In the modern business landscape where every penny counts, the accounts payable automation benefits are hard to ignore. A streamlined, error-free, and efficient accounts payable (AP) process is not just a need, it’s a must-have.

What is automated accounts payable?

Before we delve into the AP automation benefits, it’s crucial to understand what automated accounts payable is. Simply put, it’s the use of advanced cloud technology to minimize manual accounting tasks, enhance the accuracy of financial processes, and offer customized control over crucial financial functions.

This technology simplifies the AP process, making it easier for the AP team to submit invoices and process payments through a single platform, consequently saving time and money.

How can accounts payable automation software be more efficient?

An important question that arises is, how can accounts payable automation software be more efficient? The answer lies in the elimination of manual data entry and reduction of errors, making the AP process instantly more effective.

AP automation solutions secure payments, facilitate online approvals, and generate an easy-to-follow audit trail, which adds value to your business both immediately and in the long run. By transitioning from manual to automated, and hopefully, to autonomous, the entire AP process becomes more efficient and effective.

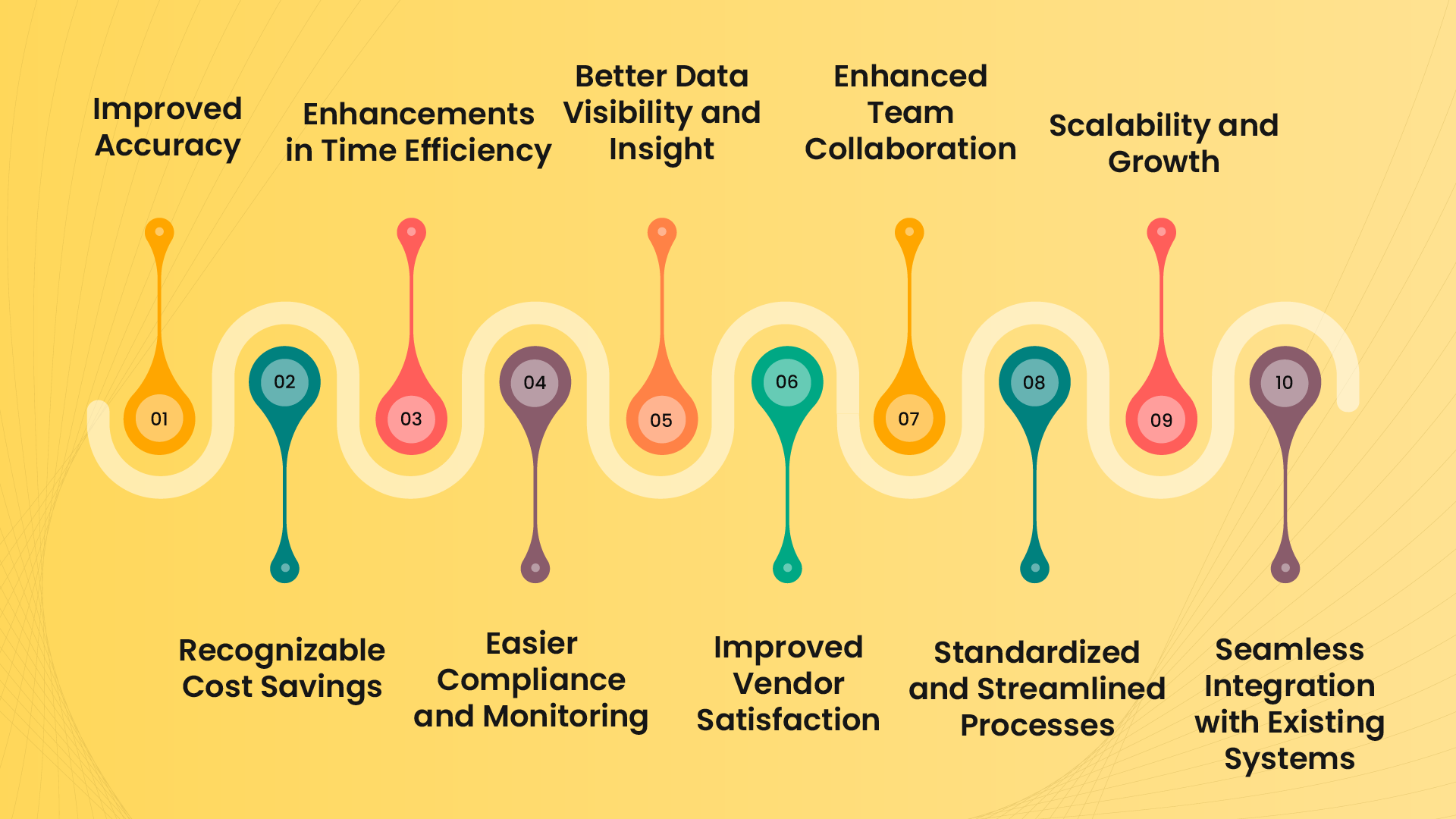

10 Major Time-Saving Benefits of Accounts Payable Automation

Saving time, reducing errors, and improving overall productivity are a few of the many benefits of automating critical aspects of the accounts payable process. Let us explore some of the notable benefits:

1. Improved Accuracy

One of the most significant advantages of AP automation is the substantial improvement in accuracy it brings to the table. By eliminating the need for manual data entry, automation drastically reduces the risk of human errors that can lead to costly mistakes and inaccuracies.

2. Recognizable Cost Savings

Automating the accounts payable process can result in significant cost savings for your business. By reducing the time and resources required to process invoices, you can lower the overall cost per invoice, enabling you to reallocate those resources to more strategic initiatives.

3. Enhancements in Time Efficiency

Automating your accounts payable process can dramatically decrease the time it takes to process invoices, from intake to approval. This improvement in efficiency allows your business to manage cash flow better and maintain healthier relationships with suppliers.

4. Easier Compliance and Monitoring

Accounts payable automation generates transparent and easily traceable records of every action taken on an invoice. This level of transparency simplifies compliance and monitoring, making it easier to detect and prevent fraud while streamlining audits.

5. Better Data Visibility and Insight

Automation provides a wealth of real-time data, allowing you to gain valuable insights into your AP processes. This increased visibility enables you to make informed decisions and optimize your processes for maximum efficiency.

6. Improved Vendor Satisfaction

By expediting the invoice approval and payment process, AP automation can help you strengthen your relationships with vendors. Timely payments and efficient communication contribute to a positive reputation, making your business a preferred partner for suppliers.

7. Enhanced Team Collaboration

Automation enables your accounts payable team to work together more effectively by consolidating multiple workflows into a single, streamlined process. This increased level of collaboration can lead to a more productive and harmonious work environment.

8. Standardized and Streamlined Processes

Accounts payable automation allows you to design and implement customized workflows that align with your business’s unique needs. This flexibility ensures that your processes remain efficient and effective, both now and in the future.

9. Scalability and Growth

As your business grows, accounts payable automation can adapt to meet your changing needs. By automating additional process elements and using the data provided, you can more effectively plan for your business’s future.

10. Seamless Integration with Existing Systems

Accounts payable automation can be easily integrated with your existing finance and enterprise resource management systems, allowing for a more cohesive and efficient workflow across your organization.

How to Automate Accounts Payable

Automating accounts payable and streamlining payment processes can be achieved by partnering with a leading integrated AP automation provider. Commence the process by scheduling an AP automation demo, perusing customer reviews, and compiling a list outlining your specific AP requirements.

To circumvent challenges in AP automation, it is crucial to identify an accounts payable software that facilitates a seamless transition from manual to standardized and automated processes. Custom-built IT-reliant solutions and ERP additions often fall short, necessitating alignment of your business’s scalability and service needs with the offerings of potential providers.

Generate interest and advocacy within your organization by communicating the myriad benefits of AP automation. Subsequently, reach out to specialized companies offering automated accounts payable solutions to gain insight into their offerings and better understand the available options.

In terms of automation possibilities in accounts payable, initiating the automation process significantly shortens the business payment cycle, potentially leading to early-payment incentives. The elimination of paper invoices is achievable through a solution that electronically captures, digitizes, and processes invoices, irrespective of their format.

The integration of artificial intelligence in AP introduces new data insights and analytics, supporting functions such as forecasting, planning, and auditing. Automation solutions extend to the entire financial supply chain, synchronizing all invoice data—from supplier details to payments—across the entirety of the payments lifecycle.

Embracing Accounts Payable Automation for Long-Term Success

Embracing AP automation is crucial for long-term success. By automating critical aspects of the accounts payable process, you’ll be able to save time, reduce errors, and better use your team’s talents.

In the end, the accounts payable automation benefits are evident and numerous. It’s time to embrace the future and take the leap to automated accounts payable processes. And who better to assist you in this journey than Zapro? With a powerful toolkit to streamline your Procure to Pay processes, Zapro is here to simplify operations, boost efficiency, ensure compliance, provide valuable analytics, and offer comprehensive support, empowering your business to achieve the best procurement outcomes.