Accounts Payable Automation with RPA and AI: A Comprehensive Guide

As the finance and accounts payable (AP) world rapidly evolves, so must your businesses to maintain a healthy competitive advantage. The increased adoption of automation technologies, such as robotic process automation (RPA) and artificial intelligence (AI), can help your organization transform how your accounts payable process is handled through a comprehensive guide exploring the ins and outs of accounts payable automation. We will cover the challenges, benefits, and various steps in implementing RPA and AI for AP automation.

1. The Importance of Accounts Payable in Modern Business

Accounts payable is a crucial aspect of any organization, directly impacting cash flow, fraud prevention, and vendor relationships. In today’s competitive business landscape, it’s essential to streamline and automate AP processes to improve efficiency and maintain a competitive edge.

1.1 The Challenges of Manual Accounts Payable Processes

Many organizations still need to rely on manual, labor-intensive, and time-consuming methods to manage their accounts payable processes. This often involves high human involvement and paper invoices, leading to bottlenecks and inefficiencies.

Two primary challenges organizations face in streamlining manual accounts payable processes are:

- Manual data entry

- Routing of invoices for approval

1.2 The Need for Automation

With advancements in automation technologies, accounts payable has become a significant area of focus for process improvement in small to mid-sized organizations. RPA and AI are gaining attention for their ability to automate manual tasks, improving the overall efficiency of accounts payable processes.

2. RPA and AI: A Powerful Combination for Accounts Payable Automation

While RPA and AI are often discussed as separate entities, their combined use can provide a powerful solution for automating accounts payable processes. Let’s look closer at the roles of RPA and AI in AP automation.

2.1 The Role of RPA in Accounts Payable Automation

RPA is primarily used to automate repetitive tasks following programmed rules. RPA can be particularly useful in automating activities that involve accessing multiple systems or require periodic auditing for compliance.

Some critical applications of RPA in accounts payable automation include:

- Invoice data entry

- Two-way and three-way PO matching

- AP approval process

2.2 The Role of AI in Accounts Payable Automation

Conversely, AI involves machine learning and continuous feedback, allowing for self-correction and adaptation. AI can be particularly useful for tasks that involve unstructured data or require more advanced decision-making capabilities.

Some critical applications of AI in accounts payable automation include:

- Intelligent data capture from various invoice formats

- Invoice classification and sorting

- Duplicate invoice checking

- Invoice exception flagging

3. Implementing Accounts Payable Automation with RPA and AI

Organizations must follow a systematic approach to implement accounts payable automation using RPA and AI successfully. The following steps will guide you through the implementation process.

3.1 Identifying the Right Processes for Automation

Start by identifying labor-intensive activities that require accessing multiple systems, are repetitive, or can be audited for compliance periodically. These are prime candidates for RPA-enabled automation.

3.2 Integrating RPA and AI for Touchless Invoice Processing

Invoices come in various formats, from paper and email attachments to electronic data interchange (EDI). RPA bots alone cannot handle these different data types consistently. AI-based machine learning models can train bots to interpret and extract data more accurately, eliminating human involvement for various invoice formats.

3.3 Automating Invoice Data Entry

RPA bots can interact seamlessly with various applications and systems, including ERP or accounting, to feed the extracted data. Automating the invoice data entry process can expedite the AP approval process and minimize the risk of human errors and associated costs.

3.4 Automating Two-way and Three-way PO Matching

The manual PO matching process is time-consuming and burdensome for accounts payable staff. RPA bots can automate most of the manual matching, reducing oversight requirements and exception handling allowing employees to focus on more critical finance responsibilities, such as budgeting and planning.

3.5 Streamlining the AP Approval Process

Automating the invoice/AP approval process and PO matching reduces human intervention by automatically routing invoices to the appropriate approver once matching is complete. Additionally, automated follow-ups are triggered to remind approvers of upcoming deadlines.

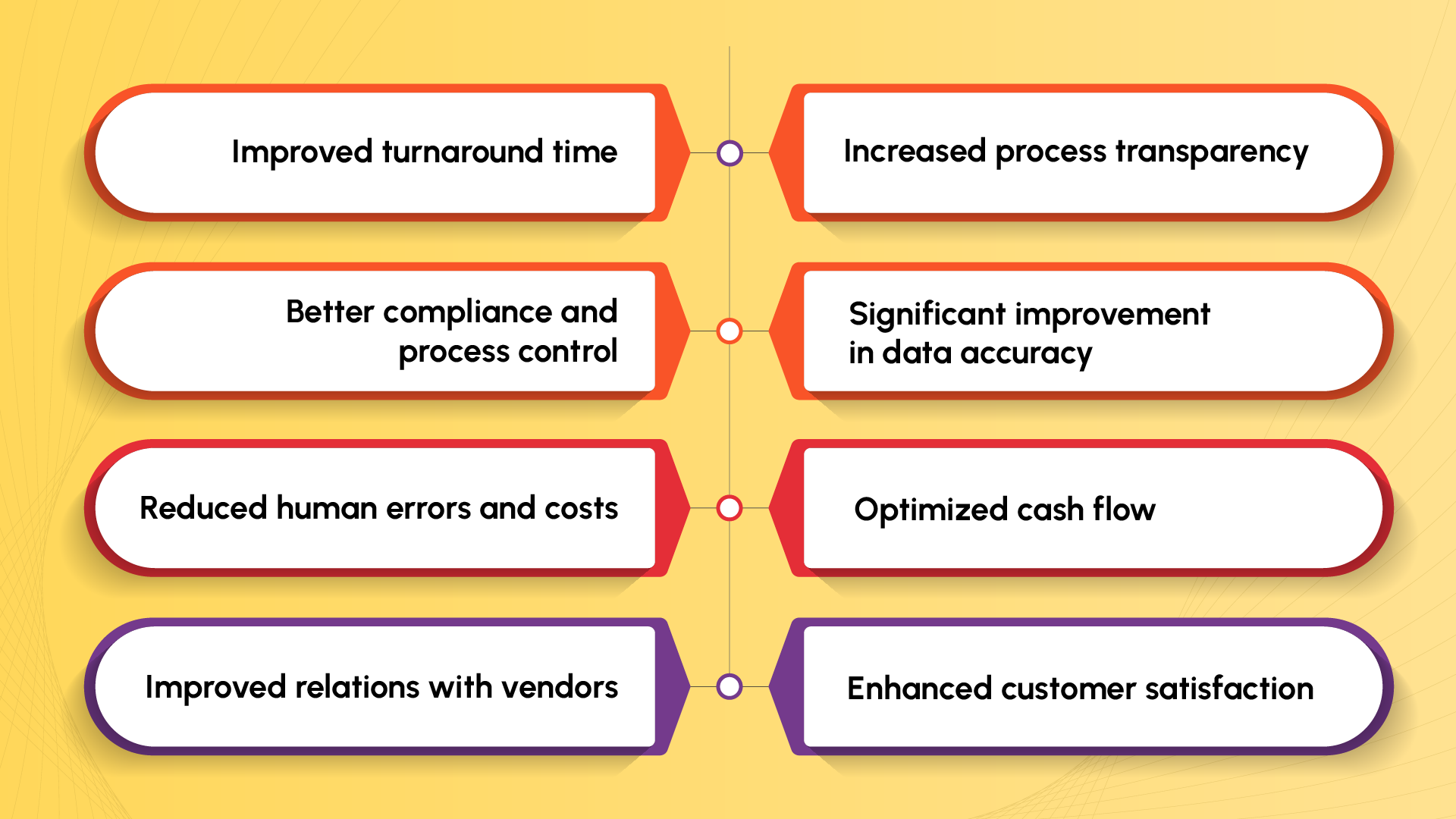

4. The Benefits of Accounts Payable Automation with RPA and AI

Implementing accounts payable automation using RPA and AI offers several benefits for organizations, including:

- Improved turnaround time

- Increased process transparency

- Better compliance and process control

- Significant improvement in data accuracy

- Reduced human errors and costs

- Optimized cash flow

- Improved relations with vendors

- Enhanced customer satisfaction

5. Case Study: Successful Accounts Payable Automation with RPA and AI

CNM LLP, a leading financial advisory firm, successfully automated its accounts payable process using Nividous RPA Bots. Using intelligent OCR capabilities, these bots could fetch and compare semi-structured and tabular data from engagement letters against timesheets. The bots created missing rates in the invoicing system. They flagged discrepancies in a report sent to stakeholders, completing data extraction and entry tasks for hundreds of records in just a couple of hours without human intervention.

6. The Future of Accounts Payable Automation

As more organizations adopt automation technologies to improve their AP processes, we expect continued innovation in AI and RPA. The integration of these technologies will enable businesses to optimize their accounts payable operations further, driving speed, accuracy, and cost optimization.

In summary, accounts payable automation with RPA and AI offers a powerful solution for organizations looking to streamline their AP processes and stay competitive in today’s fast-paced business environment. Businesses can reap the numerous benefits of AP automation by identifying the right processes for automation, integrating RPA and AI, and following a systematic implementation approach.

About Zapro

With Zapro, you get a powerful toolkit to streamline your Procure to Pay processes. Our features include Automated Procurement, AP Automation, Sourcing, Contracts, Travel and expense Management, Integrations, Compliance, Reports and analytics, Support offerings, and Data Insights. We simplify operations, boost efficiency, ensure compliance, provide valuable analytics, and offer comprehensive support, empowering your business to achieve the best procurement outcomes.