As a growing business, one of the most critical areas you must focus on should be enhancing the efficiency and accuracy of your invoice approvals. If you constantly suffer operational delays due to invoice approvals, an invoice approval workflow may be your solution.Â

A well-structured invoice approval process workflow ensures timely supplier payments, streamlines invoice management, and helps maintain a healthy business reputation. It is precisely why many companies are turning to an invoice approval process workflow that can handle their organizational requirements.Â

In this comprehensive guide, we will explore the concept of invoice approval workflows, their benefits, and how to create an effective one for your business.

Introduction to Invoice Approval Workflows

An invoice approval process workflow is a systematic approach to managing and automating the invoice approval procedures within a business. It involves predefined steps facilitating highly accurate and efficient invoice capture, processing, and management. By automating these processes, companies can dramatically save time, reduce errors, and mitigate the risk of fraud.

What is an Invoice Approval Workflow?

At its core, an invoice approval workflow is a sequence of steps designed to facilitate the approval of supplier invoices. It begins with receiving an invoice from a supplier and progresses through various validation, approval, and payment processing stages.Â

By carefully structuring and planning these stages, you provide your stakeholders with a standardized path to keep errors and compliance issues away. Numerous businesses are adopting modern AP innovation by implementing automated invoice approval workflows to enhance processes, reduce manual errors, and even boost organizational productivity.

Why is it Important?

If you want to optimize your supplier payment processes, an invoice approval workflow could be a robust solution. It not only ensures timely and accurate payments but also helps to maintain healthy relationships with suppliers.Â

Furthermore, an automated workflow reduces the risk of errors, fraud, and missed deadlines, thereby fostering a professional business reputation.

Key Benefits of Invoice Approval Workflows

Implementing an invoice approval workflow offers several advantages to businesses across various industries. Let us look at some key benefits:

1. Increased ProductivityÂ

Lesser manual intervention means your AP teams and stakeholders are not required to perform manual tasks. Automating the invoice approval process reduces such manual intervention, considerably frees up their time, and increases the invoice process efficiency. Doing so could result in a direct boost in your organizational productivity.

2. Enhanced Accuracy

Automated workflows minimize human errors and ensure all necessary information is captured and validated before approval. Also, remember the fewer human errors, the rarer mistakes are made, dramatically decreasing erroneous spending. So don’t take this tremendous benefit of an invoice approval workflow lightly.Â

3. Reduced Risk of Fraud

Businesses can minimize the risk of fraud and other financial discrepancies by standardizing the approval process and maintaining transparent financial records. Through standardization, you make your invoice approval workflow a default practice that demands utmost adherence. It not only reduces your exposure to fraud but increases your organizational compliance.Â

4. Stronger Supplier Relationships

Building trust with your suppliers goes a long way in achieving lucrative deals, operational stability, and business profitability. Timely and accurate invoice processing helps to build trust and maintain long-lasting relationships with suppliers and vendors.

5. Cost Savings

The streamlined processes and reduced errors associated with automated invoice approval workflows can lead to substantial business cost savings. Remember, the more money you save, the more resources you have to assign to improve other core competencies.Â

Creating an Invoice Approval Workflow: A Step-by-Step Guide

Creating an effective invoice approval workflow requires careful planning and customization to suit the unique needs of your business.Â

Here’s a step-by-step guide to help you get started:

Step 1 – Data Capture

Begin by ensuring that all relevant invoice information is accurately captured and recorded. It can include supplier names, addresses, invoice dates, product details, and transaction amounts. It’s essential to store this data securely for future reference and audits. Consider using invoice scanning software to automate the data capture and enhance accuracy.

Step 2 – Validation

Once the invoice data has been captured, the next step is to validate the information by matching it with supporting documents such as purchase orders, receipts, and delivery notes. This stage also involves checking if the invoice meets all predefined approval criteria. Automated systems can notify relevant stakeholders and request additional information for review if any discrepancies are found.

Step 3 – Approval Routing

After the invoice has been validated, it’s time to route it through the appropriate approval channels. An automated invoice approval workflow can streamline this process by managing the transfer of invoices between different departments and setting reminders to prevent missed deadlines.

Step 4 – Payment Processing

Once the invoice has been approved, the final step is to process the payment. Automated invoice processing systems can handle various payment solutions and ensure payments are made accurately and on time.

The Advantages of Automated Invoice Approval Solutions

In the past, businesses relied on manual invoice approval and processing methods. However, with the advent of automation technology, achieving greater efficiency, accuracy, and transparency in this crucial aspect of business management is now possible.Â

Some key advantages of automated solutions include:

1. Improved Transparency

Automated systems offer complete visibility into invoice approval, promoting accountability and fostering trust with suppliers and employees.

2. Reduced Errors

By minimizing manual intervention, automated invoice approval solutions significantly reduce the likelihood of errors and discrepancies.

3. Enhanced Security

Automated workflows help protect sensitive financial data and reduce the risk of fraud and other security threats.

4. Cost and Time Savings

By streamlining and automating the approval process, businesses can save valuable time and resources, leading to significant cost savings.

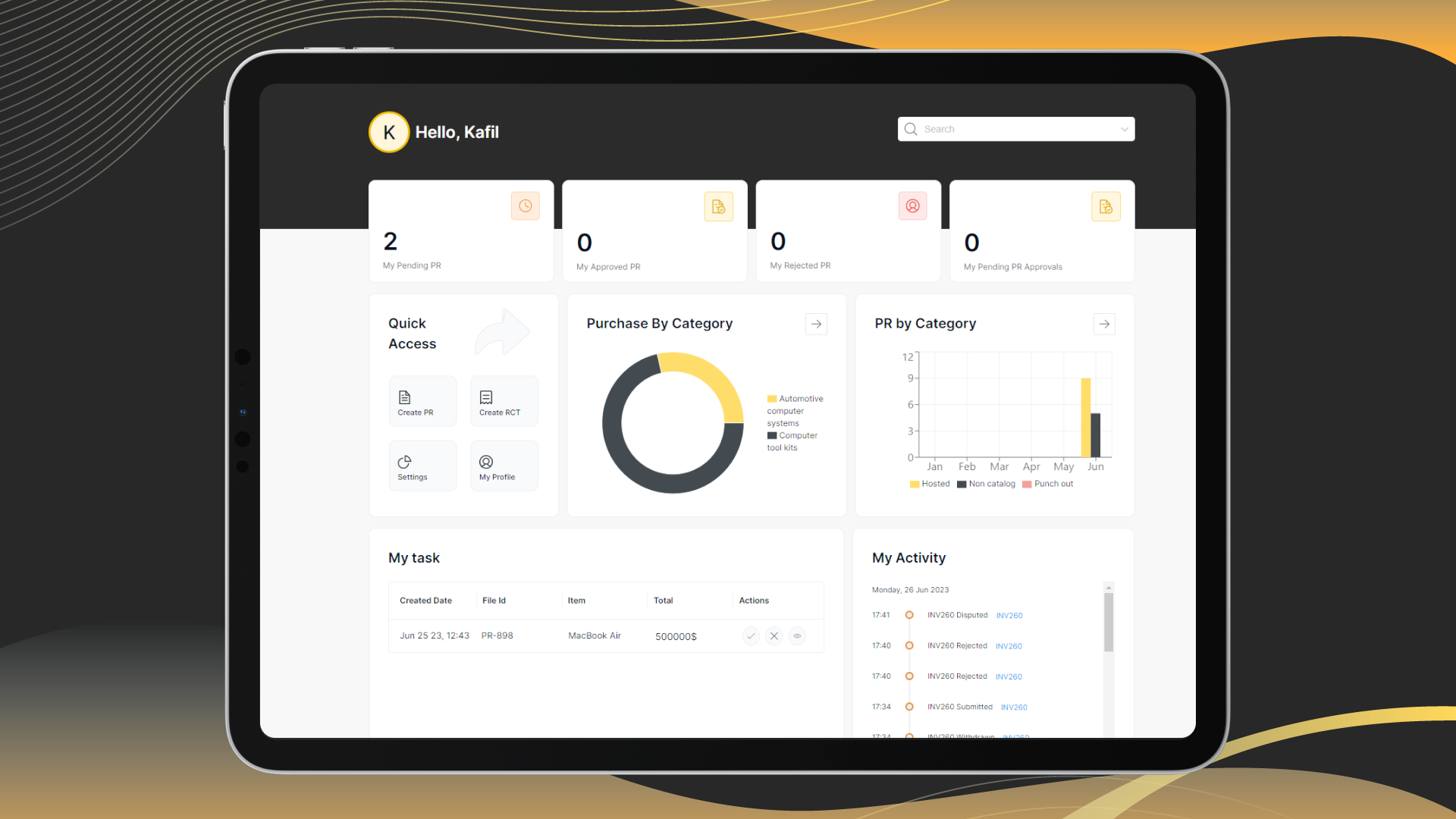

Choosing the Right Solution: Why Zapro?

Selecting the right invoice approval solution is crucial to achieving maximum efficiency and accuracy in your business processes. Zapro offers comprehensive Accounts Payable Automation Software to help you optimize your invoice approval workflow efficiently.Â

Our powerful AI-driven platform provides automated data capture, validation, storage, and seamless payment processing solutions for domestic and international suppliers.

Ready to Get Started? Get in touch with us today to take the first step towards streamlining your invoice approval process.