Do you dread your next AP audit and wish you could stall it for a little longer? However nerve-wracking they may be, accounts payable audits are instrumental in pinpointing areas showing signs of noncompliance, mistakes, inaccuracies, and fraud in your accounts payable activities.Â

Even if the intended result of an AP audit is to identify and fix any errors or risks if present, it often causes misunderstandings, fear of scrutiny, and induces stress on a business and its AP teams. This anxiety stems from the immense pressure on unprepared AP teams to scramble and remediate all issues to perform better on an upcoming AP audit.Â

Despite the feelings they induce, conquering the accounts payable audit is a must if you want to comply with regulations, spot fraud, and ultimately ensure financial integrity.Â

To help you achieve this, we will embark on an exploratory quest to cover all aspects of AP audits, including how to audit accounts payable, what documents you need, AP audit objectives, and accounts payable audit automation.Â

Here are the topics we will cover:

- What is an Accounts Payable Audit?

- The Four Stages of an AP Audit

- Documents needed for AP Audit

- The Objectives Of Accounts Payable Audits

- How To Prepare For an Accounts Payable Audit

- Automate Accounts Payable Audits

- Discover AI-Powered AP Automation With Zapro

Without further ado, let’s begin with answering the simple question—What is an accounts payable audit?

What is an Accounts Payable Audit?

An accounts payable audit or AP audit is a detailed assessment of a business’s financial records and AP processes. It has specialized auditors that step in and gauge the reliability, compliance, completeness, and accuracy of your AP processes and activities.Â

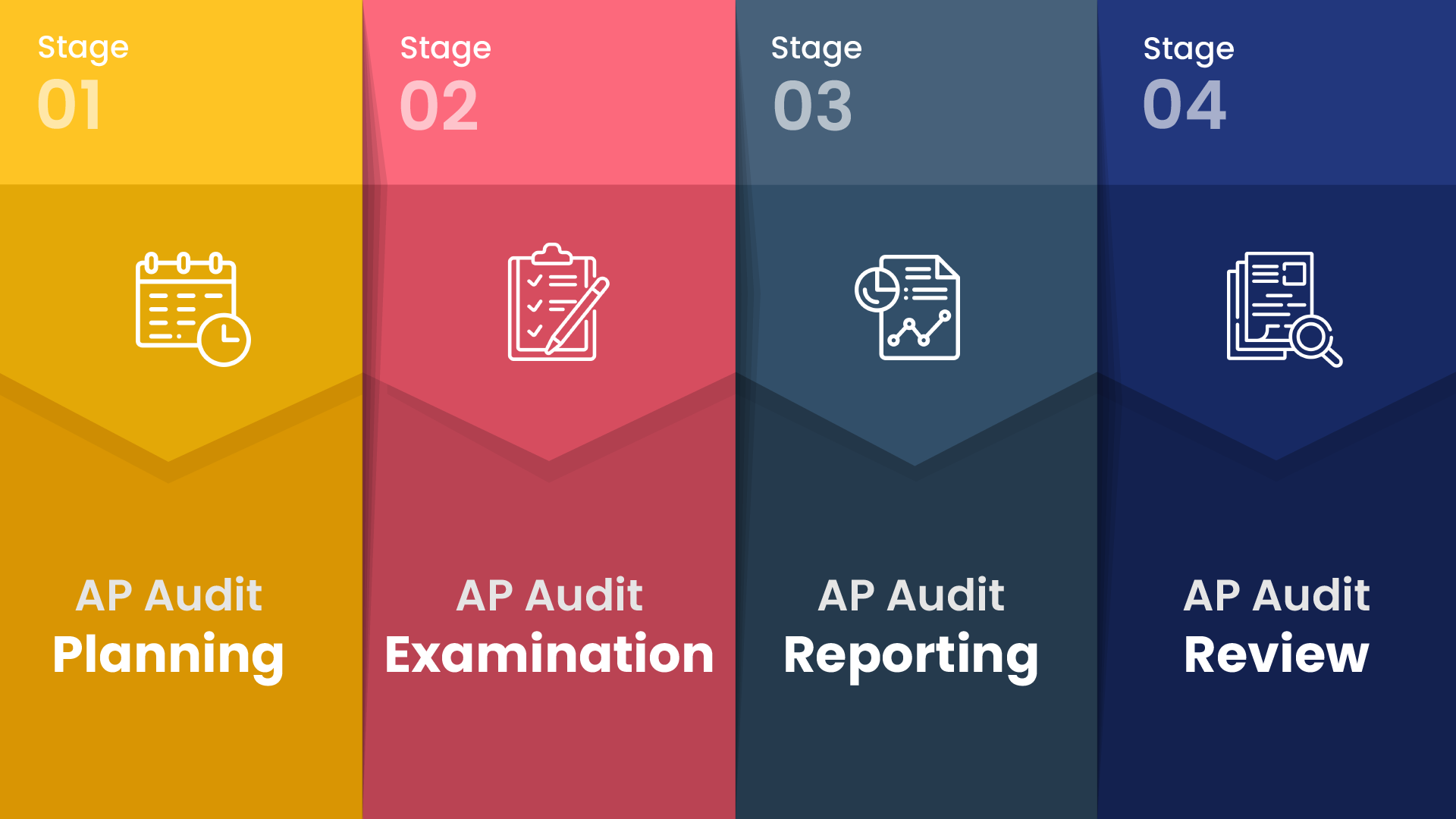

The Four Stages of an AP Audit

If you have issues, inaccuracies, and redundancies in your AP processes, read on to understand the stages of a typical AP audit. It might give you the insight you need to take the stress out of your next audit.

Stage 1: AP Audit Planning

In the first stage, the auditors carefully plan and confirm the parameters and goals they will cover during the audit. This information will serve as a solid foundation for the AP audit plan. Rest assured; most professional auditors will ensure their plan leaves no stone unturned while scrutinizing your AP activities.

Stage 2: AP Audit Examination

The real work begins once the objectives and the AP audit plan is strategized. Auditors will waste no time and dive deep into all records, documentation, and other relevant information associated with your accounts payable process.Â

While this stage can be a relatively short experience for smaller companies, it can go on for days or even months for larger companies.Â

This process is exasperated when the business is unprepared for the AP audit. Following a thorough and successful inspection, all the data obtained will undergo analysis for discrepancies.Â

Stage 3: AP Audit Reporting

Next, it is time for the AP auditor to report their findings to the relevant stakeholders. The report will typically include a detailed view of all areas inspected under the AP audit scope, including the processes followed, findings, feedback, guidelines, and identified issues. The identified concerns are often assigned threat levels based on severity.Â

Stage 4: AP Audit Review

Lastly, an accounts payable audit is complete only when the relevant decision-makers review and act on the information provided in the audit report. This stage is particularly crucial because failing to address the issues highlighted in the AP audit report can lead to severe regulatory, legal, and financial ramifications for the business.Â

Documents needed for AP Audit

However unpleasant AP audits are, they can be a quicker and smoother experience for both the auditor and the auditee. One of the best ways to achieve this is to keep the vital documents the auditor will want to look at handy before the audit can commence. Let us look at some essential documents most auditors look for in an AP audit:Â

- An AP internal controls review.

- Budget-to-actual expense reports with detailed analysis and explanations of any inaccuracies or issues.

- Accounts payable risk assessment.Â

- Expenses risk assessment.

- Period-end accounts payable ledger with appropriate details.

- Overview of the current accounts payable and expense audit activities and procedures.

- A report documenting any deficiencies in accounts payable and expense controls

- Detailed information on all unrecorded liabilities

- Detailed information on any fraud investigation due to inadequate controls.

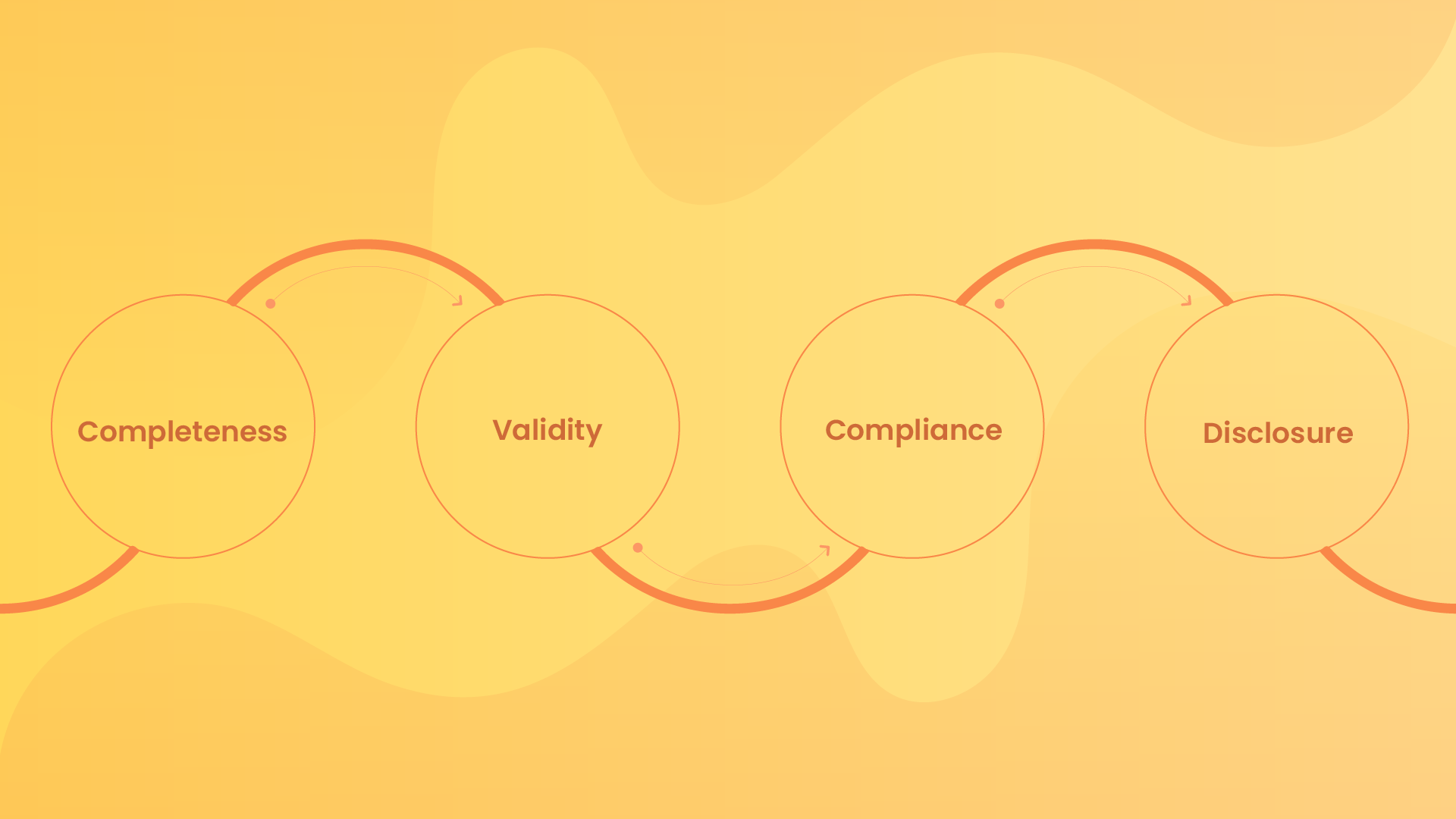

The Objectives Of Accounts Payable Audits

An AP audit is neither random nor aimless. Instead, it is a meticulously planned activity conducted by specialized internal or external auditors that know when, where, and what to look for in your accounts payable activities.Â

Here is what the auditors typically look for during an extensive AP audit.

1. Completeness

You may have heard this word used frequently during conversations about AP audits, but what exactly does it entail? Let me explain. One of the fundamental duties of the accounts payable department is to ensure that the general ledger balances and payable balances match.Â

Any documents supporting and verifying that the payments tally with the recorded payables is the “completeness” an auditor will look for during an AP audit.

2. Validity

During an audit, another critical area of focus is the validity of transactions with vendors and suppliers. At their discretion, auditors will contact your third-party vendors and suppliers to ensure that the accounts payables transactions under scrutiny are factually legitimate.Â

3. ComplianceÂ

Generally Accepted Accounting Principles (GAAP) come into play for this aspect of an AP audit. It is of utmost importance that the company on the receiving end of the audit, its AP teams, and relevant stakeholders follow GAAP procedures right down to the tee. Checking compliance entails that AP auditors thoroughly investigate the company’s audit trail and spot any suspicious activity.Â

A professional auditor will not stop until all financial documents, including balance sheets, general ledgers, end-of-period statements, income statements, and cash flow statements, are thoroughly assessed, and the transaction paths are satisfactory. Only then will they move on to the next stages of the AP audit.Â

4. Disclosure

The final objective of the auditor is to verify that all your activities and financial transactions are appropriately disclosed and recorded on the year-end financial statement. The auditors will be looking for suspicious transactions and their justification.Â

Businesses in this predicament must attest that all the annual AP transactions and purchases are factual and legitimate.Â

How To Prepare For an Accounts Payable Audit

Now that you understand what auditors look for in AP audits let us walk through what you should be doing to prepare yourself for your next audit.

1. Questions To Ask Yourself

The questions you should be asking yourself to stay prepared for an AP audit are:

- Have you adequately recorded, documented, verified, and authorized all invoices with your suppliers and vendors?

- Do you have any potential accruals and liabilities that aren’t accounted for?

- Have you performed reconciliation on your AP accounts?

- Have you checked, recognized, and accounted for all the discounts and credits with your suppliers and vendors?

- Have you found any overpayments and duplicate payments that require verification?

- Do you have any unresolved problems with your vendors that may hurt you during an audit?

- Are there any suspicious transactions that need further scrutiny?

- Are your accounts payable records matching their supporting documentation?

- Are your AP procedures being correctly communicated and adhered to by your organizational stakeholders?

- Are there uninvestigated signs pointing to fraud in your AP transactions?

These are just a few crucial questions that will help you get ready. Answering these questions will give you a clearcut idea of what documents and actions are necessary to safeguard your financial integrity.Â

2. Calculate Accounts Payable Turnover

The accounts payable turnover, calculated by dividing the total supplier purchases by the average accounts payable, shows just how quickly your business is paying its suppliers. A high accounts payable turnover indicates to auditors that you are a business that efficiently handles its working capital. It is also indicative of the quality of your AP payments and processes.Â

Auditors use the accounts payable turnover to identify AP problems such as discrepancies, fraud, and delayed payments. So businesses should be prepared with documents supporting high accounts payable turnover if applicable. It can strengthen an auditor’s belief that your AP processes are up to shape.Â

3. Accounts Payable negative Liabilities

Overpaying your suppliers and vendors more than what you owe them may send red flags to your auditors, warranting further investigation. Resolving such accounts, payable negative liabilities before the audit will positively impact your company’s decision-making and financial health.Â

Above all, it will allow you the opportunity to rectify all instances of accounting errors, incorrect vendor credits, and duplicate payments resulting in a smoother audit.Â

Automate Accounts Payable Audits

While the scope and complexity of AP audits are increasing every year, more businesses are finding themselves unable to cope with or manage the accuracy of their accounts payable activities. Luckily there is a solution that can help fix this.Â

Enter automated AP audit software. AP audit automation software is a one-stop shop that reduces the stress, time taken, and disruptions caused by AP audits.Â

Most audits are drawn out due to simple human errors that alarm auditors. Automation can help you eliminate that possibility. Straight off the bat, AP audit automation standardizes and accelerates processes to ensure that you have fewer compliance issues, redundant processes, and menacing disputes.

Moreover, a capable automated AP software should be able to integrate with your existing ERP systems to provide your AP teams with absolute round-the-clock visibility into all POs and invoice data.Â

With automation handling your AP audits, you can rest assured that you will always know the exact status of your accounts payable. A good bit of advice is to find the right software that can effectively handle all the issues you are facing with your accounts payable audits.Â

Discover AI-Powered AP Automation With Zapro

Zapro, an AP automation solution, offers a comprehensive set of features designed to enhance visibility and optimize AP processes making your next audit an absolute breeze. By digitizing and automating invoice processing, payment reconciliation, and related tasks you eliminate any chances of human error, fraud, or any other occurrences that could lead to problematic audits.Â

Zapro empowers organizations with real-time visibility into their financial operations. With enhanced visibility, organizations can improve communication, streamline workflows, optimize resource allocation, and make data-driven decisions.Â

Embrace Zapro and unlock the power of enhanced visibility in your organization and never look at AP audits the same again.