Invoice matching is a task that doesn’t usually get noticed until something goes wrong in the invoice matching process and broader accounts payable matching process.

However, behind most accounts payable issues, there is invoice matching. More precisely, whether an organization adopts a 2-way matching or a 3-way matching, a decision commonly discussed as 2-Way Matching vs 3-Way Matching in finance teams.

Both can be seen as solutions to determine if a money outflow is legitimate before it actually happens. However, the difference is in the extent of the verification process and the amount of risk that the organization is willing to take, which defines the difference between 2-way matching and 3-way matching.

If you are a member of the finance team, a procurement leader, or a CFO, you should understand the difference between 2-way matching and 3-way matching in order to manage the accounts payable matching process effectively. Choosing the right method will help you fight against fraud, avoid payment of excessive amounts, enhance the relationship with suppliers, and accelerate the payment process. Conversely, selecting the wrong method may hamper the performance of the business and expose it to unnecessary risks.

This article aims to explain the two processes in such a way that an ordinary person can understand. We will examine the working mechanisms of each method, the scenarios where they are best applied, and how automation can speed up and make the invoice matching process more reliable, especially in 2-way vs 3-way matching in accounts payable.

2. What Is 2-Way Matching?

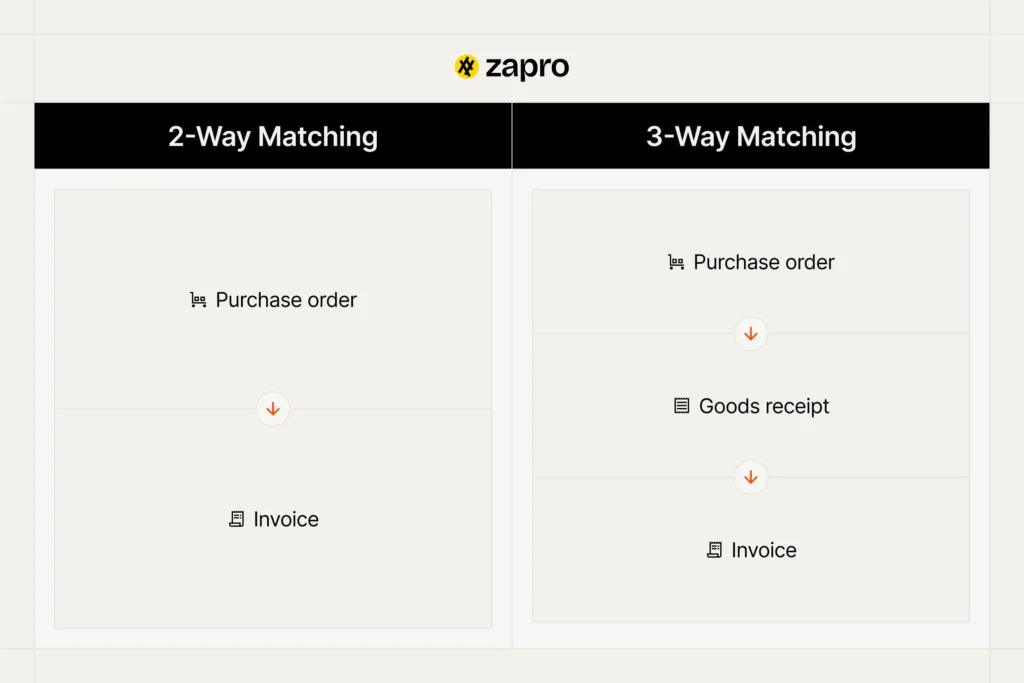

2-way matching is the process of verifying an invoice by comparing two documents before issuing a payment, a common approach in the invoice matching process. Essentially, these documents are the purchase order and the supplier invoice.

During a 2-way matching procedure, the accounts payable department investigates whether the supplier’s invoice agrees with the purchase order as part of the accounts payable matching process. This entails checking the invoice for quantities, prices, and product descriptions, among other things. In case the supplier’s invoice is in accordance with the purchase order, payment can be made.

The main point is that if the invoice corresponds to what was ordered and agreed upon, it is considered valid in the purchase order invoice matching step.

2-way matching is mostly the case when purchasing services, subscriptions, and other goods for which there is no physical delivery. For instance, software licenses, consulting services, or maintenance contracts might use 2-way matching, which explains when to use 2-way matching.

Key Characteristics of 2-Way Matching

- Comparing purchase order to invoice

- Less time-consuming as compared to more elaborate matching processes

- Less bureaucratic work

- More dependent on the accuracy of the supplier

According to Ardent Partners, processing an invoice manually costs an average of $9.25, over 20 percent of invoices have exceptions, and 38 percent of businesses reported fraud in the past year.

2-way matching is perfectly suited for situations where the level of trust is high and the risk of discrepancies is low. On the other hand, it entails that what was ordered was also delivered, which may not always be the case with physical goods, a limitation often highlighted in 2-way matching vs 3-way matching examples.

3. What Is 3-Way Matching?

3-way matching is a process in which an additional step is required to verify the transaction, extending the standard invoice matching framework.

Hence, it is three documents that need to be compared before approving the payment: the purchase order, the goods receipt, and the supplier invoice, forming the foundation of 2-way vs 3-way matching in accounts payable.

The goods receipt, also referred to as a goods receipt note (GRN) or receiving report, is the documentation that the goods have been delivered physically to the purchaser. It’s the team in the warehouse or the receiving department who issue this paper.

The three checks performed by accounts payable during a 3-way matching are:

- Was the item ordered? Purchase order

- Was the item received? Goods receipt

- Was the invoice billed correctly? Supplier invoice

Only when all three documents are in agreement is payment authorized in the accounts payable matching process.

3-way matching is the norm in manufacturing, retail, construction, and basically anywhere there is handling of physical inventory. That way, the risk of paying for goods that are not received or incorrect will be greatly reduced, which explains when to use 3-way matching.

Key Characteristics of 3-Way Matching

- Purchase order, goods receipt, and invoice comparison

- Provides strong safeguards against overbilling and fraud

- High level of accuracy

- More manual work if not automated

While 3-way matching does offer increased protection, it can cause delays in the payment process if the availability of receiving data is late or inaccurate.

4. 2-Way vs 3-Way Matching: Key Differences

Generally speaking, the difference between 2-way matching and 3-way matching is about the extent of control and verification within the invoice approval workflow.

2-way matching is all about the ordered goods compared to the billed ones. There is no proof of delivery here.

3-way matching confirms the order, delivery, and the invoice, making it a more comprehensive form of purchase order invoice matching.

This makes the 3-way matching not only more reliable, especially for goods procurement, but also more complicated to manage.

Comparison Table

| Aspect | 2-Way Matching | 3-Way Matching |

| Documents matched | Purchase order and invoice | Purchase order, goods receipt, and invoice |

| Delivery verification | Not included | Included |

| Risk level | Moderate | Low |

| Processing speed | Faster | Slower if manual |

| Best for | Services, subscriptions | Physical goods, inventory |

| Fraud prevention | Limited | Strong |

5. When to Use 2-Way Matching vs 3-Way Matching

It is not a matter of which method is superior between 2-way and 3-way matching. Rather, it should be the question of which one fits the transaction type in the procure to pay process.

Use 2-Way Matching When

- Enlisting the services of a company or buying a digital product

- There is no physical handing over of the goods to be verified

- The amount involved in the transaction is small or moderate

- There is good rapport with the supplier

- Speed is prioritized

Examples would be software licensing, marketing, consulting, and utilities, all common 2-way matching vs 3-way matching examples.

Seamless flow from PO to pay

Use 3-Way Matching When

- Buying physical goods

- There is a need to have accurate inventory

- The amount of the transaction is significant

- There is a high possibility of the supplier overcharging

- There are regulatory or audit requirements

Examples include raw materials, office supplies, spare parts, and retail goods.

Many companies use both methods in conjunction with the type of spend categories. Such a dual approach strikes a balance between operational speed and control.

6. How 2-Way and 3-Way Matching Work in Automated Systems

If the invoice matching process is done manually, it is definitely slow and susceptible to mistakes. Besides, individuals have to review the documentation, find missing invoices, and finally resolve discrepancies through email and phone calls within the accounts payable function.

Automated accounts payable systems transform the entire process.

With automated 2-way matching, purchase orders can be automatically matched with vendor invoice data through a system. Unless the discrepancy is large, the invoice goes through without manual intervention. Those exceptions that cannot be automatically resolved are marked for further investigation.

Meanwhile, automated 3-way matching will not only check the invoice with the purchase order but also with the goods receipt. Therefore, present-day systems generally extract data from the receiving side in real time, eliminating delays in the accounts payable matching process.

Automation provides the following benefits:

- Sped-up invoice processing

- Error reduction

- Visibility in real time

- Enforcement of consistent policies

Besides, automation enables an organization to execute varying matching criteria depending on the type of spend, the supplier, or the value.

8. Common Challenges and How to Overcome Them

Missing or Delayed Goods Receipts

In 3-way matching, one of the biggest obstacles is the absence of a goods receipt note (GRN). If the teams responsible for receiving delay the update, invoices are held up.

Solution: Integrate your receiving and accounts payable systems and ensure receipt confirmation is done in real time.

Invoice and PO Mismatches

Mismatches are often the result of price changes, quantity differences, or tax errors during the purchase order invoice matching stage.

Solution: Use tolerance thresholds and automated alerts so that minor issues can be resolved without human intervention.

Supplier Errors

Suppliers might submit invoices with wrong PO numbers or incorrect line items.

Solution: Set a standard invoice submission format and provide a supplier portal for guided invoicing.

Manual Workload

Manual matching takes up a lot of time and causes fatigue in the accounts payable department.

Solution: Use invoice automation software that allows matching at scale.

9. Best Practices for Efficient Invoice Matching

- Implement 2-way matching for service-based, low-risk expenditures

- Apply 3-way matching to acquisitions of goods and inventories

- Set and enforce price and quantity variance limits

- Automate wherever possible in the invoice matching process

- Conduct supplier training on how to submit vendor invoices correctly

- Track exception occurrences to improve upstream processes

Consistency is essential. Once invoice matching rules are clearly defined and consistently applied, payment procedures become faster and more reliable.

10. Conclusion

Actually, 2-way matching and 3-way matching should not be viewed as opposing strategies. They are instruments functioning at different thresholds of risk and control in the accounts payable matching process.

2-way matching concentrates on speed and ease of use. It is the ideal model when delivery confirmation is not required.

3-way matching, on the other hand, is about minimizing errors and increasing security. It is a must-have process when dealing with physical goods and inventory.

The most successful businesses are those that do not make an arbitrary choice between the two. They match the proper method with the situation and leverage automation to optimize both approaches within 2-Way Matching vs 3-Way Matching.

Moreover, as invoice volumes and supplier networks grow, automated matching becomes a necessity. It safeguards liquidity, enhances supplier trust, and gives finance teams confidence in payment accuracy.

Get Started with Smarter 3-Way Matching

Simplifying purchase to payment.

FAQ

What is a 2-way matching with an example?

2-way matching is a process where a purchase order is compared with the vendor invoice. For example, when a company pays a software subscription at the exact amount stated in the purchase order, the invoice is automatically approved.

What is 3-way matching in accounts payable?

3-way matching in accounts payable involves matching a purchase order with both a goods receipt or receiving report and an invoice before payment is released.

Which is better: 2-way or 3-way matching?

Each method serves different needs. 2-way matching is faster and suitable for services, while 3-way matching provides stronger controls and is better for physical goods.

What documents are used in 3-way matching?

The documents are the purchase order, the goods receipt note or receiving report, and the supplier invoice.

Don’t miss our weekly updates

We’ll email you 1-3 times per week—and never share your information.

Healthcare

Healthcare Financial Services

Financial Services Technology

Technology Venture Capitalist

Venture Capitalist Chief Procurement Officer

Chief Procurement Officer Chief Financial Officer

Chief Financial Officer