In the realm of modern business, efficiency and accuracy play pivotal roles in driving success. Among the critical processes that demand attention is invoice processing, an essential function that facilitates financial transactions between companies and vendors.

Traditionally, this operation has been a manual and labor-intensive task, often leading to extensive time consumption, resource drain, and increased human error risks.

As businesses scale and transactions surge, the importance of automated invoice processing (AIP) becomes increasingly evident.

AIP, through the power of cutting-edge technology, offers a transformative solution to streamline this tedious process, saving both time and resources while enhancing accuracy and overall productivity.

In this article, we’ll get into what AIP is, explore its significance, examine how it works and touch up on what you need to look out for when evaluating automated invoice processing software.

Let’s get right in!

What is Automated Invoice Processing?

Automated Invoice Processing (AIP) is a technology-driven approach that simplifies and accelerates the traditionally time-consuming and error-prone task of handling invoices. At its core, AIP leverages advanced software and intelligent algorithms to digitize, extract, and process data from invoices automatically.

In traditional manual systems, each invoice requires labor-intensive manual entry, which is time-consuming and susceptible to human errors. Employees have to handle physical paperwork, key in data manually, and reconcile it with purchase orders, receipts, and payment records.

This manual handling often leads to delayed processing, data inconsistencies, and increased risk of discrepancies.

In contrast, AIP streamlines the entire process. With data extraction and validation automated, it significantly reduces processing time, enhances accuracy, and eliminates repetitive manual tasks.

Digitizing and centralizing invoice data also enables easy access and retrieval, fostering better transparency and auditability. Furthermore, as businesses scale, AIP can effortlessly handle increased invoice volumes, ensuring seamless operations without additional resource burden.

Why is Automated Invoice Processing important?

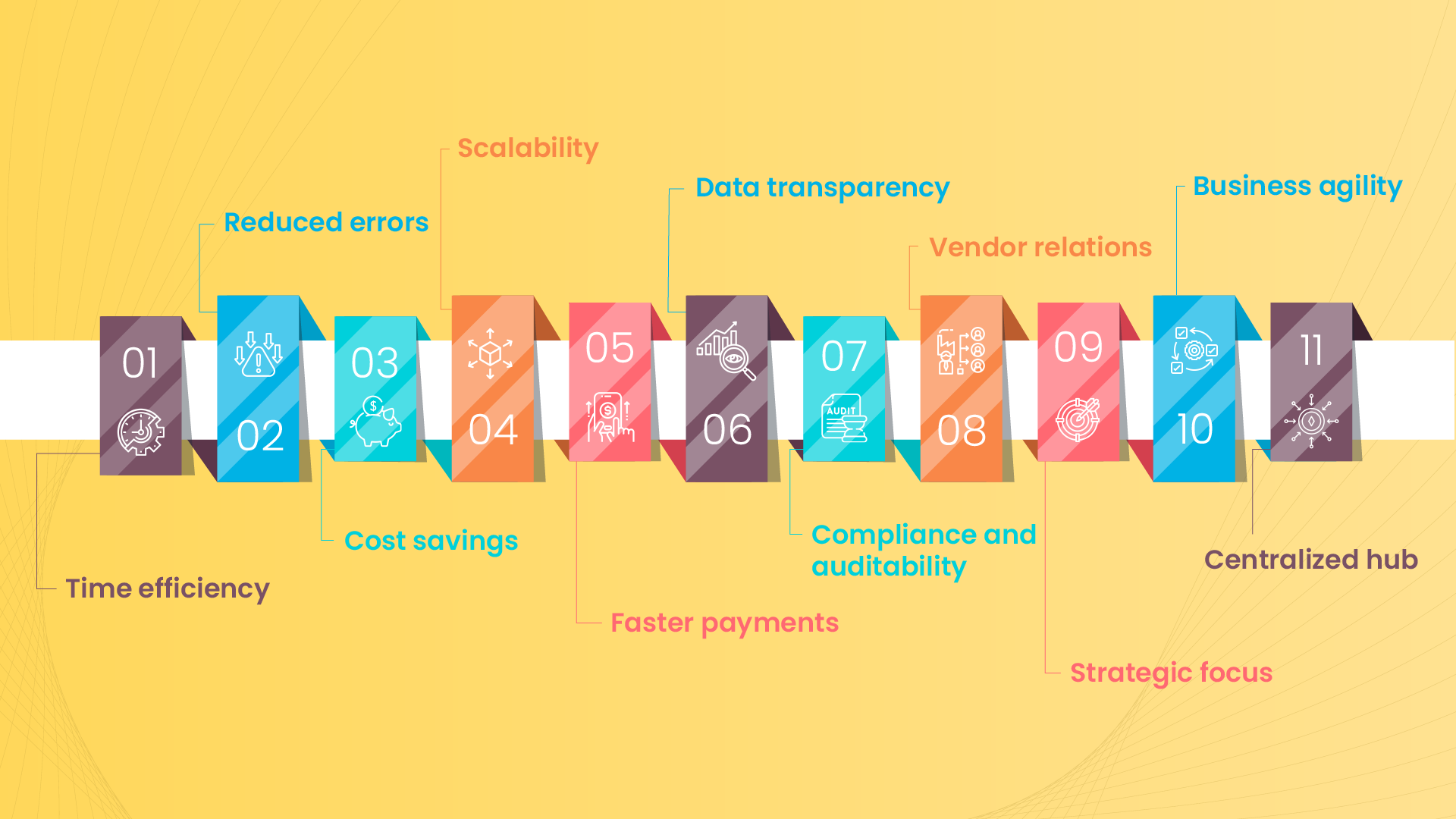

AIP has become a vital asset for modern businesses due to the myriad of benefits it offers. Let’s explore why AIP is crucial for organizations aiming to streamline their financial operations and boost overall efficiency.

The adoption of AIP yields a host of advantages, from time and cost savings to improved data accuracy and vendor relations.

With streamlined processes and enhanced financial visibility, organizations can empower their teams to concentrate on higher-value tasks, ultimately driving the company’s success in an ever-evolving business landscape.

How does Automated Invoice Processing work?

In manual invoice processing, the steps are typically labor-intensive and time-consuming. Employees receive paper-based or emailed invoices, manually input data into accounting systems, and cross-reference details with purchase orders and receipts.

This manual handling often leads to errors, delays, and the need for multiple reviews for approval. The paper-based trail makes tracking and retrieval of invoices challenging, while compliance and auditing become intricate tasks.

Automated Invoice Processing streamlines the entire workflow, offering remarkable time and resource savings. Here’s how it typically works:

- Invoices are received and captured electronically or scanned into the system.

- Advanced Optical Character Recognition (OCR) technology extracts relevant data from the invoices, such as invoice numbers, dates, line items, and amounts.

- The extracted data undergoes automatic validation, cross-referencing it with purchase orders and receipts to ensure accuracy.

- Invoices are automatically routed through an approval workflow based on predefined rules and hierarchies.

- Relevant personnel receive notifications for timely reviews, approvals, and exception handling.

- Digitized invoices and associated data are securely stored in a centralized database for easy access and retrieval.

- Automated integration with ERP systems ensures seamless data transfer and synchronization, eliminating the need for manual data entry and reducing errors.

- Improved productivity and reduced operational costs are achieved through streamlined workflows.

- Enhanced compliance and auditability with a transparent and efficient system for managing financial transactions.

- Businesses can focus on strategic initiatives while efficiently managing their invoicing operations.

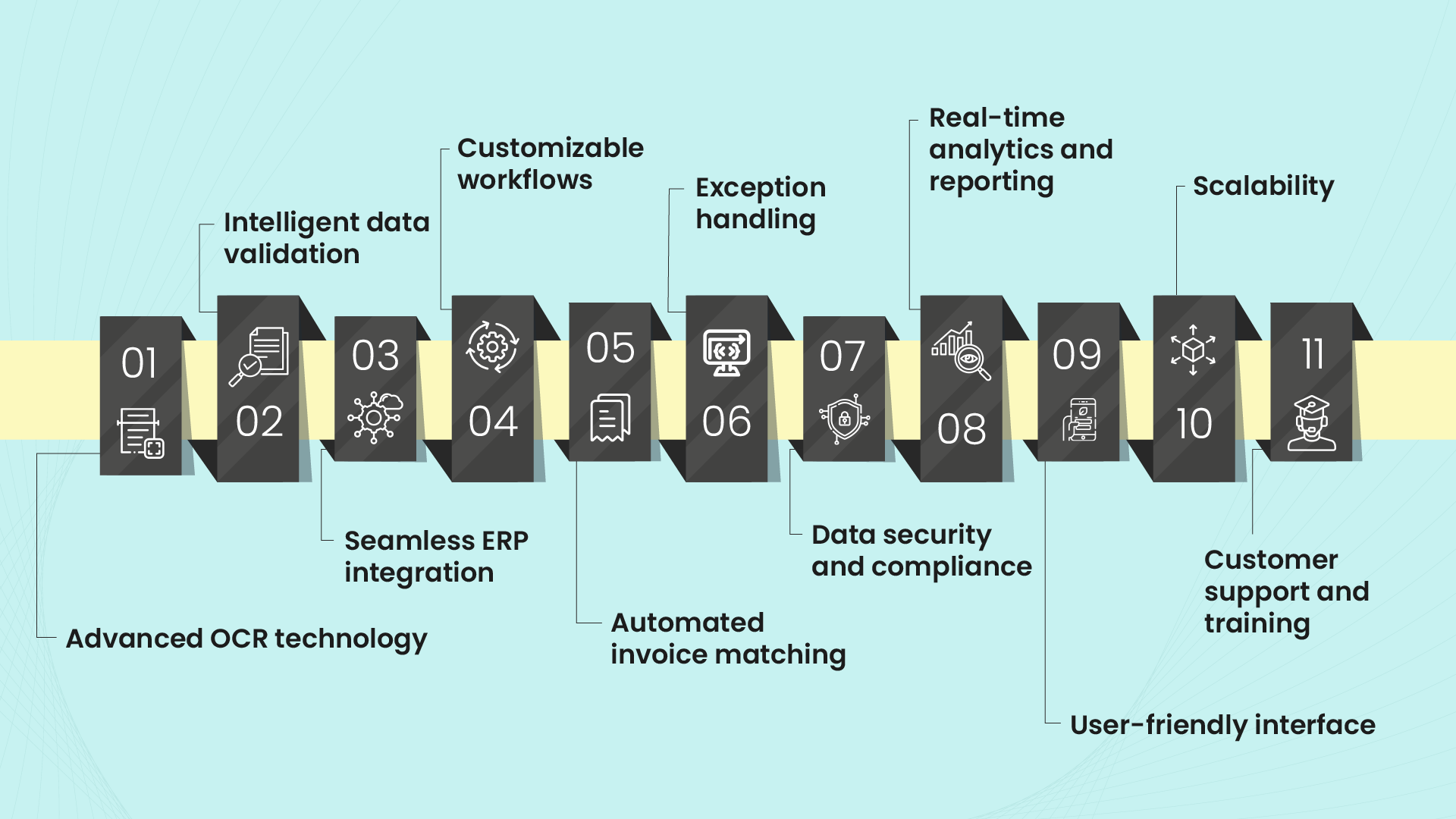

What to look for when evaluating an AIP software

Choosing the right AIP software is crucial to optimize your invoice processing workflow. As you evaluate different solutions, consider the following key features and functionalities:

Automate Your Invoicing Process Effortlessly & Accurately With Zapro

Automated Invoice Processing has emerged as a game-changer in today’s fast-paced business landscape. With its ability to enhance time efficiency, reduce errors, cut costs, and ensure scalability, AIP holds significant importance for organizations seeking to optimize their financial operations.

With Zapro’s cutting-edge solution, automating your invoicing process becomes effortless and precise. Two standout features that set Zapro apart are:

With Zapro as your trusted partner, you can unlock the potential of efficient and accurate invoice processing, empowering your organization to focus on strategic initiatives and achieve newfound business agility.

Schedule a demo with Zapro today and embark on a transformative journey to optimize your invoicing operations effortlessly!