Accounts Payable Automation Software for Efficient AP Workflow

Reduce costs, save time, and ensure error-free payments.

TRUSTED BY LEADING BRANDS

Archaic platforms are crippling

your procurement workflows

Real-life challenges in manual AP management

Inefficient accounts payable processes don’t just slow you down; they significantly cost your business.

- Incur unnecessary late payment penalties and missed early payment discounts.

- Time wasted on tedious manual data entry and invoice processing.

- Chase after stakeholders for approval with paper and a digital trail of records.

Essential Features of AP Automation Software

for Streamline AP workflow

Automate Routine

Order Smartly

Streamline Workflows

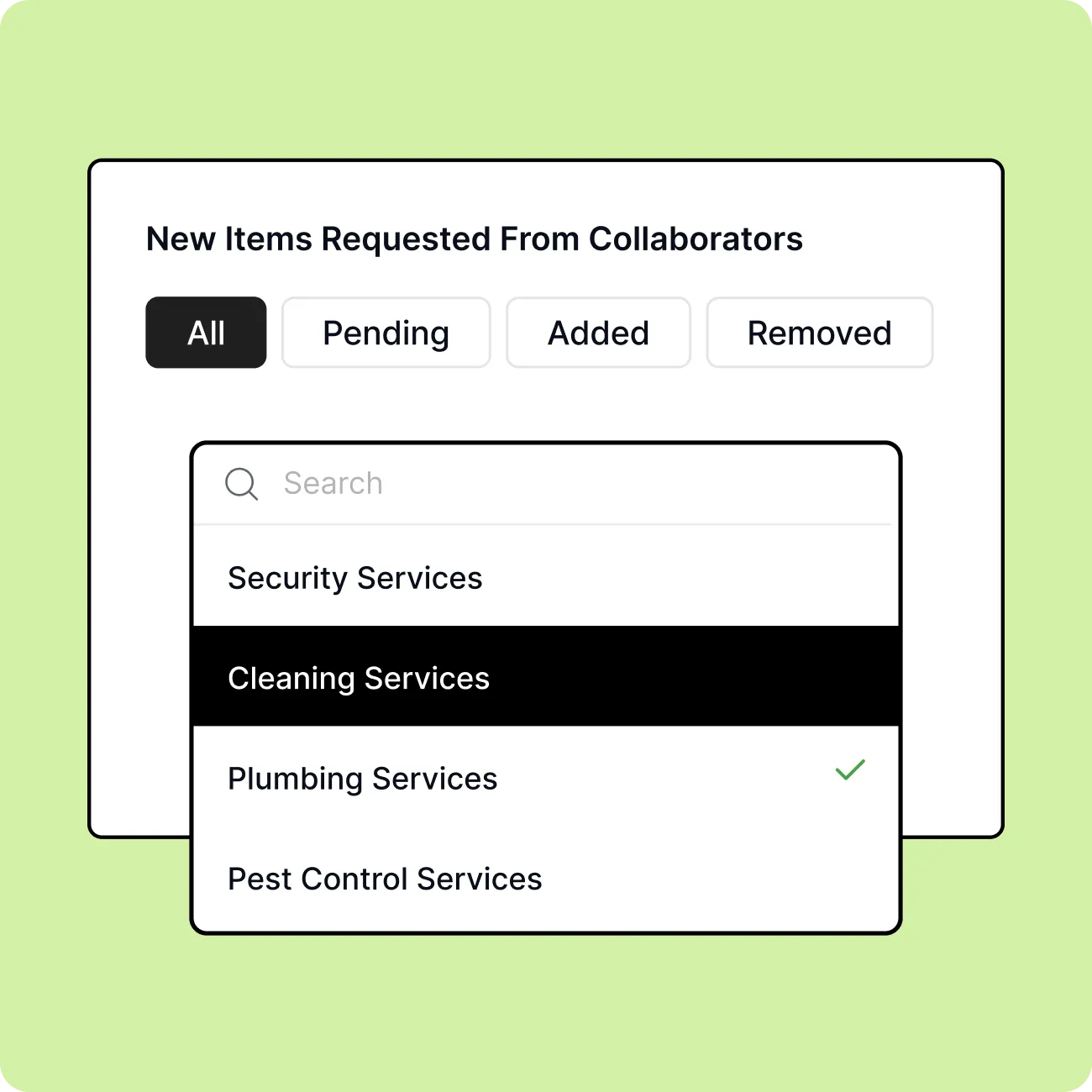

Collaborate Easily

Overcome human errors

- Minimize errors with precise AP automation solutions.

- Increase accuracy while maintaining seamless compliance.

- Never miss discounts with automated payment scheduling.

Manage cashflow effortlessly

- Uncover spending patterns and optimize budget allocation effectively.

- Gain unmatched control over business finances, drive strategic growth.

- Streamline operations for effective financial management and growth.

Get rid of operational bottlenecks

- Streamline operations for smoother workflows with Zapro.

- Eliminate payment delays to maintain strong cash flow.

- Boost productivity and employee morale efficiently.

Build strong supplier relationships

- Strengthen supplier ties with timely, accurate payments.

- Enhance communication and fortify your supply chain effortlessly.

- Access a secure, unified interface for meaningful conversations.

Key Benefits of AP Automation with

Zapro AP Automation Platform Solution

Split Billing

Efficiently allocate expenses across distinct segments for seamless financial tracking and management.

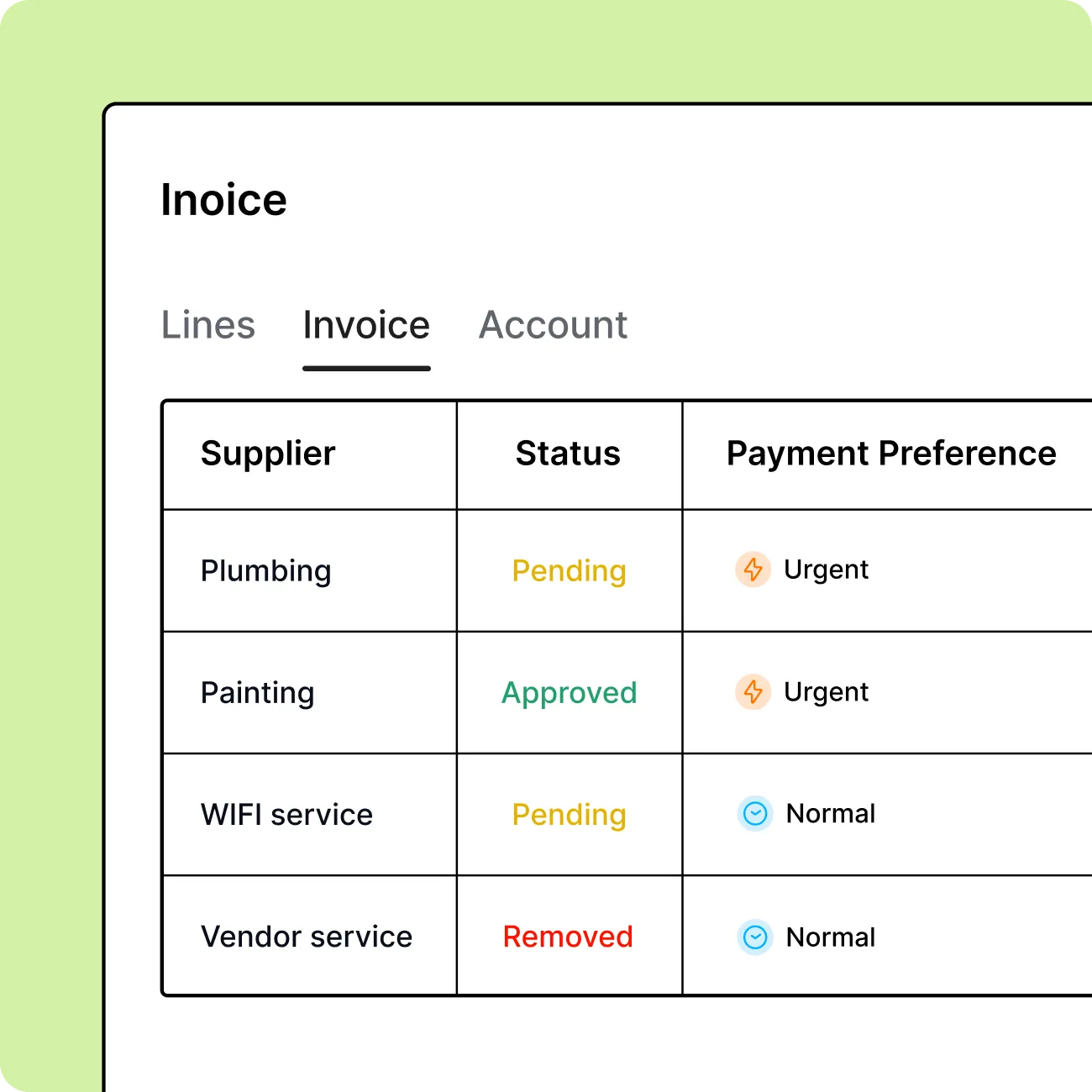

In-Built Collaboration

Attach detailed documentation and collaborate with stakeholders directly for improved auditability.

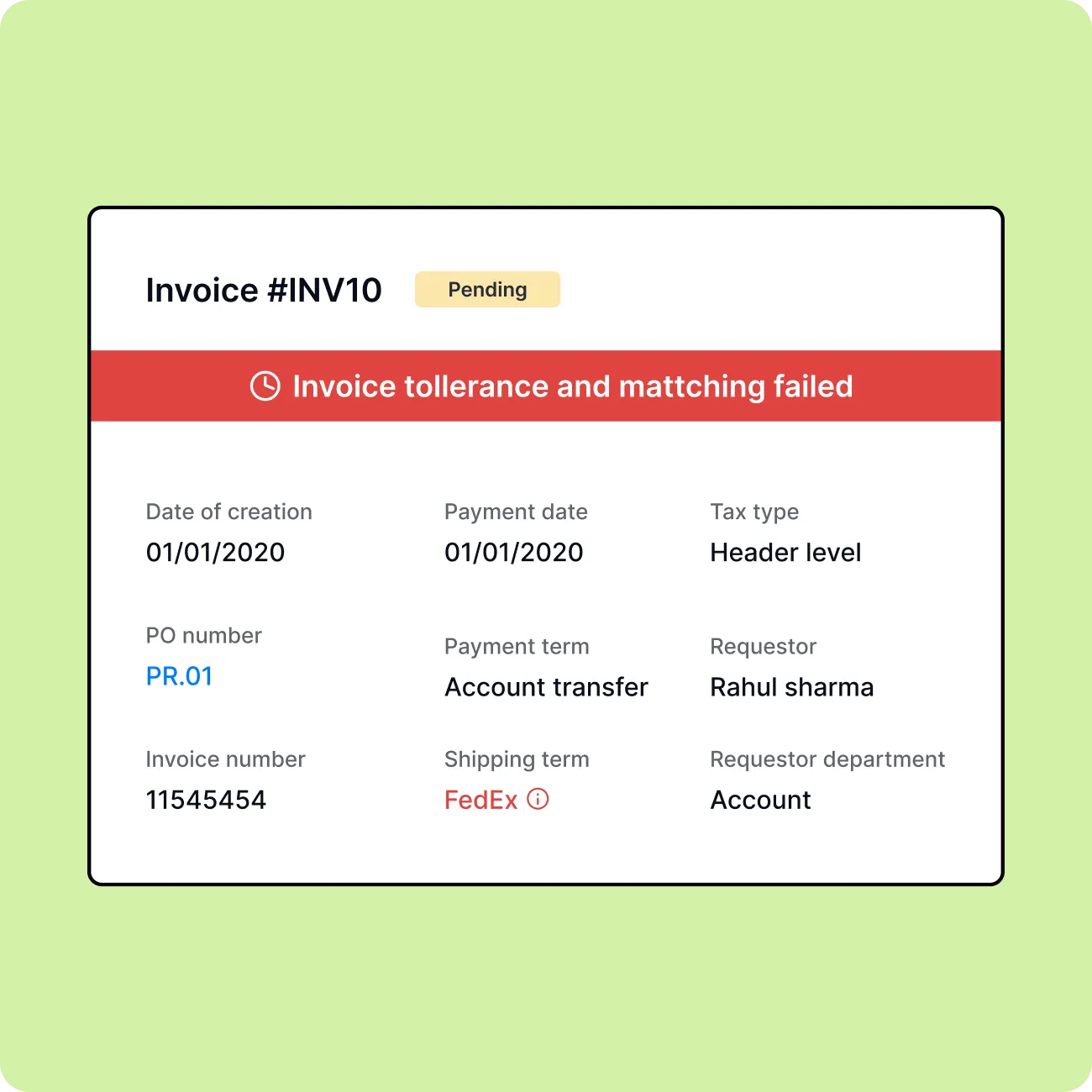

Comprehensive Errors

Instantly identify and resolve errors with elaborate error messages for smoother transactional flows.

Role-Based Workflows

Customize processes with secure, role-specific access for optimized procurement processes.

Add Watchers

Keep relevant stakeholders informed instantly with real-time notifications without bombarding them.

Custom Awards

Choose between AI-powered suggestions and the custom award feature to close your bidding process.

Zapro AP Automation Software for All Industries

Streamline invoice processing and procurement tasks to improve the success of your business initiatives.

Ensure compliance and streamline procurement of essential supplies, mitigating supply chain risks.

Rapidly process transactions with enhanced data-driven insights for strategic decision-making.

The Future of Procurement Is Here.

Automate your entire procurement cycle from sourcing to reconciliation with collaborative, agentic, AI-powered procurement software.

The Voice of Our Customers

“Zapro made procurement effortless with a user-friendly interface and stellar support. Our team and suppliers adapted quickly, and we’re now seeing faster approvals and smoother collaboration.”

— Maria Rowan Business Controller, Repromed

Read Case Study

“Zapro’s strategic sourcing tools have allowed us to negotiate superior contracts and realize significant cost savings.”

— Frank Esmeijer Vice President Development, Bob W

Read Case Study

“Implementing Zapro improved our vendor coordination significantly, leading to a substantial reduction in costs and faster vendor onboarding.”

— Akhil Sikri CTO, zolo

Read Case StudyFAQs

What is AP Automation?

Accounts Payable (AP) Automation refers to the use of digital tools and technologies to streamline and automate the accounts payable processes. By minimizing manual input, AP automation enhances accuracy and efficiency in managing payments. It reduces invoice processing times, lowers the risk of errors, and provides companies with real-time visibility into their liabilities and financial commitments.

What is an AP automation software?

Accounts Payable (AP) automation software is a powerful digital solution designed to transform and streamline the entire invoice-to-payment process within a business. At its core, it eliminates manual tasks, reduces human errors, and significantly accelerates the traditional, often paper-heavy, accounts payable workflow.

Instead of invoices being manually entered, routed for approval via email or physical folders, and paid individually, AP automation software uses advanced technologies like Optical Character Recognition (OCR) to automatically capture data from invoices, regardless of their format (digital or scanned paper). This data is then routed through pre-defined, intelligent approval workflows tailored to your company’s policies, ensuring compliance and proper authorization. The software integrates seamlessly with your existing Enterprise Resource Planning (ERP) and accounting systems, enabling real-time data synchronization and comprehensive financial visibility.

The primary goal of AP automation is to enhance efficiency, cut operational costs, improve cash flow management by facilitating early payment discounts, and strengthen vendor relationships through timely and accurate payments. Solutions like Zapro’s AP automation offer features such as automated invoice capture, intelligent matching against purchase orders, customizable approval hierarchies, secure payment processing, and robust reporting, giving finance teams unprecedented control and insight into their spending.

Who is the leader in AP automation?

Identifying a single “leader” in the AP automation space can be subjective, as the ideal solution often depends on a company’s specific size, industry, and complexity of needs. The market is dynamic, with various providers excelling in different areas such as advanced AI capabilities, seamless ERP integrations, global payment capabilities, or catering specifically to small businesses versus large enterprises.

However, prominent players often recognized for their comprehensive offerings and significant market presence include companies like Tipalti, Stampli, Medius, and AvidXchange. These providers are frequently cited for their robust features, scalability, and ability to handle diverse AP challenges. At Zapro, we believe true leadership is also defined by a commitment to customer success and continuous innovation. While others focus on broad market share, Zapro distinguishes itself by offering an AI-powered, end-to-end spend management platform that not only automates AP but also integrates procurement, contracts, and expense management. This holistic approach empowers businesses to achieve guaranteed savings and unparalleled visibility across their entire spend lifecycle, providing a distinct advantage for organizations seeking truly intelligent financial operations. Our focus on user satisfaction and a unified spend ecosystem positions Zapro as a formidable and forward-thinking force in the AP automation landscape.

How much does AP automation software cost?

The cost of AP automation software can vary significantly, ranging from a few hundred dollars to tens of thousands per month or year, depending on several key factors. There isn’t a one-size-fits-all price, as solutions are typically customized to a business’s unique requirements.

Common pricing models include:

Per-Invoice Basis: Many solutions charge a fee per invoice processed. This fee typically decreases as your monthly invoice volume increases. This model is often favored for its scalability.

Per-User Basis: Some software providers charge based on the number of users who will access the system.

Subscription-Based (Tiered): This involves a monthly or annual fee based on a tiered feature set or a combination of invoice volume and users. Higher tiers offer more advanced functionalities.

Key factors that influence the overall cost include:

Invoice Volume: The number of invoices you process monthly or annually is usually the biggest determinant.

Features and Functionality: Basic solutions for automated data capture and simple approvals will be less expensive than comprehensive platforms offering advanced features like AI-powered anomaly detection, 2-way/3-way matching, multi-currency support, global payment capabilities, and deep analytics.

Integration Needs: The complexity of integrating with your existing ERP or accounting systems (e.g., SAP, Oracle, QuickBooks, NetSuite) can impact initial setup and ongoing costs. Pre-built connectors generally cost less than custom integrations.

Implementation and Onboarding: Initial setup fees, training, and data migration services are common upfront costs.

Support and Maintenance: The level of customer support (e.g., 24/7, dedicated account manager) and software updates can be included in the subscription or charged separately.

Business Size and Complexity: Larger enterprises with complex workflows and higher security requirements will typically invest more than smaller businesses.

While there’s an investment, it’s crucial to view AP automation as a strategic investment rather than just an expense. The significant savings generated from reduced manual labor, eliminated errors, improved fraud prevention, and captured early payment discounts often lead to a rapid return on investment (ROI). At Zapro, we work closely with clients to provide transparent pricing models tailored to their specific needs, ensuring clear value and measurable savings.

Which accounts payable automation solution is the most reliable?

Reliability in an accounts payable automation solution is paramount, as it directly impacts your financial accuracy, compliance, and overall business continuity. The “most reliable” solution is one that consistently delivers on its promises of performance, security, and support.

Here are the key aspects that define a reliable AP automation solution:

Data Security and Compliance: A reliable solution employs robust security measures, including end-to-end encryption, multi-factor authentication, and regular security audits.

It adheres to relevant financial regulations (e.g., GDPR, SOC 2, ISO 27001) to protect sensitive financial data from breaches and unauthorized access.

Accuracy and Error Reduction: The software should minimize human errors through advanced OCR technology, intelligent data validation, and automated matching capabilities (e.g., 2-way and 3-way PO matching). High accuracy ensures that payments are correct and prevents costly discrepancies.

System Uptime and Performance: A reliable platform boasts high availability and minimal downtime, ensuring your AP operations run smoothly without interruption. Fast processing speeds are also crucial for efficiency.

Seamless Integration Capabilities: The ability to integrate effortlessly with your existing ERP, accounting systems, and other financial tools is a hallmark of reliability. This ensures data consistency, eliminates manual re-entry, and creates a unified financial ecosystem.

Robust Support and Continuous Innovation: A dependable vendor offers excellent customer support, comprehensive documentation, and a commitment to ongoing software updates and enhancements. This ensures that the solution remains effective, secure, and aligned with evolving business needs and technological advancements.

Audit Trails and Visibility: A reliable system provides a complete, transparent audit trail for every transaction, making it easy to track invoice statuses, approvals, and payments.

Zapro’s AP automation solution is engineered with these reliability factors at its core. We prioritize enterprise-grade security, offer a highly accurate and efficient processing engine, ensure seamless integrations, and back our platform with dedicated support. Our commitment to continuous improvement means our solution evolves with your business, providing a consistently dependable and high-performing platform for all your accounts payable needs.

How does AP automation ensure compliance?

Zapro’s module ensures compliance by embedding procurement policies directly into the workflow. Through this, the system enforces adherence to internal guidelines and external regulations on each transaction. We eliminate the risk of manual errors and unauthorized spending by providing a robust framework of approved suppliers and pre-negotiated contracts accessible across the platform.

How does your AP automation module integrate with existing tools?

At the core of our AP automation module lies its ability to seamlessly integrate with your existing ERP and accounting systems, enabling a fluid exchange of data and eliminating the need for manual data entry. This interoperability ensures that all your financial data remains consistent and up-to-date, thus maintaining the integrity of your financial reporting. Through robust APIs and pre-built connectors, we automate the entire procure-to-pay process, from requisition and purchase order creation to invoice approval and payment processing, fostering a unified system that amplifies efficiency and control.

How does your AP Automation functionality handle different currencies?

In the global procurement landscape, dealing with multiple currencies is a common challenge. In our product AP automation is designed to simplify this complex task:

- Seamless Integration: Integrate smoothly with your existing ERP and accounting systems, ensuring consistency and control in multi-currency transactions.

- Multi-Currency Support: Automatically handle transactions in different currencies, ensuring all your payables are accurately managed.

- Real-Time Currency Conversion: Exchange rates are updated in real-time, providing the most current conversion rates for accurate financial reporting.

- Comprehensive Reporting: Generate reports that let you analyze transactions across currencies, helping you understand currency impact on overall spend.

How does indirect procurement software improve efficiency?

Indirect Procurement Software is ideal for any procurement company that wants to automate its purchasing tasks, view supplier data on a single pane of glass, and have a thorough knowledge of real-time spend analysis to support decision-making.

What is accounts payable workflow software?

An Accounts Payable Workflow Software facilitates the recapitulatory tasks such as invoice approvals, payment scheduling, and document management. Equip your finance teams to process payments quickly and with zero errors.

How does accounts payable workflow software benefit my business?

With Accounts Payable Workflow Software, finance teams can spend less time chasing invoices and more time focusing on strategic priorities. By automating routine tasks it reduces manual effort, improves payment accuracy, speeds up approval cycles, and strengthens compliance, helping the whole business run smoothly.

Will my staff need training to uselet Zapro?

While Zapro’s AP Automation is user-friendly, we offer comprehensive training and support to ensure your team can leverage all the features effectively.

Healthcare

Healthcare Financial Services

Financial Services Technology

Technology Venture Capitalist

Venture Capitalist Chief Procurement Officer

Chief Procurement Officer Chief Financial Officer

Chief Financial Officer