In today’s fast-paced digital world, the concept of Accounts Payable Automation has become a game-changer for many businesses. One area that significantly benefits from this is

Accounts Payable. Through Accounts Payable Automation (AP Automation), companies can streamline their financial operations, increase efficiency, and reduce human errors.

In this comprehensive guide, we’ll delve into the world of AP automation, its key benefits, how it works, and why it’s time your organization should consider automating its accounts payable process.

The Concept of Accounts Payable Automation

Accounts payable automation is a technology developed to improve, speed up, and streamline the back-end financial process. It automates the routine steps involved in managing payable accounts, such as receiving invoices, coding, routing for approval, payment, and reconciliation.

AP automation technology eliminates the need for manual data entry at any stage of the process, thereby reducing the risk of human errors prevalent in traditional AP processes. It introduces a new concept known as “touchless” processing, which means that the need to manually input data is virtually eliminated, although approvals may still require a simple mouse click.

The Challenges with Manual Accounts Payable

Traditional accounts payable (AP) processes, though tried and tested, have their share of challenges.

Time-Consuming Manual Data Entry

With conventional AP methods, manual data entry is a significant bottleneck. Staff members have to key in details from paper invoices into the accounting systems, a process that can be tedious and time-consuming, especially when dealing with a heap of invoices.

Human Error and Financial Discrepancies

Another pitfall of manual processes is the high susceptibility to human error. Mistakes can range from typos to miscalculations or even entering the same invoice twice. Over time, these errors can snowball, potentially leading to significant financial losses and trust issues with vendors.

Inefficiencies and Delays

Without automation, the entire AP process, from invoice receipt to approval and payment, can be slow. Paperwork can get misplaced, someone might be on vacation, and an approval is pending – all these can result in missed payment deadlines, incurring late fees or penalties.

Difficulty in Tracking and Managing Invoices

Paper-based AP processes can lead to a lack of transparency in invoice management. This can result in communication challenges within the organization and with vendors, and even lost or misplaced invoices.

Managing Vendor Enquiries about Payments

Manual AP systems often struggle to efficiently handle vendor inquiries about payments. Tracking payment statuses and providing timely responses becomes challenging, impacting vendor relationships and overall business efficiency.

The Magic of Accounts Payable Automation

AP automation offers a solution to these challenges by streamlining operations, reducing errors, and improving transparency, ultimately resulting in significant time and cost savings.

How Does Accounts Payable Automation Work?

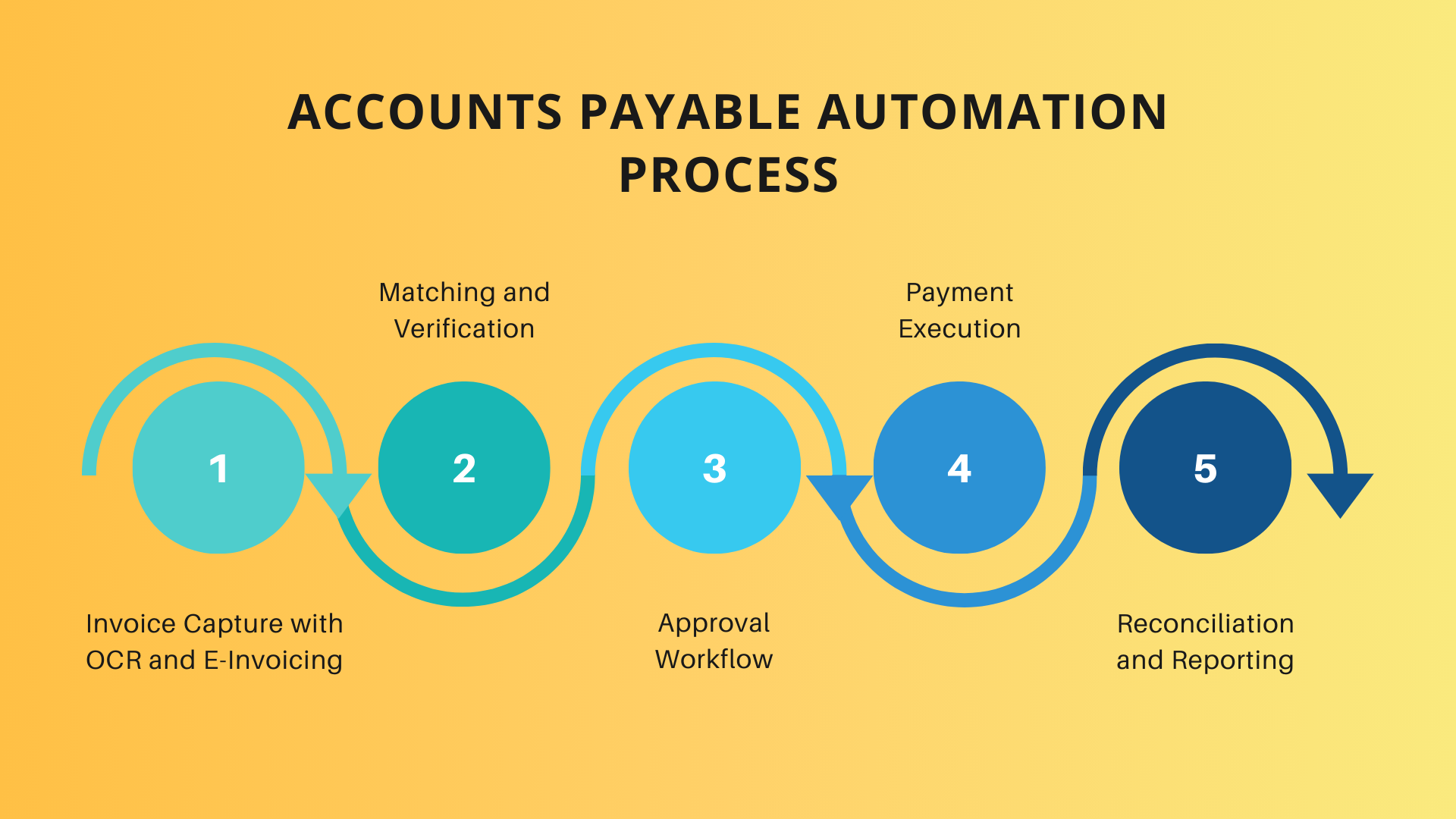

AP automation software converts your suppliers’ invoices into a standard digital format and then pushes them through a digital workflow that culminates with paying suppliers. Here are the steps in the AP automation process:

- Invoice Capture with OCR and E-Invoicing: The initial phase of AP automation is about digitizing incoming invoices. This happens with Optical Character Recognition (OCR) technology, which scans, reads, and converts paper-based invoices into digital data.

- Matching and Verification: After capturing invoice data, the system automatically compares and matches invoices against corresponding purchase orders and delivery receipts. This ensures that the invoiced items and the agreed-upon purchase terms align perfectly.

- Approval Workflow: The AP automation system routes invoices to the relevant personnel or department for approval based on predefined rules set by the organization.

- Payment Execution: Once an invoice is approved, the AP automation system facilitates the payment process, including scheduling payments to optimize cash flow, selecting the preferred payment method, and executing the payment automatically or with minimal human intervention.

- Reconciliation and Reporting: After payment execution, the system carries out an automated reconciliation process which matches payment transactions with bank statements to verify that amounts and beneficiaries align.

The Compelling Reasons to Automate Accounts Payable

There are several reasons to automate AP, some of which involve a tangible and rapid return on investment. By digitizing AP and reducing the need for manual effort, AP automation can drive down your processing costs.

Save Time

AP automation can significantly cut down on time spent on manual tasks. With the elimination of manual data entry and approval processes, your team can focus on more strategic tasks.

Improve Accuracy

Mistakes can be costly. AP automation reduces the risk of human error, ensuring a higher level of consistency and reliability in financial data management.

Enhance Efficiency

AP automation streamlines the entire invoice-to-payment cycle, freeing up your finance team to focus on strategic decision-making and planning.

Fraud Prevention

AP automation systems are equipped with advanced features that continuously monitor transactions, flagging anomalies or suspicious patterns for review. This helps to detect fraud and safeguard the integrity of financial data.

Prevent Duplicate Payments

Automated systems prevent duplicate payments by cross-referencing data, ensuring each invoice is uniquely identified. This feature adds an extra layer of protection against financial errors.

Vendor Management

An automated vendor management system can maintain up-to-date vendor details, track communication, and ensure compliance with contract terms, leading to stronger vendor relationships.

Top Accounts Payable Tasks to Automate

From data entry to vendor management, there are several AP tasks that can greatly benefit from automation. By automating these tasks, companies can save time, reduce errors, and improve overall efficiency.

- Data Entry: Automating data capture of all source documents is faster and less prone to error than entering data manually.

- Invoice Matching: Invoices can be automatically matched to supporting documents, like purchase orders and receiving documents (three-way matching).

- Approval Routing: Electronic routing to all the necessary approvers is faster than manually sending documents to each of them, and it also provides better tracking throughout the workflow.

- Payment Scheduling and Execution: Automation ensures timely and accurate payments, taking advantage of early payment discounts and avoiding late fees.

- Vendor Management: An automated vendor management system can maintain up-to-date vendor details, track communication, and ensure compliance with contract terms, leading to stronger vendor relationships.

How to Automate Accounts Payable

Companies generally apply AP automation software either in a software-as-a-service model, where the application is hosted in the cloud, or on premises, for companies that prefer to host and manage their own systems. Once a system is in place, finance staff as well as approvers need to be trained, and it’s worth spending time to configure rules so you can automate as many steps as possible.

Importance of Selecting the Right AP Automation Software

Choosing the right AP automation software for your business is a crucial step towards achieving operational efficiency. The selection process requires meticulous attention to ensure alignment with the organization’s specific needs. Here are a few factors to consider:

- Understanding Your Needs: Begin with a thorough assessment of your organization’s AP processes, volume of transactions, and unique requirements.

- Scalability and Flexibility: Ensure that the software can adapt and scale according to the growth and evolving requirements of your organization.

- Integration Capabilities: The AP software should seamlessly integrate with your existing Enterprise Resource Planning (ERP) systems, financial platforms, and other key business tools.

- Advanced Features: Look for advanced features like Optical Character Recognition (OCR) for invoice capture, machine learning algorithms for fraud detection, and robust reporting tools to provide valuable insights.

- Security and Compliance: Ensure that the software adheres to the highest security standards, safeguarding sensitive financial data.

- Vendor Reputation and Reviews: Conduct thorough research on the vendor’s track record, industry reputation, and customer reviews.

- AI-Enabled Data Extraction: Opt for AP automation software equipped with AI-enabled data extraction. This advanced technology streamlines the extraction of information from invoices, reducing manual effort and enhancing accuracy in data processing.

The Future is Accounts Payable Automation

AP automation is an indispensable tool for modern businesses aiming to enhance their financial operations. By integrating this system, organizations can reap both tangible and strategic benefits, positioning them for sustained success and growth.

At Zapro, we believe in the power of automation to transform businesses. Whether you’re a small startup or a large corporation, our team of experts can help you implement AP automation in your organization. With our help, you can streamline your processes, reduce errors, and improve efficiency.

Embrace the future of accounts payable with Zapro. Contact us today to learn more about how we can help your business thrive with AP automation.