Managing your accounts payable (AP) efficiently is crucial for maintaining healthy relationships with your vendors and suppliers. With the right AP software, you can automate your payment processes, reduce manual tasks, and streamline your entire AP operation from start to finish.Â

To help you find the ideal solution for your business, we’ve compiled a list of the top accounts payable software products available in 2023.

Accounts payable software is designed to automate your payment processes by leveraging customized instructions for each business process. It filters, categorizes, matches, and validates critical accounting information recorded in your accounting system—all within a few simple mouse clicks.

If you are looking for AP software, you should know that although many software are available in the market, they are all not the same. While some may be niche, catering to specific functions and addressing particular AP problems, others can be broader. Broader software solutions cover enterprise resource management (ERP) systems or AP automation tools.

By implementing accounts payable software, businesses can process, record, and pay discounted vendor invoices while reducing manual tasks and streamlining their AP operations.

The Importance of AP Automation

AP automation is all about reducing manual tasks and streamlining payable processes. By automating your AP processes, you can:

- Save time by reducing data entry and manual tasks

- Improve accuracy and reduce errors

- Enhance your cash flow management

- Strengthen vendor relationships by making timely payments

- Increase productivity and efficiency within your finance team

Top 14 Accounts Payable Platforms

To help you find the perfect AP software for your business, we’ve compiled a list of the top 14 accounts payable platforms available in 2023:

1. Zapro

Best overall AP software for businesses of all sizes with services ranging from effortless AP automation to automated procurement, and everything in between

2. Tipalti

Best for reducing risk and cost with enterprise-grade financial and compliance controls

3. QuickBooks Online

Best for small and mid-market companies that accept a wide range of payment methods

4. Sage Intacct

Best for businesses interested in GAAP compliance and multi-dimensional report views

5. NetSuite

Best for small and mid-sized companies looking to grow

6. Microsoft Dynamics 365

Best for Microsoft-friendly companies of all sizes

7. Acumatica

Best for businesses wanting an intuitive user interface, collaboration, and unlimited user pricing

8. Epicor

Best for companies of all sizes looking to grow their business

9. Oracle EPM Cloud

Best for large enterprise companies with complex accounting needs

10. SAP

Best for large companies with big budgets or smaller businesses using SAP’s tailored offerings

11. Stampli

Best for companies with difficult communications that need fast results

12. FreshBooks

Best for small businesses and freelancers without a large finance team

13. Lightyear

Best for midsize businesses and teams

14. Xero

Best for small and mid-sized companies already using an entry-level solution like BILL

Key Features of AP Automation Software

When evaluating accounts payable software, consider the following key features:

When evaluating accounts payable software, consider the following key features:

- Optical character recognition (OCR) for invoice scanning and data capture

- Invoice processing and automation

- Automated approval workflows

- Global cross-border payments

- Document management and storage

- Self-service supplier onboarding

- Tax compliance and fraud prevention

- Payment discounts optimization

- Electronic document matching

- Online multi-currency international mass payments

- Secure payment methods

- Automatic payments reconciliation

- Spend and cash management

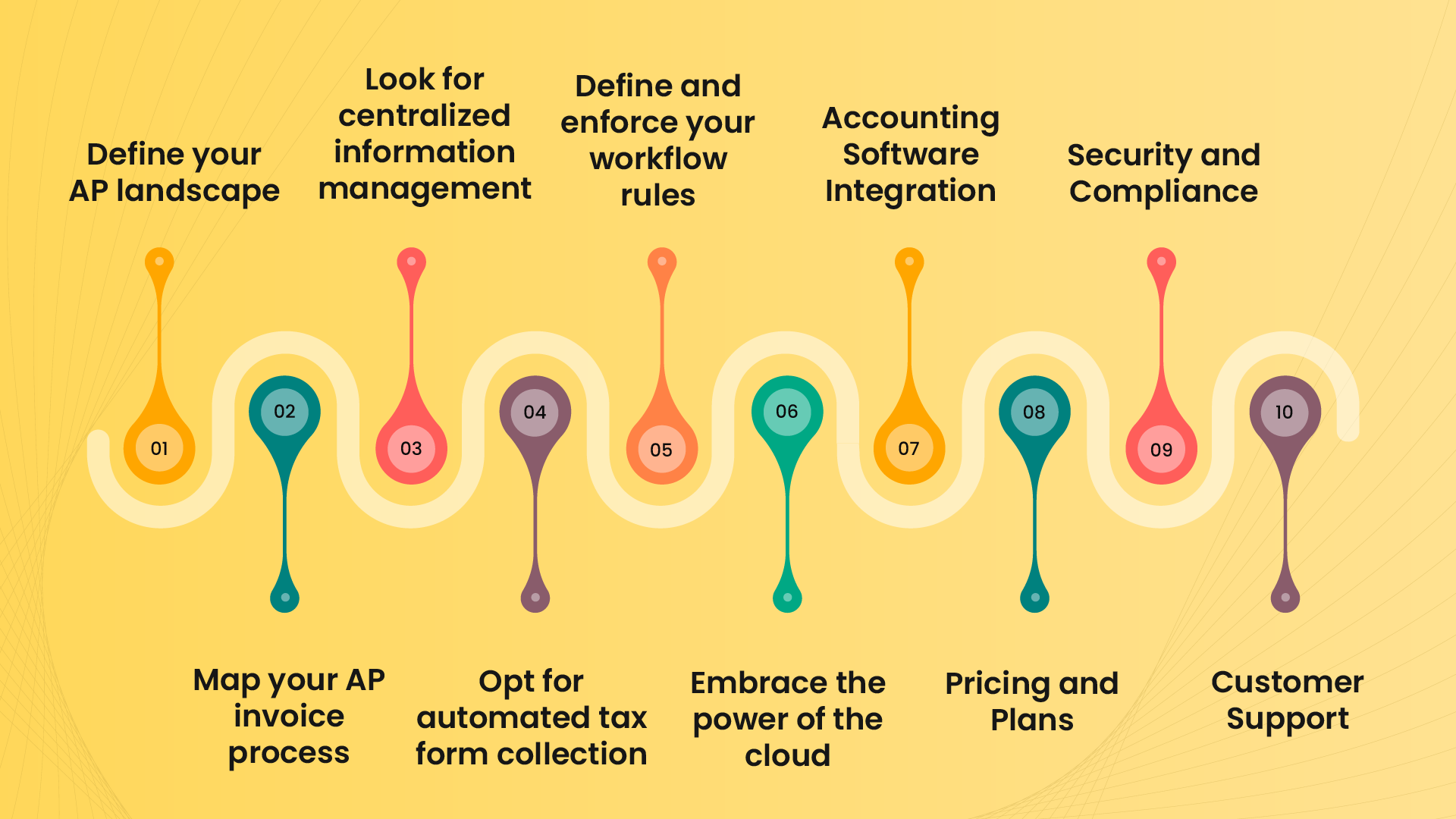

How to Choose the Best AP Software

When selecting the best accounts payable software for your business, consider the following steps:

1. Define your AP landscape

Understand the intricacies of your invoice processing to determine the features your software must have.

2. Map your AP invoice process

Identify your pain points and challenges in both non-PO-related expense invoices and PO-related direct spend invoices.

3. Look for centralized information management

Choose software for easy collaboration and access to all invoice elements in one central location.

4. Opt for automated tax form collection

Select a solution that simplifies tax and regulatory compliance by automating tax form collection.

5. Define and enforce your workflow rules

Opt for software that allows you to set and enforce workflow rules to minimize errors and double payments.

6. Embrace the power of the cloud

Choose a cloud-based AP software solution for easy deployment, scalability, and access from anywhere.

7. Accounting Software Integration

Seamless integration with your existing accounting software is crucial for a successful AP software implementation. Ensure that your accounts payable software can integrate with popular accounting applications like QuickBooks, Xero, Sage Intacct, and ERP systems.

8. Pricing and Plans

Accounts payable software pricing varies depending on the features, scalability, and level of automation offered. Some solutions have a fixed monthly subscription, while others provide a pay-per-transaction model. Be sure to compare pricing plans and consider the long-term value and return on investment when making your decision.

9. Security and Compliance

Security and compliance should be top priorities when choosing an accounts payable software. Look for solutions that offer encryption, secure payment processing, and compliance with relevant industry rules and regulations.

10. Customer Support

Strong customer support is essential for your AP software’s smooth implementation and ongoing use. Choose a solution that offers reliable customer support through multiple channels, such as phone, email, live chat, and online resources.

To summarize

Choosing the proper accounts payable software is critical for improving your business’s efficiency, cash flow, and vendor relationships. By considering the key features, pricing, security, and customer support, you can find the perfect solution to streamline your AP operations and propel your business forward.

Start by evaluating the top 13 accounts payable platforms mentioned in this guide, and remember to take your time to find the best fit for your unique needs. With the right AP software, you’ll experience increased productivity, reduced manual tasks, and a more efficient accounts payable process.

About Zapro

With Zapro, you get a powerful toolkit to streamline your Procure to Pay processes. Our features include Automated Procurement, AP Automation, Sourcing, Contracts, Travel and expense Management, Integrations, Compliance, Reports and analytics, Support offerings, and Data Insights.Â

We simplify operations, boost efficiency, ensure compliance, provide valuable analytics, and offer comprehensive support, empowering your business to achieve the best procurement outcomes.

Get in touch with Zapro today!