been verified and matched, it is sent for approval. This step involves multiple department heads and managers, the accounts payable team, and the finance department. Disjointed approvals can cause delays and even potential for fraudulent activity.

5. Payment

Upon approval, the process moves to payment. Payment terms depend on the agreement with the supplier. Late payments can cause irreparable damage to supplier relationships, so it’s vital to implement checks and balances to ensure this doesn’t occur.

6. Record Keeping

The end-to-end invoice approval workflow continues beyond payment to record keeping. This is where invoice information is meticulously recorded in the company’s accounting system to ensure detailed expense tracking and financial reporting.

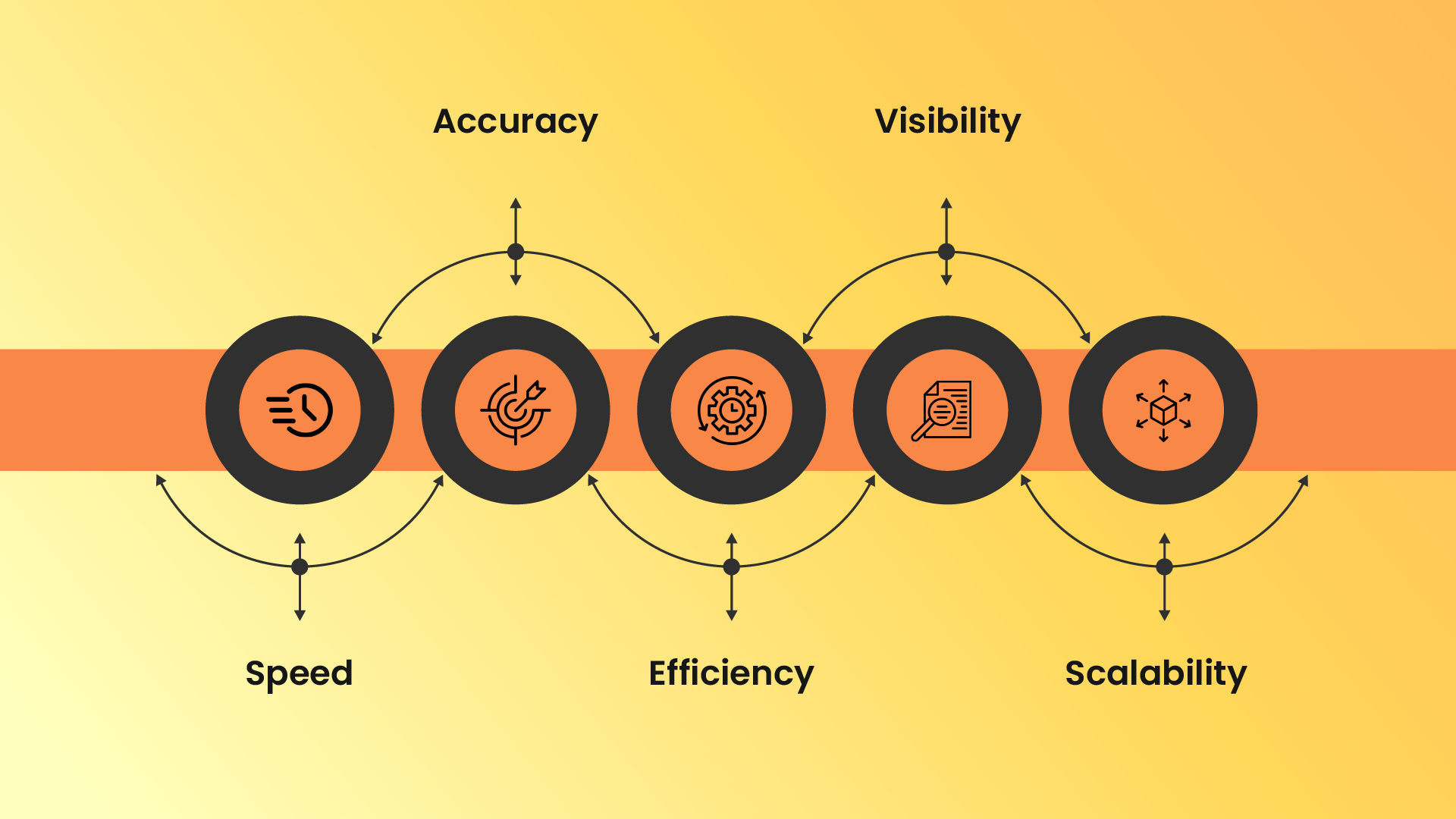

The Benefits of Automating Your Invoice Approval Workflow

Automating your invoice approval workflow can bring significant benefits to your business, including:

1. Speed and Efficiency

Automating your invoice approval workflow enables rapid processing and approval of invoices, allowing teams to handle more documents efficiently without the hassle of manual data entry, chasing approvals, or filing paperwork.

2. Accuracy

With automation, invoices undergo a systematic capture, approval, routing, storage, and archiving process based on pre-set rules, ensuring impeccable accuracy.

3. Cost Reduction

Manual invoice processing typically costs between $15 to $40 per invoice. Automation slashes these expenses.

4. Visibility and Control

A centralized platform equipped with an intuitive dashboard grants stakeholders comprehensive oversight of the approval process, fostering transparency and accountability.

5. Relationship Building

Automation ensures prompt payments and swift response times, cultivating trust and reinforcing relationships with partners and employees.

6. Employee Retention

By alleviating the burden of manual invoice approvals, automation empowers employees to dedicate their efforts to strategically significant tasks, which can enhance job satisfaction and retention.

7. Scalability

Automation facilitates the seamless scaling of invoice processing volumes without straining the team or necessitating additional personnel.

8. Compliance

Automation software is ingrained with rules that ensure adherence to local regulations across diverse regions, irrespective of the company’s operational scale.

The Risks of Manual Invoice Processing

Manual invoice processing can be risky, with the following potential problems:

1. Human Error

Manual invoice processing involves several touchpoints, increasing the chance of human error. A single mistake can result in overpayments, underpayments, or unpaid invoices, which require significant time, money, and effort to mitigate.

2. Lack of Visibility

Without an automated system, tracking invoices and payments at any point in their processing is challenging. That leads to poor communication with vendors and suppliers who rely on accurate documentation and makes it much more difficult to follow an audit trail when trying to identify problems in the invoicing process.

3. Risk of Fraud

Financial documents are an especially ripe target for fraudsters. Improperly approved invoices and other common forms of payment fraud are much easier to pull off in a system of manual checks and multiple human touchpoints.

4. Costly Delays

Every hour your finance department spends correcting human errors, identifying fraud, or tracking down missing invoices is an hour that could have been spent on more productive tasks. Additionally, manual processing is simply slower and more cumbersome, and the case for automation becomes hard to ignore.

5. Strained Vendor Relationships

Late payments and invoicing errors can quickly strain your relationship with vendors and damage your reputation within your industry. Automating your AP workflows eliminates many factors that might make your vendors think twice about bringing their business to you in the future.

6. Less Employee Engagement

Performing data entry and manually processing invoices, payments, and other financial documents requires many tedious and repetitive tasks. Given the high risk of human error, those tasks also come with a high degree of stress and responsibility, all of which add up to a less engaged workforce, higher rates of burnout, and more employee turnover.

Automating Your Invoice Approval Workflow with MHC

MHC provides scalable AP solutions that can accommodate the complicated needs of any enterprise organization. From intelligent invoice capturing to automated invoice auditing and processing to real-time visibility into your business’s most vital invoicing functions, we provide a reliable and easy-to-use software system that integrates with your existing ERP right out of the box. Our solution offers:

1. Easy Receipt of Invoices

Our software allows for easy receipt of invoices in various formats, including paper documents, faxes, emails, or electronic document formats like Word, PDF, Excel, and others.

2. Optical Character Recognition (OCR)

OCR makes it simple for your automation software to capture key data from received invoices and port that information into your system.

3. 3-Way Matching

Our automated system uses 3-way Matching to validate each invoice against two other documents, ensuring the data is accurate and protecting your AP team against invoice fraud.

4. Automated Routing

Verified invoices are routed to your organization’s decision-makers for approval. Automation ensures that each invoice reaches the person authorized to approve it speedily and efficiently.

5. Notifications and Reminders

Our software sends automated reminders and error notifications to every department involved with signing off on invoices, reducing the time your AP team needs to contact approvers and chase down signatures to keep your processing on schedule.

6. Improved Vendor Relationships

By ensuring that each invoice arrives on time and error-free, our software helps keep your vendors happy and eager to work with you in the future, which in turn helps boost your reputation within your industry.

7. Faster Approvals

Our automated solution gets the proper documents in front of the right people at the right time and ensures they know when their approvals are due, resulting in quicker and fewer delays.

8. Fraud Detection

Our software automatically flags irregularities and runs 3-way Matching to confirm the legitimacy of every invoice, helping to protect your reputation and keep you compliant with all relevant regulations.

9. Easy Onboarding

Our solution comes with intuitive controls that significantly reduce the new material these approvers are expected to learn, removing some of the pressure and allowing a smooth transition into their roles.

Conclusion

Automating your invoice approval workflow can significantly benefit your business, including reducing errors and delays, improving visibility and control, and strengthening vendor relationships. Manual invoice processing can be risky, with the potential for human error, lack of visibility, and fraud. MHC provides a scalable AP solution that can accommodate the complicated needs of any enterprise organization, from easy receipt of invoices to automated routing and fraud detection. Contact us today to schedule a demonstration of the many ways MHC automation solutions can streamline invoice approvals and other crucial financial documentation processes.

About Zapro

With Zapro, you get a powerful toolkit to streamline your Procure to Pay processes. Our features include Automated Procurement, AP Automation, Sourcing, Contracts, Travel and expense Management, Integrations, Compliance, Reports and analytics, Support offerings, and Data Insights. We simplify operations, boost efficiency, ensure compliance, provide valuable analytics, and offer comprehensive support, empowering your business to achieve the best procurement outcomes.